Oil Trading Alert originally sent to subscribers on September 24, 2014, 9:21 AM.

Trading position (short-term; our opinion): Long positions with a stop-loss order at $89 are justified from the risk/reward perspective. Initial price target: $96.

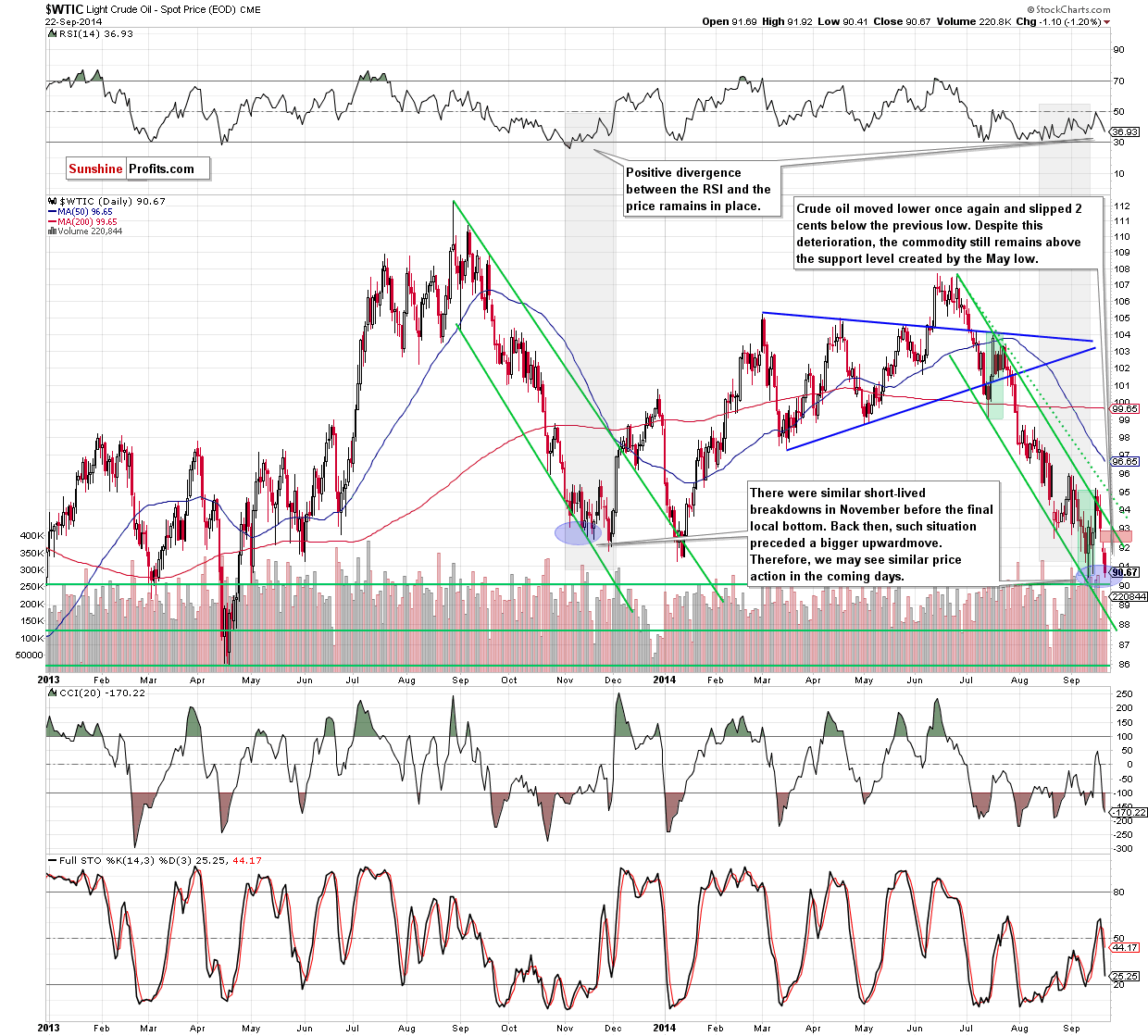

Today’s alert is going to be rather short as the situation simply developed in tune with our expectations. Crude oil moved higher after moving very insignificantly below the previous September low. Let’s take a closer look at this move (charts courtesy of http://stockcharts.com.)

Basically, yesterday’s rally erased previous day’s decline. Please note that the volume that accompanied yesterday’s daily rally was bigger than the volume that we had seen on the previous day when WTIC had declined. The implications are bullish for the short term.

More importantly, the analogy between the November lows and current situation remains in place and the implications are bullish for the coming weeks. Our yesterday’s comments remain up-to-date:

(...) when we take a closer look at the above chart and compare the current situation to the one that we saw in November, we clearly see that back then, there were similar short-lived breakdowns, which preceded a local bottom and a bigger upward move. What’s interesting, positive divergence between the RSI and the price remains in place (the same situation we saw in November). What does it mean for crude oil? Taking all the above into account and comining with a fact that the history tends to repeat itself, we still believe that the next sizable move will be to the upside.

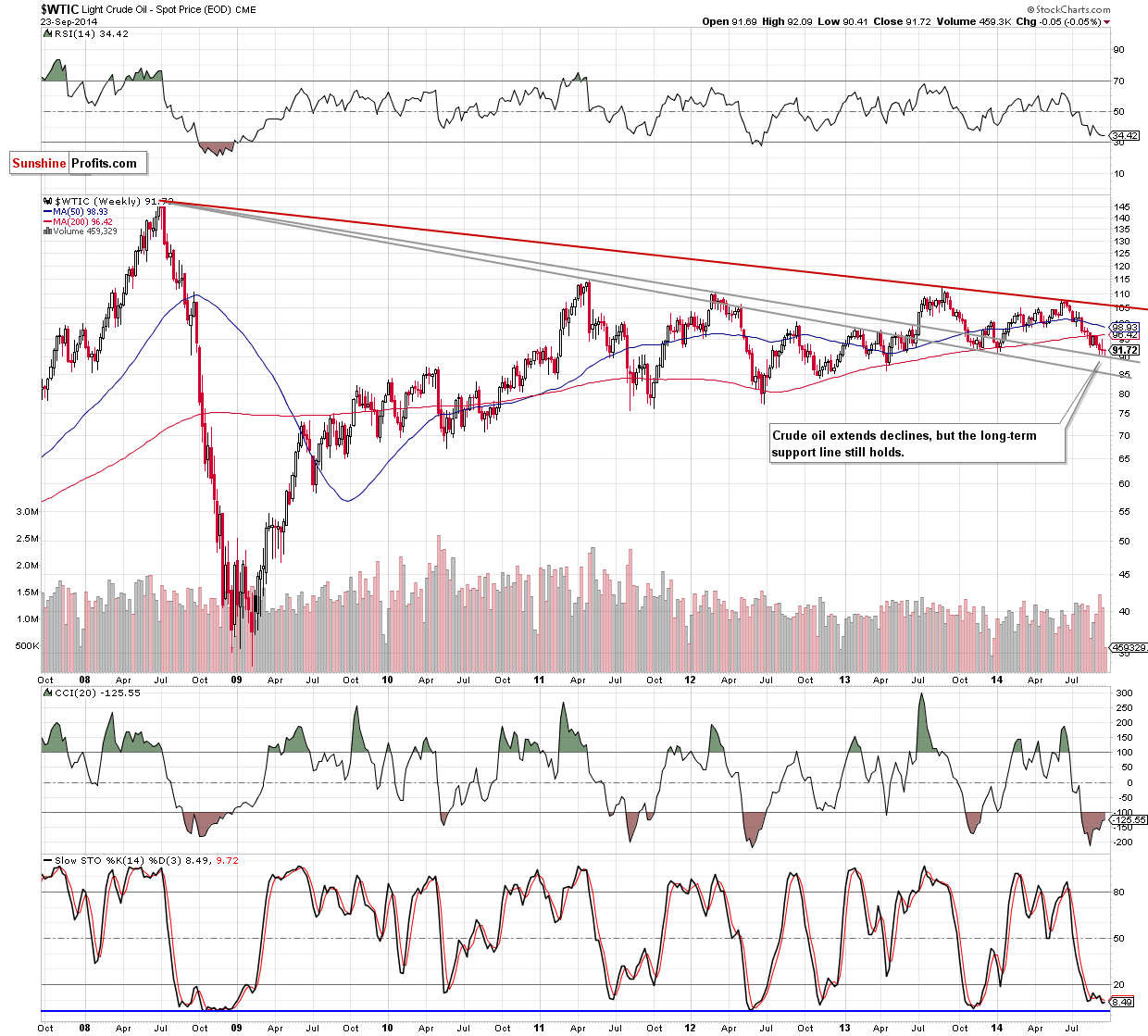

Naturally, the long-term picture continues to support the above-mentioned bullish case.

“Black gold” remains above the long-term support line, so the next bigger move is likely to be to the upside.

Since generally nothing changed based on yesterday’s price swings we can summarize the situation on the crude oil market in the same way as we’ve done yesterday.

Summing up, although crude oil moved lower [this week], the size of a breakdown and the pace of its invalidation says that it was only [a temporary] deterioration. Additionally, the medium- and short-term support zones and positive divergence between the RSI and the price are still in play. Therefore, although there will likely be bumps along the road, the similarity to the situation that we saw in November (when crude oil hit several fresh intraday lows before the local bottom materialized) suggests that the space for further declines is limited and the bigger upward move is just around the corner. Taking all the above into account, we believe that keeping long positions is still justified from the risk/reward perspective.

Very short-term outlook: bullish

Short-term outlook: mixed with bullish bias

MT outlook: bearish

LT outlook: bullish

Trading position (short-term; our opinion): Long with a stop-loss order at $89. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts