Einstein allegedly once claimed that insanity is doing the same thing over and over again and expecting different results. It turns out that central bankers are really insane. Their loose, unconventional monetary policy has not worked in Japan for the last quarter-century, but it did not prevent the Bank of Japan from adopting zero interest rates targets for ten-year Japanese government bonds and from the commitment from overshooting its inflation target. But let’s leave the analysis of the central bankers’ denial of reality to psychologists and focus on the short summary of the Japanese economy in the last quarter-century. Such an analysis would outline the necessary context for the examination of the relationship between the BoJ’s actions, the USD/JPY exchange rate and gold.

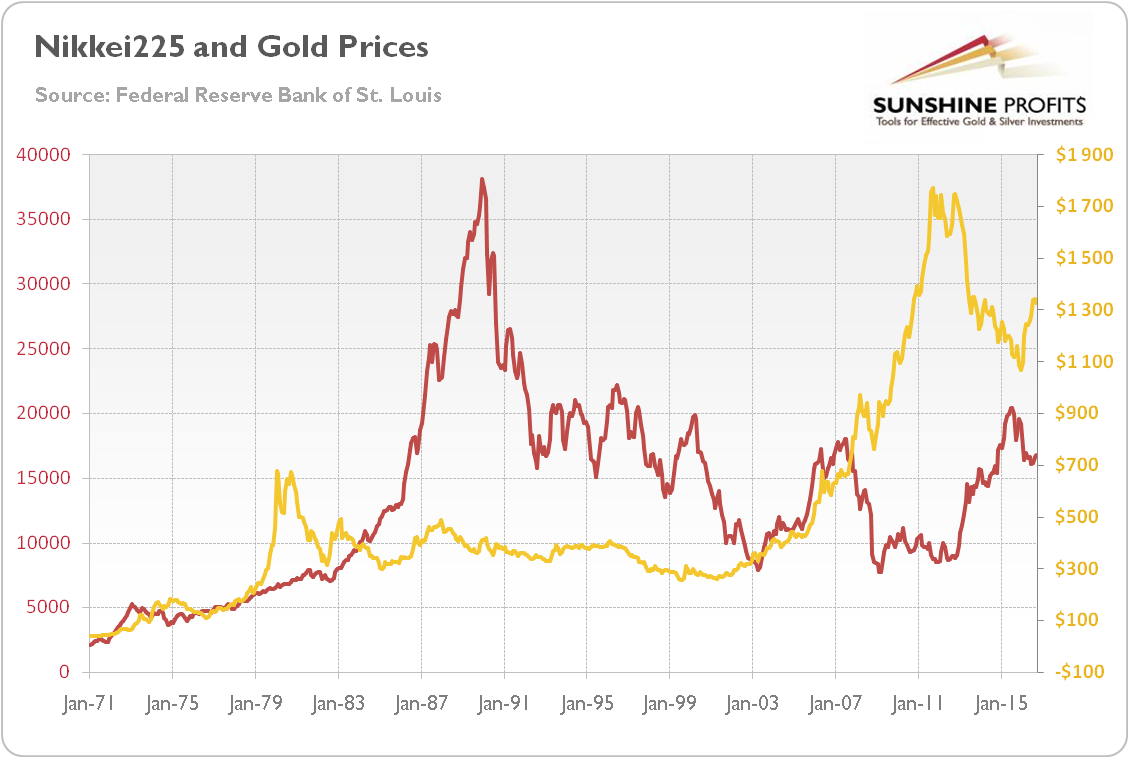

The current Japan’s problems date back to the 1980s when one of the biggest asset bubbles in human history occurred. The scale of irrational exuberance is shown in the chart below, in which we also plotted gold prices against the Nikkei225 Index. Although there is no clear correlation in the long-term, an interesting negative relationship between the Japanese stock market and the gold prices has manifested recently. We will discuss this link in detail in the following sections of this edition of the Market Overview.

Chart 1: The Nikkei225 Index (red line, left axis) and the price of gold (yellow line, right axis, London P.M. Fix) from January 1971 to September 2016.

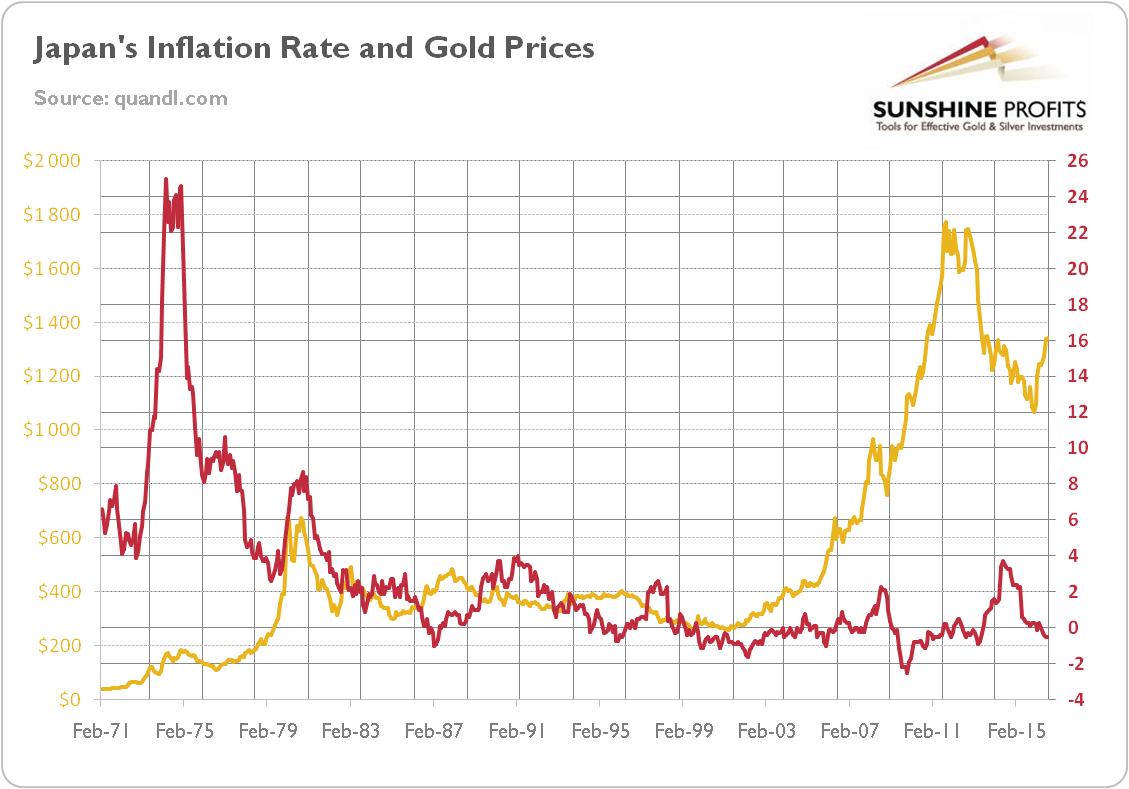

The country’s lost decades are consequences of the burst of the bubble and the following asset deflation. The Japanese economy fell into “balance sheet recession”, which led to the chronic impairment of overleveraged, asset-dependent companies. In short, the economic growth was negatively impacted by paying down high debt levels accumulated in the preceding boom by the corporate sector. Thus, the lack of response of the economy to the extraordinary monetary stimulus and zero interest rates policy should be hardly surprising. The chart below presents the BoJ’s failure to generate stable and positive inflation in the last quarter-century (and it also shows the lack of any clear correlation between Japan’s CPI inflation rate and the price of gold in the long run).

Chart 2: The Japan’s CPI inflation rate (red line, right scale, in %) and the price of gold (yellow line, left axis, London P.M. Fix) from February 1971 to August 2016.

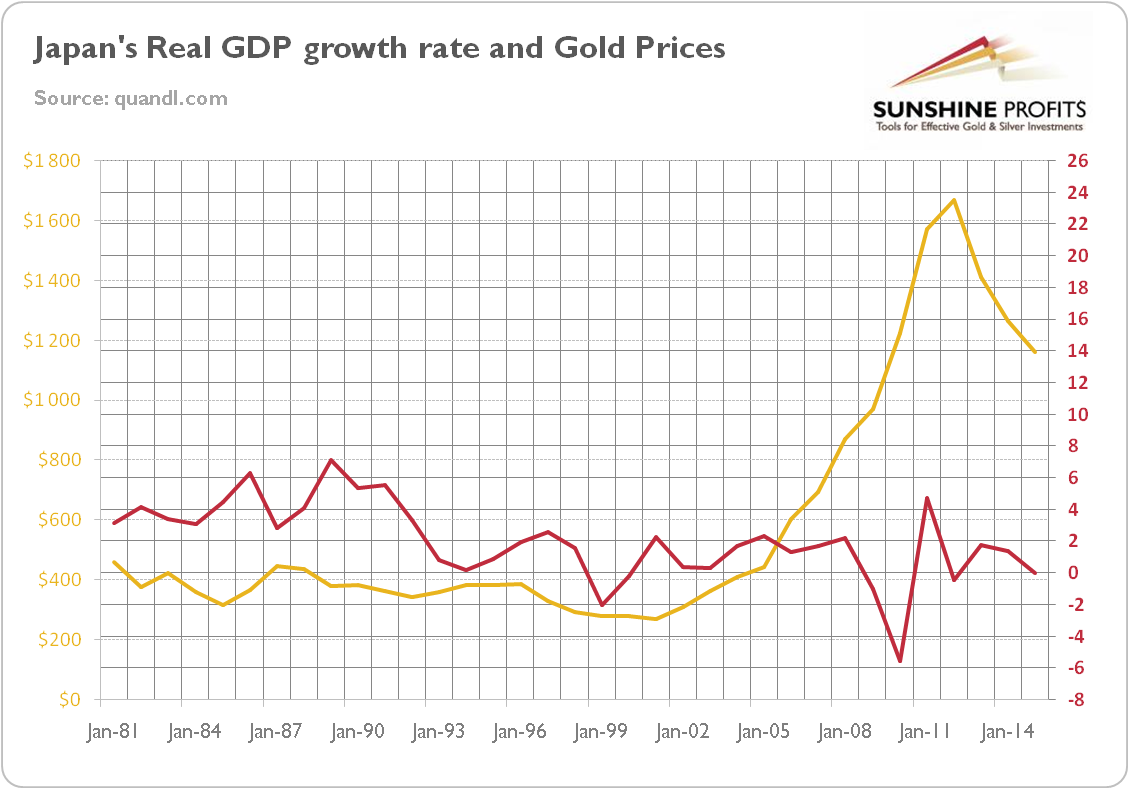

These measures only managed to keep zombie banks and companies afloat, blocking would-be competitors and inhibiting economic growth. Indeed, the real annual GDP growth over the last 25 years was less than 1 percent, as you can see in the chart below. The futile efforts to stimulate the economy during the lost decades made the BoJ a monetary policy vanguard followed by other central banks, including the Fed. This is why the BoJ’s actions are worth analyzing. By the way, the chart also shows that there is no clear correlation between gold prices and the Japan’s real economic growth.

Chart 3: Japan’s real GDP growth rate (red line, right axis, in %) and the price of gold (yellow line, right axis, London P.M. Fix) from 1981 to 2015.

What does it all mean for the gold market? Well, neither ZIRP (launched as early as in the 1990s), nor qualitative and quantitative easing, nor NIRP (all measures introduced by Kuroda in the 2010s) helped the Japanese economy. The facts speak for themselves: the Bank of Japan’s stimuli have failed. What is important here is that the central bankers refused to admit failure and continued the same ineffective strategy. You know, it’s a bureaucratic logic: the lack of effects of a given policy is not a proof of failure, but evidence that central bankers are not doing enough. Therefore, we can be sure that the recent changes in the BoJ’s monetary framework are not the last word from Kuroda. Our belief is enhanced by the enormous level of Japan’s gross public debt, which stands for about 250 percent of the GDP and is simply too large to be paid off (surely, the net public debt is smaller, but it is still unpayable through a mere fiscal consolidation). Hence, we should expect more decisive attempts to inflate the debt away and stronger fiscal-monetary cooperation, perhaps even the introduction of helicopter money. This may be good news for the gold market, since new monetary measures should support the price of gold, provided that they change the policy stance, not merely the framework, and that investors consider the measures as credible. However, if such measures weaken the yen and boost the U.S. dollar, gold may be under pressure.

If you enjoyed the above analysis and would you like to know more about the relationship between the Bank of Japan’s actions and gold, we invite you to read the November Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview