Oil Trading Alert originally sent to subscribers on December 21, 2015, 9:46 AM.

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective.

On Friday, crude oil lost 0.78% as a combination of bearish reports from Genscape, Inc. and Baker Hughes weighed on investors’ sentiment. Thanks to these circumstances, light crude closed another week under the Aug lows, but is it enough to trigger a drop to a fresh low?

On Thursday, Genscape, Inc. reported that stockpiles at the Cushing Oil Hub in Oklahoma increased by 1.4 million barrels last week and are close record highs. On top of that, Friday’s Baker Hughes report showed that U.S. oil rigs rose by 17 to 541 for the week ending on December 11, which together affected negatively investors’ sentiment and pushed the commodity to an intraday low of $35.68. What’s next? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

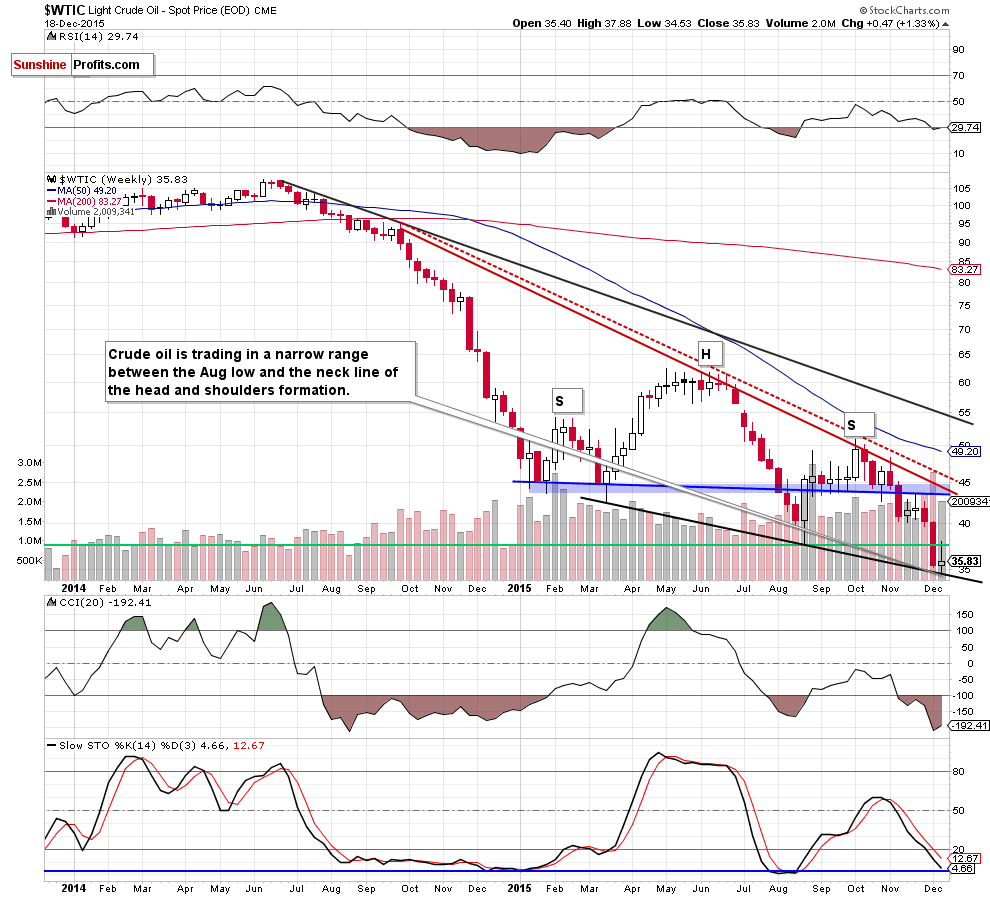

Looking at the weekly chart, we see that crude oil is trading in a narrow range between the Aug lows and the neck line of the head and shoulders formation. Therefore, in our opinion, as long as there is no invalidation of the breakdown below the Aug low or a breakdown under black support line, another sizable move is not likely to be seen.

Will the daily chart give us more clues about future moves? Let’s check.

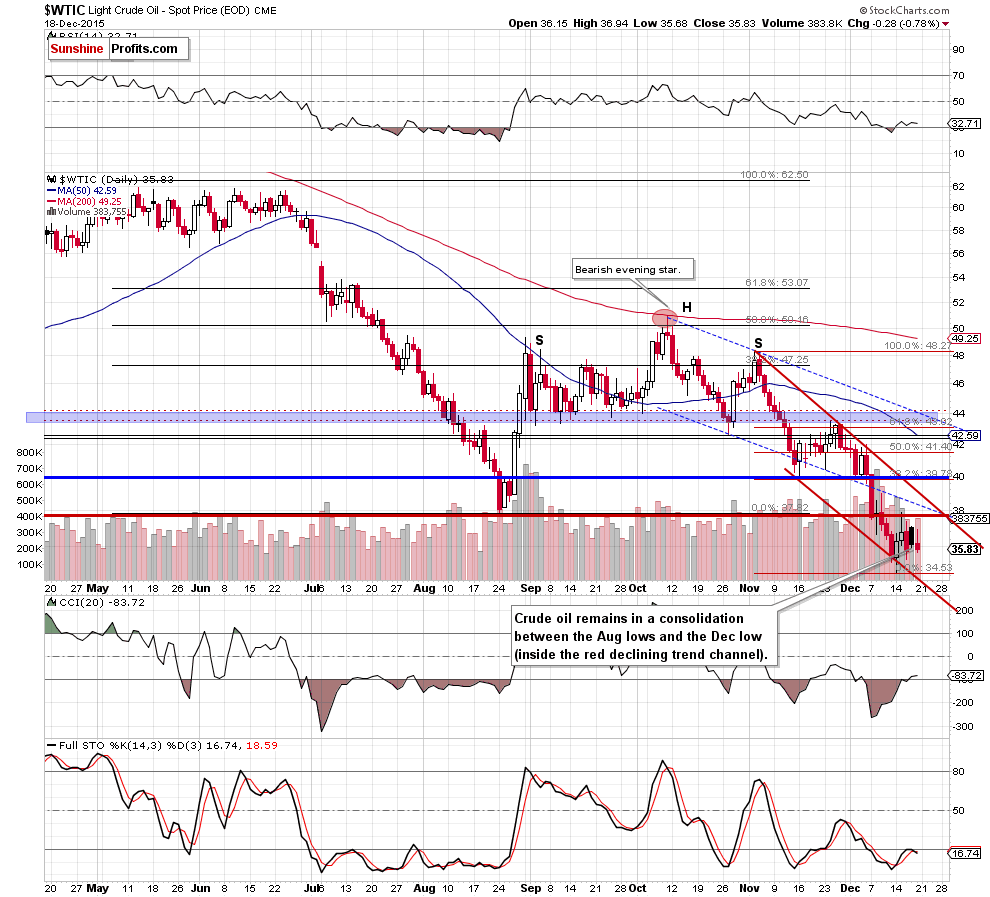

From today’s point of view, we see that crude oil is consolidating between the Aug and the Dec lows (inside the red declining trend channel), which means that a breakout/breakdown will indicate the direction of another bigger move.

Nevertheless, we should keep in mind that the current position of the daily indicators suggests that oil bulls will try to push the commodity higher. If this is the case, the initial upside target would be the red horizontal resistance line based on the Aug low and then the upper border of the red declining trend channel. If these lines are broken, we’ll likely see an increase to our next upside target - the barrier of $40 (please note that this area is also reinforced by the 38.2% Fibonacci retracement based on the Nov-Dec declines).

Summing up, crude oil is trading in a narrow range, which suggests that as long as there is no breakout above the upper border of the declining trend channel (or a breakdown under $$34.53) another sizable move is not likely to be seen and short lived moves in both directions should not surprise us. Nevertheless, in our opinion, the medium-term trend remains down and lower values of the commodity are still ahead us. Therefore, we’ll likely re-open short positions at higher prices (after crude oil will finish its corrective upswing) in near future.

Very short-term outlook: mixed

Short-term outlook: mixed with bearish bias

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts