Oil Trading Alert originally sent to subscribers on December 2, 2015, 9:59 AM.

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

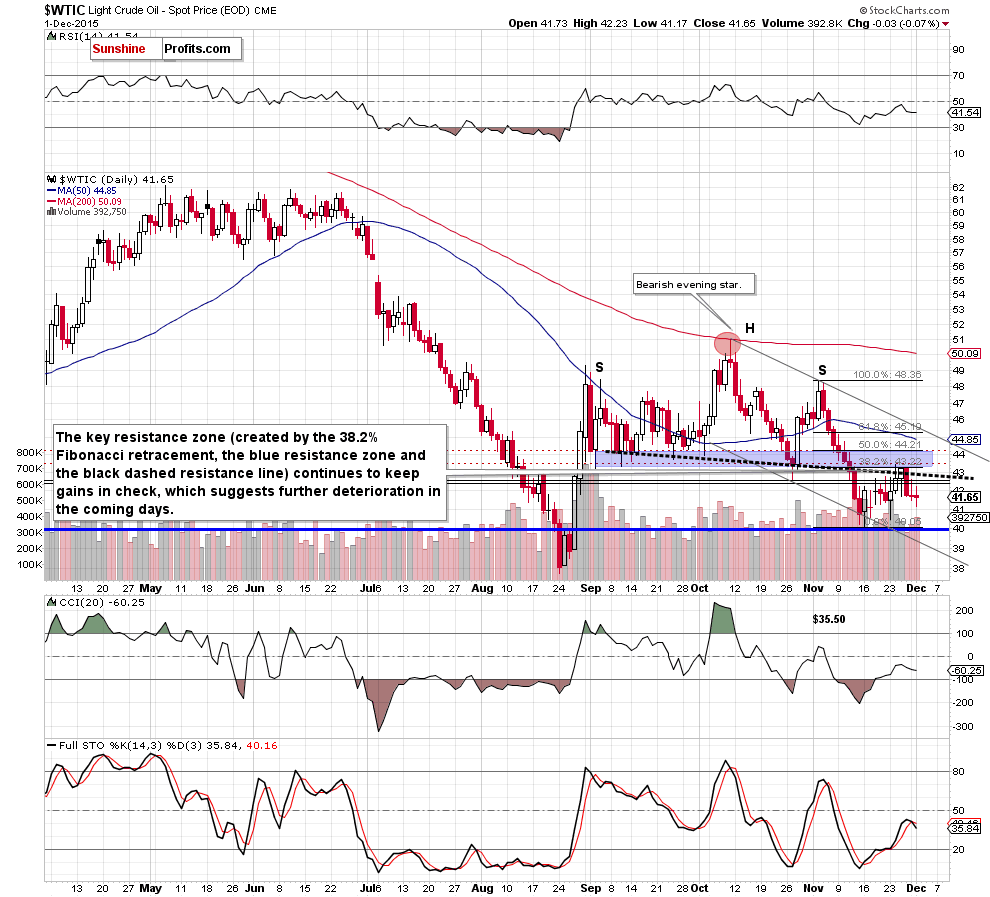

Although crude oil moved higher supported by a weaker U.S. dollar, the commodity reversed and declined as the uncertainty around weekly supply reports and OPEC Friday’s meeting weighed on the price. As a result, light crude closed another day under its key resistance area. Time for a drop to the barrier of $40?

Yesterday, the USD Index gave u some gains and dropped under the barrier of 100, making crude oil more attractive for buyers holding other currencies. As a result, light crude climbed to an intraday high of $42.23. Despite this improvement, the commodity reversed and declined as the uncertainty around weekly supply reports and OPEC Friday’s meeting weighed on investors’ sentiment. Will we finally see a test of the barrier of $40? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

Looking at the daily chart, we see that although oil bulls tried to push the commodity higher, they failed once again, which resulted in another pullback. This means that what we wrote on Monday remains up-to-date:

(…) the commodity invalidated a small breakout above the black dashed resistance line and erased all Wednesday’s gains, which is a strong negative signal that suggests further deterioration in the coming week (even if oil bulls will try to re-test the key resistance area once again). If this is the case, and light crude declines from here, we’ll see another test of the barrier of $40 in near future.

Finishing today’s alert, please note that the Stochastic Oscillator generated a sell signal, giving oil bears another reason to act.

Summing up, the key resistance zone continues to keep gains in check, which suggests that a re-test of the barrier of $40 is more likely than not. Therefore, short positions (which are already profitable as we opened them when crude oil was trading around $46.69) continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts