Oil Trading Alert originally sent to subscribers on May 14, 2014, 9:59 AM.

Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective

On Tuesday, crude oil gained 1.34% as worries over the situation in Ukraine and concerns about the success of the agreement between Libya and rebels outweighed disappointing Chinese and U.S. data. In reaction to this, light crude climbed above $102 and approached the next resistance zone. What’s next?

Yesterday, official data showed that Chinese industrial production rose 8.7% year-over-year in April, declining slightly from 8.8% in March. Additionally, retail sales for the month rose by 11.9%, slipping from the 12.2% year-over-year increase in March. Later in the day, the U.S. Commerce Department showed that retail sales inched up by 0.1% last month, missing expectations for a 0.4% increase, while core retail sales (without automobile sales) were flat in April, below forecasts for a 0.6% increase.

Despite the combination of China's disappointing manufacturing data (which reveal fresh signs of weakness in the world’s second largest oil consumer) and weaker-than-expected U.S. data (which usually raised concerns over the economy’s recover), the price of light crude moved higher. Additionally, it seems that investors ignored news of a possible doubling of Libya's oil production following the reopening of oil fields and pipelines on Monday. As mentioned earlier, in reaction to these circumstances, crude oil extended gains and closed the day slightly below $102.

Will the commodity climb much higher? Let’s check the technical picture of crude oil (charts courtesy of http://stockcharts.com).

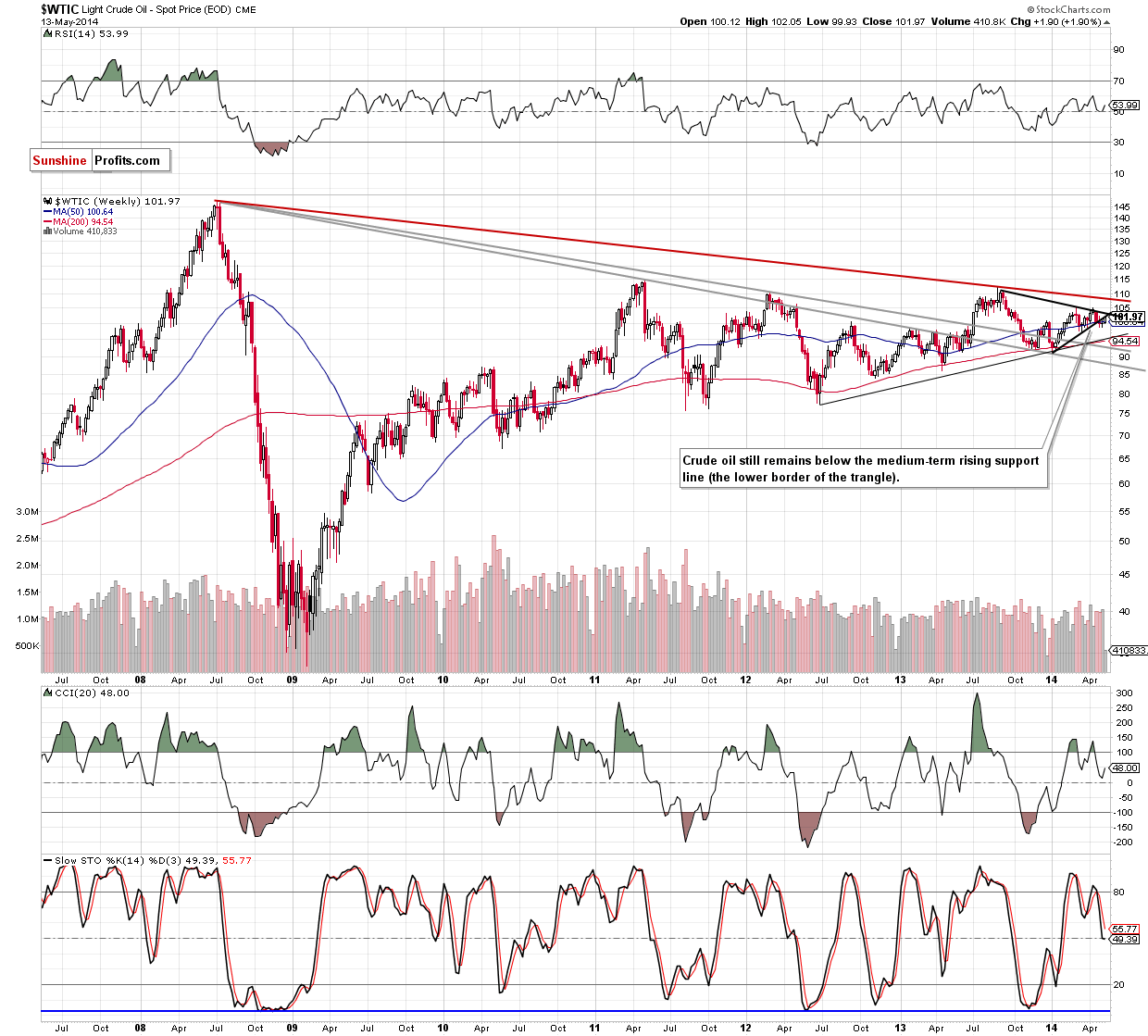

From today’s point of view, we can summarize the first part of the week in one sentence: corrective upswing to the lower border of the triangle. As you know from our previous alerts, we remain convinced that as long as this strong resisrance line remains in play further deterioration is still likely. Please note that from this perspective, the recent upward move seems to be nothing more than a veryfication of the breakdown. If this is the case, the bearish scenario from our Oil Trading Alert posted on Apr. 30 will be in play:

(…) if the commodity extends losses (…), we will likely see further deterioration and a drop even to around $95, where the medium-term support line (based on the June 2012 and January 2014 lows) is.

Can we infer something more from the short-term chart?

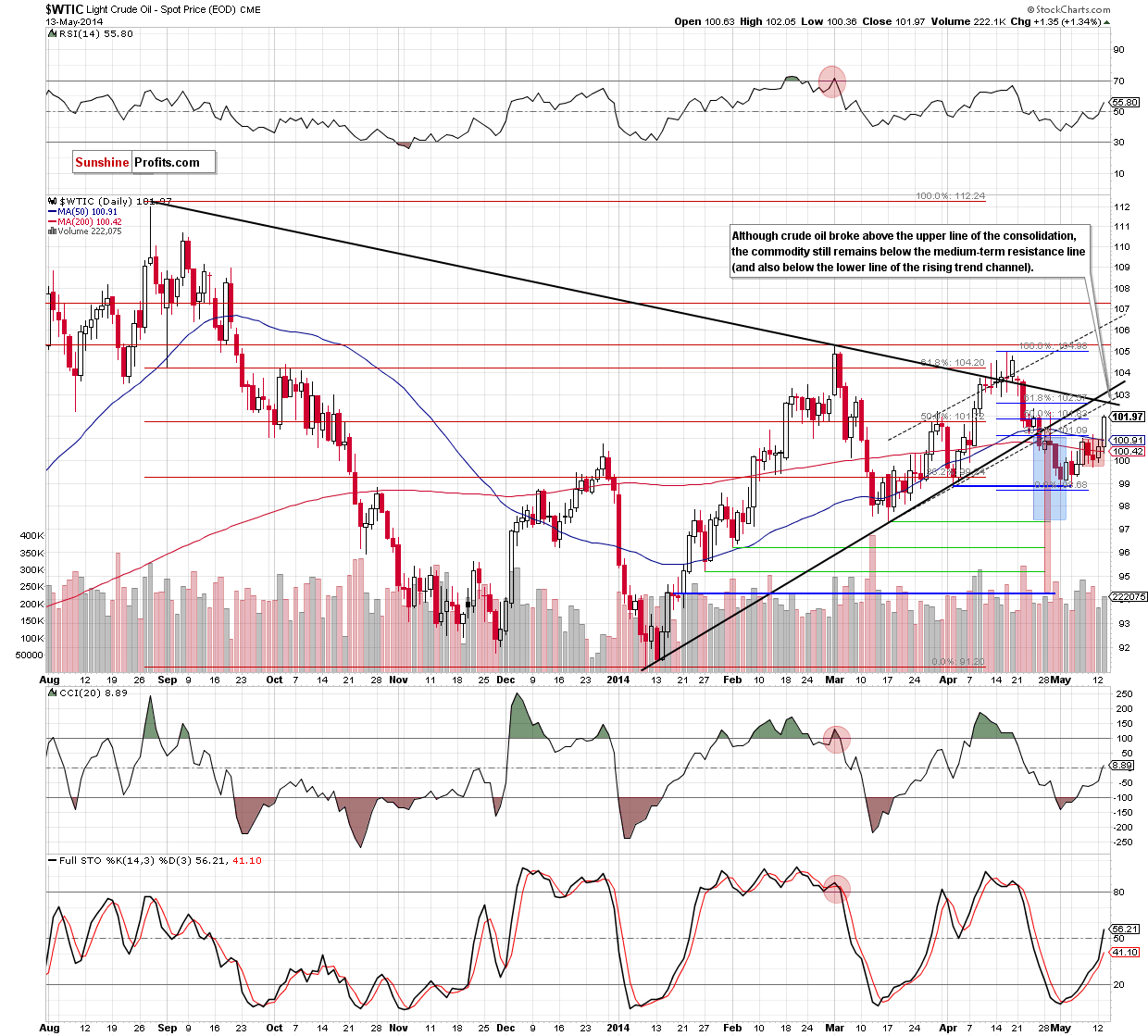

Looking at the above chart, we see that the very short-term situation has improved as crude oil broke above the upper line of the consolidation range and the resistance zone created by the 50-day moving average and the 38.2% Fibonacci retracement. According to what we wrote yesterday, such price action triggered an upswing to the next Fibonacci retracement. Despite this improvement, the commodity still remains below two major resistance lines (the medium-term black line and the lower border of the rising trend channel), which means that the breakdown below them and its consequences remain in play. Nevertheless, if the 50% Fibonacci retracement is broken, we will likely see a test of the strenght of these key resitance lines (currently around $102.68 and $103.05). At this point, it’s worth noting that this area is also reinforced by the black declining resistance line, which is also the upper line of the triangle. In our opinion, this combination is strong enough to stop further improvement and if this is the case, we will likely see a pullback in the coming days.

Summing up, the most significant improvement of yesterday’s session was the breakout above the upper line of the consolidation range and the resistance zone. Although the very short-term situation has improved, we think that the combination of 2 medium-term black lines and the lower border of the rising trend channel will be strong enough to stop further improvement and trigger a pullback in the coming days.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Taking into account the fact that the medium-term resistance line is currently higher than at the beginning of the month (when short positions were opened), we decided to raise the stop-loss order to $104. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts