Yesterday's bullish attempt has met a swift response and the oil price powerfully reversed lower. Earlier today, the bulls are pushing higher again, though less vigorously than yesterday or the day before. Do they have any aces up their sleeves? The risk appetite is creeping back into the market and OPEC joined by Russia may support them...

Will both leading oil producers (Saudi Arabia and Russia) be able to reach an agreement on production cuts extension? It's hard to assess the world demand when taking into account the Iran situation, Venezuela supply issues, or the wildcard of U.S. shale production. One would be also ill-advised to ignore the oil reserves, that mighty stockpile...

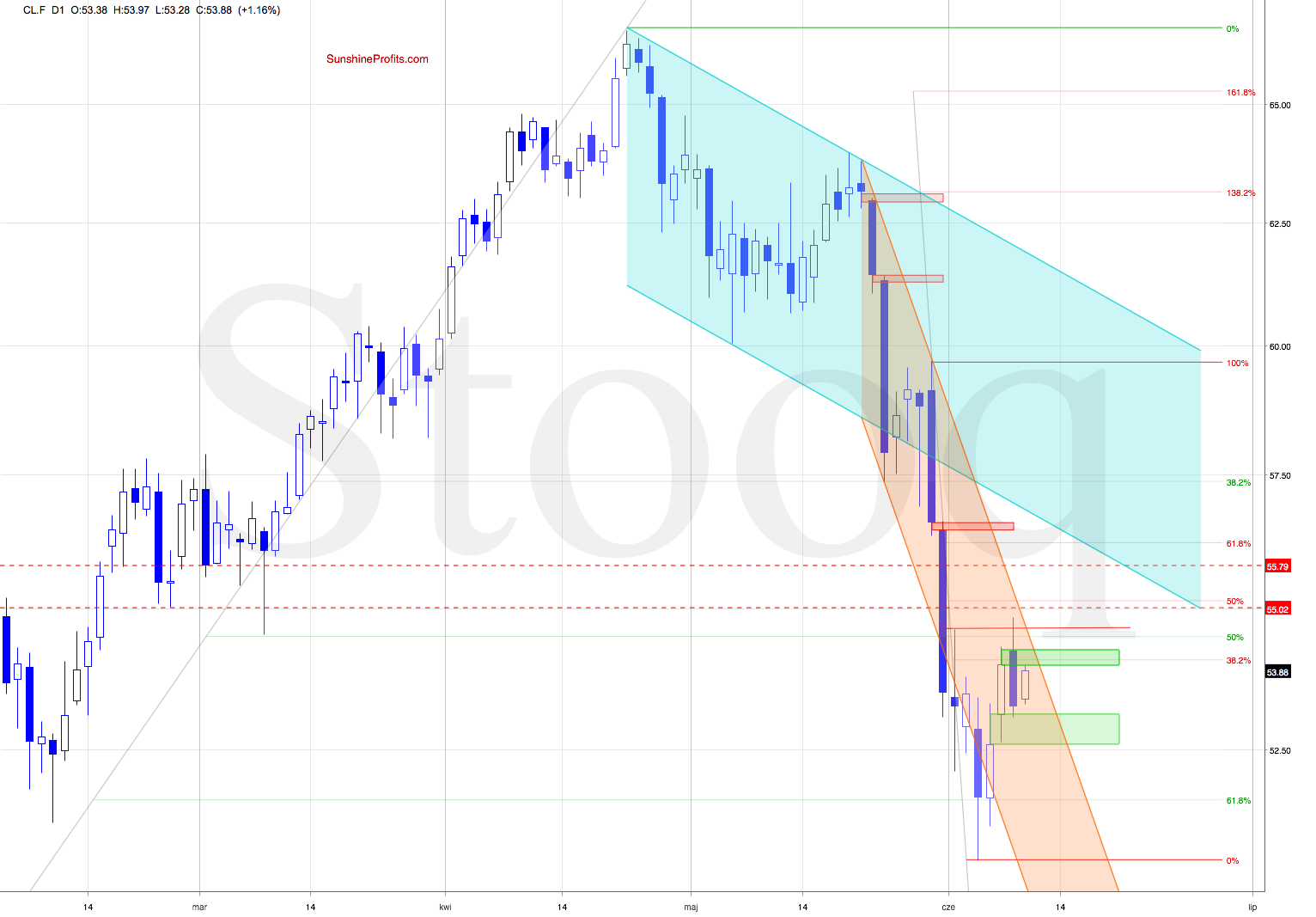

Leaving the fundamentals aside, let's take a closer look at the chart below (chart courtesy of www.stooq.com).

Yesterday, crude oil futures moved above the early June intraday highs only to give up all the gains and reverse sharply lower. The downside move closed the gap opened by yesterday's opening price (the upper green zone). The downswing also tested the lower gap created on Friday (the lower green zone).

Friday's gap withstood the selling pressure and earlier today, the oil price is rebounding as it changes hands at around $53.95 currently.

Crude oil trades not only below the previously-broken late February and early-March lows, but also below the 38.2% Fibonacci retracement and inside the declining orange trend channel. It suggests that as long as there is no breakout above these resistances, further improvement is questionable and another move to the downside can't be ruled out.

Summing up, yesterday's bullish upswing gave way to bearish momentum and oil reversed lower. The bulls are attempting another move higher earlier today but the oil price is trading below the 38.2% Fibonacci retracement, still inside the declining orange trend channel. Unless we see breakout above the Feb-Mar 2019 lows, another move to the downside remains on the table.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Oil Trading Alerts also benefit from the trading action we describe. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up for the free newsletter today!

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Sunshine Profits - Tools for Effective Gold & Silver Investments