Oil Trading Alert originally sent to subscribers on November 18, 2015, 7:48 AM.

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective.

On Tuesday, crude oil lost 2.19% as a stronger greenback and worries that weekly reports would show another build in crude oil inventories weighed on investors’ sentiment. In these circumstances, light crude gave up some of Monday’s gains and closed the day slightly above $41. Where will the commodity head next?

On Friday, Baker Hughes report showed that the number of rigs drilling for oil in the U.S. increased by 2 to 574. This first weekly rise in almost three months fuelled worries that reports would show another build in crude oil inventories and pushed the commodity lower. Additionally, the USD Index extended gains and approached the barrier of 100, making crude oil less attractive for buyers holding other currencies. As a result, light crude hit an intraday low of $40.58, but then rebounded slightly and closed the day slightly above $41. Where will the commodity head next? Let’s examine charts and find out (charts courtesy of http://stockcharts.com).

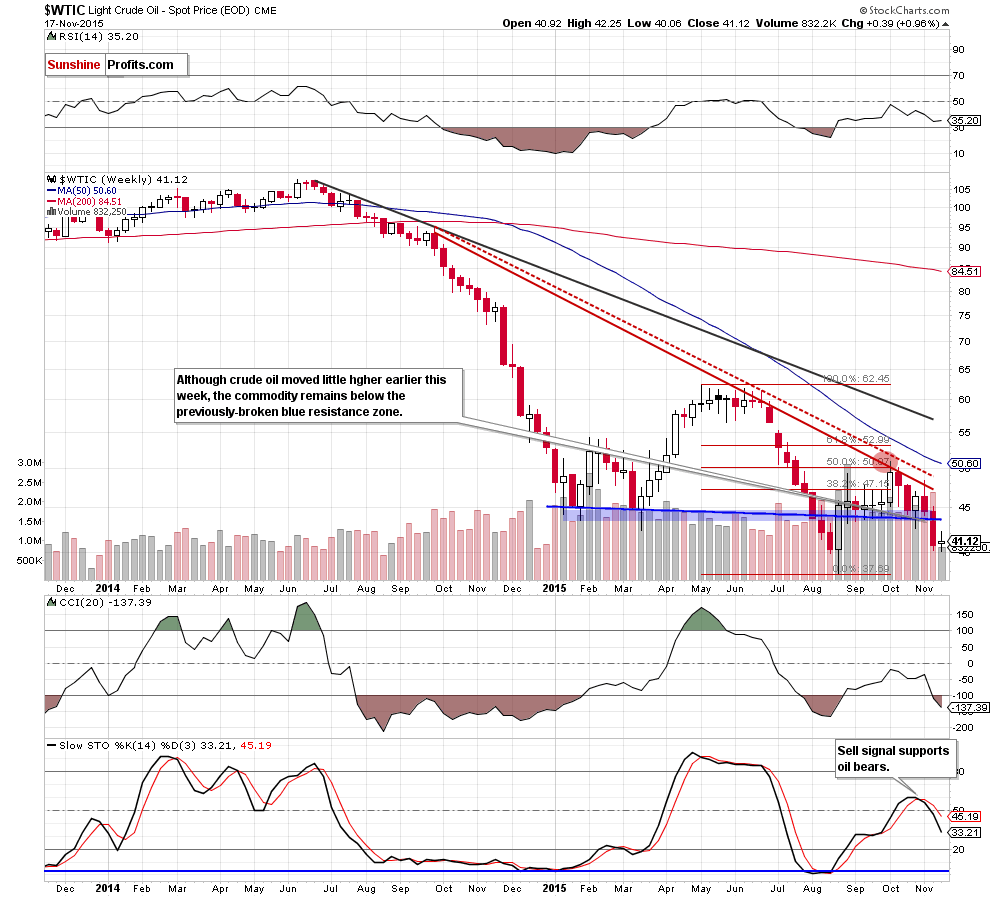

The situation in the medium term hasn’t changed much as crude oil is still trading under the previously-brken blue zone (reinforced by the blue line), which serves as the nearest important resistance. Additionally, sell signal generated by the Stochastic Oscillator remains in place, supporting oil bears.

Having said that, let’s take a closer look at the short-term changes.

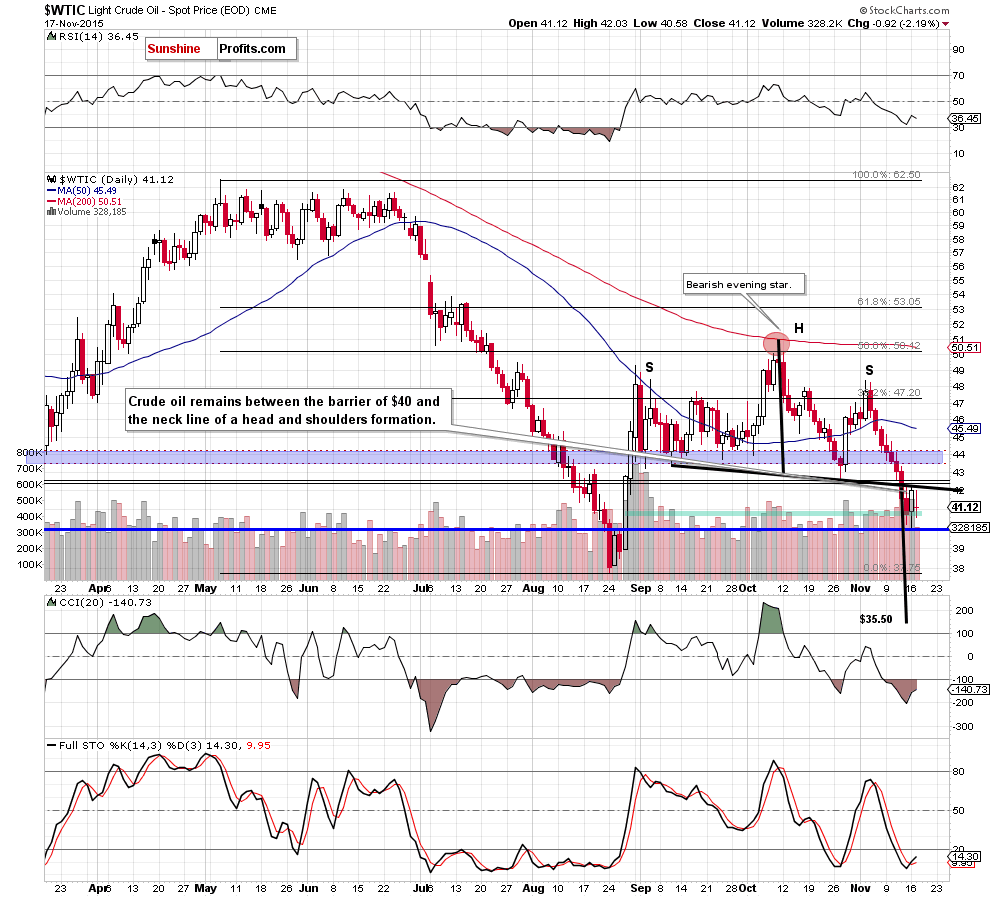

From this perspective, we see that the black resistance line encouraged oil bears to act, which resulted in a pullback. Taking this fact into account, we believe that our yesterday’s commentary is up-to-date:

(…) the commodity climbed to the black resistance line, which could be the neck line of a potential head and shoulders formation. If this is the case and crude oil declines from here, we’ll see a drop below $40 in the coming days. At this point, it is worth noting that if we see such price action, the current decline will likely accelerate, which will likely translate to a test of the Aug lows.

Nevertheless, taking into account the above-mentioned bearish pattern, we may see a decline even to around $35.50, where the size of the downward move will correspond to the height of the formation.

Finishing today’s alert, we would like to notice that the daily Stochastic Oscillator generated a buy signal, which may result in another test of the black resistance line in the coming day.

Summing up, the first resistance line triggered a pullback, which increases the probability that the potential head and shoulders formation (marked on the daily chart) is underway. If this is the case, we’ll see further deterioration in the coming weeks (even if crude oil moves higher and re-tests the black resistance line in the coming day). Therefore, we believe that short positions (which are already profitable as we opened them when crude oil was trading around $46.69) continue to be justified from the risk/reward point of view.

Very short-term outlook: bearish

Short-term outlook: bearish

MT outlook: bearish

LT outlook: mixed with bearish bias

Trading position (short-term; our opinion): Short positions with a stop-loss order at $54.12 and initial (!) target price at $35.72 are justified from the risk/reward perspective. We will keep you – our subscribers – informed should anything change.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts