Oil Trading Alert originally sent to subscribers on July 10, 2014, 7:53 AM.

Trading position (short-term; our opinion): Speculative short positions in crude oil seem to be justified from the risk/reward perspective.

On Wednesday, crude oil lost 1.48% as the reported resumption of Libyan crude production and the EIA weekly report on U.S. inventories weighed on the price. As a result, light crude hit its lowest level since June 5 and dropped below the next downside target. Does it mean that oil bulls lost ground?

Yesterday, crude oil started the session lower after Libya announced the resumption of operations at its main oil fields. However, the price decline accelerated after official weekly U.S. oil inventories data reflected a number of bearish factors. Although the U.S. Energy Information Administration reported that U.S. crude oil supplies declined by 2.4 million barrels in the week ended July 4, beating expectations for a decline of 2.2 million barrels, the report also showed a 600,000-barrel increase in the amount of refined motor gasoline in storage during a week when inventories were expected to fall in response to strong holiday driving demand. As a result, light crude hit a 5-week low of $101.85. Will the commodity drop any further from here? Let’s check what can we infer from the charts (charts courtesy of http://stockcharts.com).

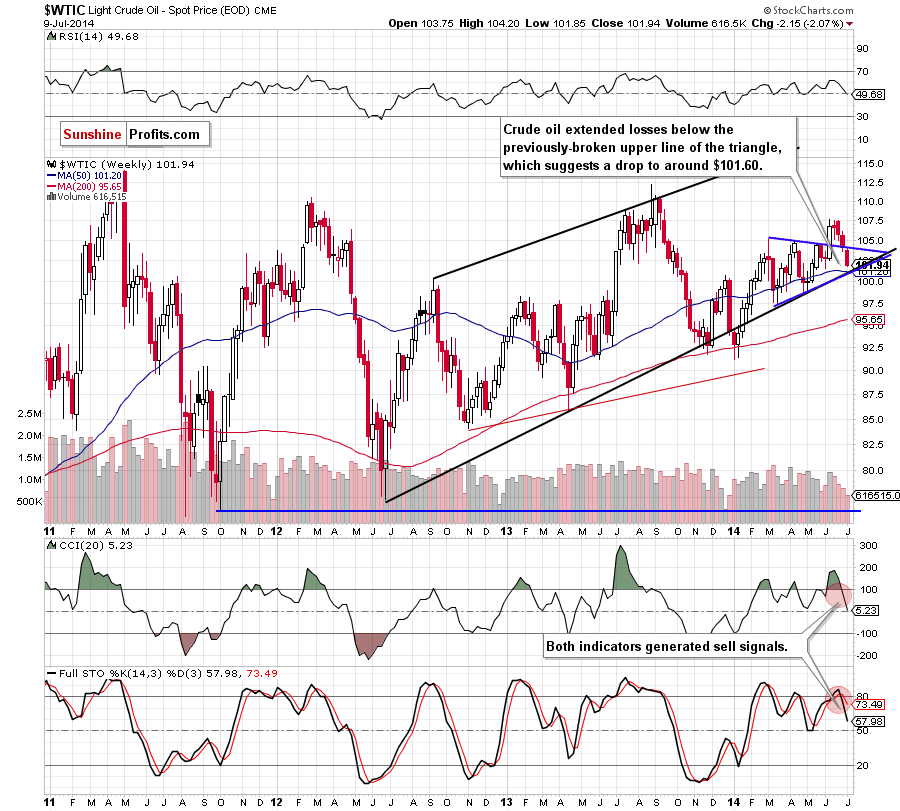

The medium-term outlook has deteriorated slightly as crude oil still extended losses and moved away from the upper line of the blue triangle. Taking this fact into account and combining it with the current position of the indicators, which still favors oil bears, we are convinced that our last commentary is still up-to-date:

(…) crude oil will extend the current correction and the initial downside target will be around $101.60, where the June low is. At this point it’s worth noting that slightly below this level is a strong support zone created by the 50-week moving average (currently at $101.26) and the lower line of the trend channel (and lower border of the blue triangle), which may pause further deterioraion.

Now, let’s check if the short-time outlook is the same.

Quoting our last Oil Trading Alert:

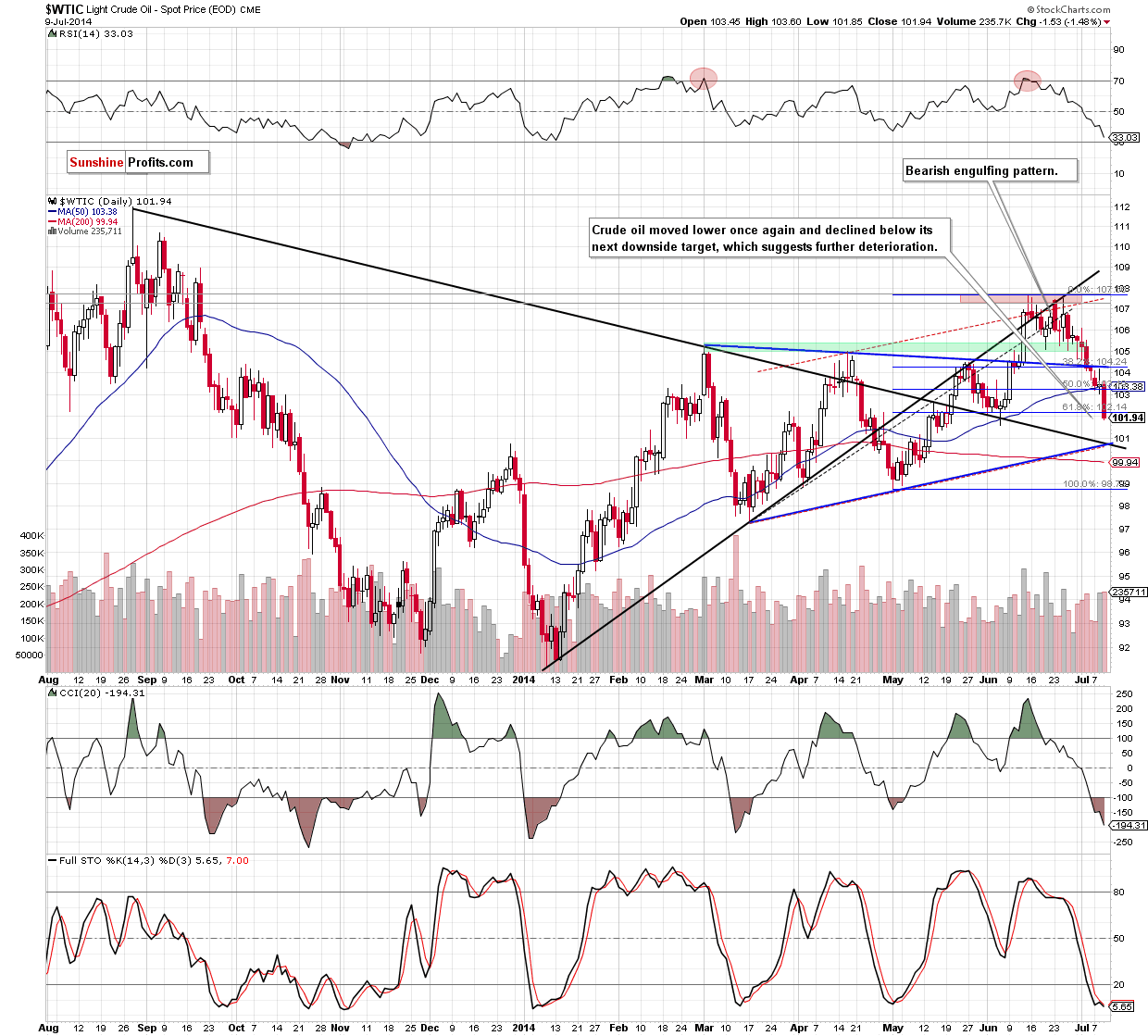

(…) if oil bulls fail, we’ll see another attempt to break below the support zone. If it happens, the next downside target will be around $102.14, where the 61.8% Fibonacci retracement is. Please keep in mind that sell signals generated by the indicators remain in place, supporting the bearish case at the moment.

Looking at the above chart, we see that oil bears’ attack on the support zone has been very effective. As a result, they not only realized the above-mentioned scenario, but also pushed the commodity below its nearest support. In this way, oil bulls lost their chance for a corrective upswing and invalidation of the breakdown below the medium-term blue resistance line (at least in the short term). What does it mean for crude oil? In our opinion, the very short-term technical situation has changed from bearish to even more bearish as Tuesday’s upswing was nothing more than a verification of the breakdown. Therefore, it’s doubtful to us that we’ll see a rebound before a drop to (at least) $101.60, where the June low and the medium-term downside targets are. Please remember that you should keep an eye on the commodity in this area, because, as we have pointed out before, this support zone may pause further deterioration.

Summing up, the very short-term situation has deteriorated significantly as crude oil declined not only below the 50% Fibonacci retracement and the 50-day moving average, but also below the next downside target. Additionally, the breakdown below the blue medium-term support/resistance line was verified, which together suggests further deterioration. In this environment, we remain bearish and wait for lower values of crude oil, which are still ahead us. Therefore, short positions, opened on June 17 around $106.50, are more profitable after yesterday’s decline and still justified from the risk/reward perspective.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed

LT outlook: mixed

Trading position (short-term): Short. Stop-loss order at $109.20. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts