Oil Trading Alert originally sent to subscribers on March 19, 2014, 7:57 AM.

Trading position (short-term): Short. Stop-loss orders for crude oil and WTI Crude Oil (CFD): $102.95.

On Tuesday, crude oil gained 1.60% after an information that a pipeline connecting Oklahoma storage with Gulf Coast refineries will be open sooner than previously expected. Thanks to this news, light crude rebounded, finishing the day above $99 per barrel.

Yesterday, Enterprise Products Partners LP (EPD) informed that the expanded Seaway pipeline will be in service by late May or early June (as a reminder, the company had previously said the expansion would be completed by the end of the second quarter). The 500-mile, 30-inch diameter pipeline runs from storage hub Cushing, Okla. to the Gulf Coast and a new parallel pipeline is being built to expand Seaway's capacity from 400,000 barrels a day to 850,000 barrels a day. At this point it’s worth noting that supplies at Cushing have fallen for six straight weeks and stand at their lowest level since February 2012. Nevertheless, despite shrinking Cushing supplies, analysts expect that today’s EIA report will show that overall domestic crude stocks rose last week, amid lower demand due to seasonal refinery maintenance. If this increase is bigger than expected, it will likely have a negative impact on the price of light crude later in the day.

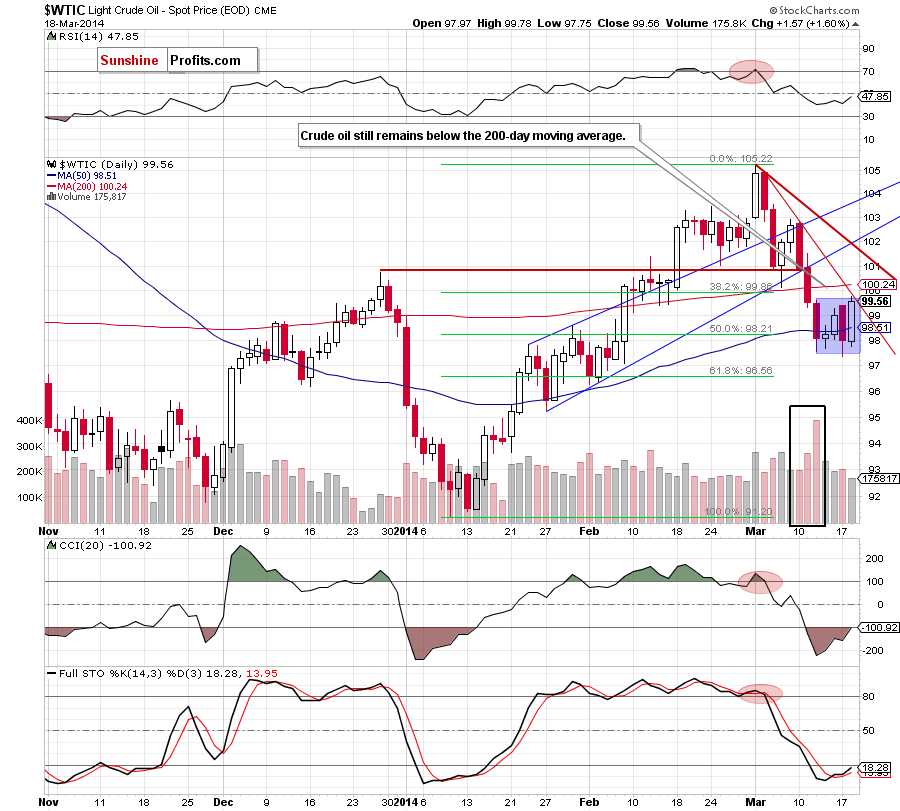

Having discussed the above, let’s move on to the technical changes in the crude oil market (charts courtesy of http://stockcharts.com.)

On the above chart, we see that the very short-term situation has improved slightly as crude oil rebounded sharply and climbed above the 50-day moving average. Despite this corrective upswing, light crude still remains in a consolidation (marked with a blue rectangle). Additionally, the commodity reached the first declining resistance line (marked with red). If it encourages oil bears to act, we may see another attempt to move lower. If this is the case, the downside target will be the lower border of the consolidation range (around $97.55). However, if this line is broken, we may see further improvement and an increase to the 200-day moving average, which still serves as the major resistance (currently at $100.24). At this point it’s worth noting that this area is also reinforced by the 38.2% Fibonacci retracement based on the recent decline (around $100.37). Please note that yesterday’s upswing materialized on relative small volume (similarly to what we saw in the previous week and also at the beginning of the month), which suggests that the buyers may not be as strong as it seems at first glance.

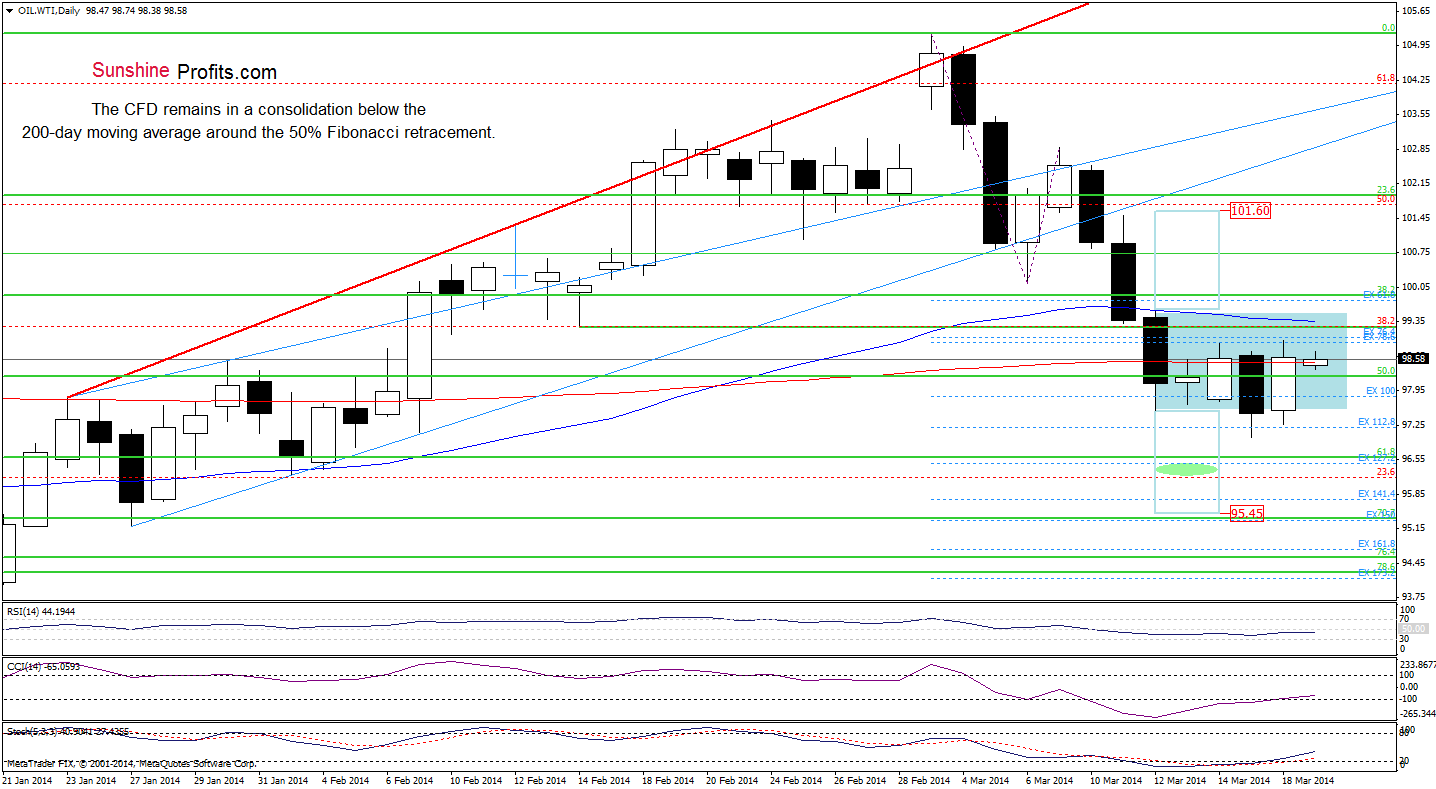

Having discussed the current situation in light crude, let’s take a look at WTI Crude Oil (the CFD).

On the above chart, we see a situation (just like in the case of crude oil) hasn’t changed much. Although the CFD rebounded yesterday, it still remains in a consolidation around the 200-day moving average and the 50% Fibonacci retracement. Therefore, what we wrote in our last Oil Trading Alert is still up-to-date.

(…) From this perspective, it seems that as long as this resistance is in play, a bigger corrective upswing is not likely to be seen and another attempt to move lower should not surprise us. Nevertheless, taking into account the fact that the CFD remains in a consolidation, we should consider two scenarios. On one hand, if oil bulls break above the nearest resistance and push the price above Wednesday high (which is currently reinforced by the 50-day moving average), we may see an upward move to around $101.60. On the other hand, if they fail and the CFD drops below Wednesday low, we may see a downward move not only to the first downside target (the 61.8% Fibonacci retracement around $96.55), but even to around $95.45, where the 70.7% Fibonacci retracement and the Jan.27 low are. Looking at the position of the indicators, we see that they are still overbought, but there are no buy signals at the moment.

Summing up, although the very short-term outlook improved slightly yesterday, the overall situation hasn’t changed much as crude oil remains in the consolidation below the strong resistance zone created by the red declining resistance line, the 200-day moving average and the 38.2% Fibonacci retracement. Additionally, as mentioned earlier, yesterday’s upswing materialized on relative small volume, which suggests that another downswing can’t be ruled out.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: bullish

LT outlook: mixed

Trading position (short-term): Short. Stop-loss orders for crude oil and WTI Crude Oil (CFD): $102.95. We will keep you informed should anything change as far as our opinion is concerned, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts