Italian Drama Eases…

Italy has a new government! On Thursday, law professor Giuseppe Conte was appointed prime minister with support from the League and the Five Star Movement. The leaders of Italy’s populist alliance, Luigi Di Maio and Matteo Salvini would be vice premiers. The formation of a government implies that there will be no fresh elections. Investors can breathe a sigh of relief, as the nomination avoided the risk that snap election would strengthen the populists’ power.

Moreover, the ruling parties have whitewashed their anti-euro stance. In his first speech in parliament on Tuesday, Conte said that Italy, a founding member of the European Union, would stay in its “home,” and that leaving euro was “never in discussion.”

Surely, several points in his maiden speech were alarming. Conte expressed a desire to lift Russian sanctions, expel some immigrants, or boost government expenditure. The agenda of tax cuts and higher welfare spending (the government plans to introduce a minimum basic income of €780 per month for the poorest Italians, funded by the state) will not be fiscally sustainable. And Italy’s public debt is already enormous. The government notices it, but wants to reduce it by “increasing our wealth, not through the austerity measures that in recent years have allowed it to grow.” It does not seem encouraging.

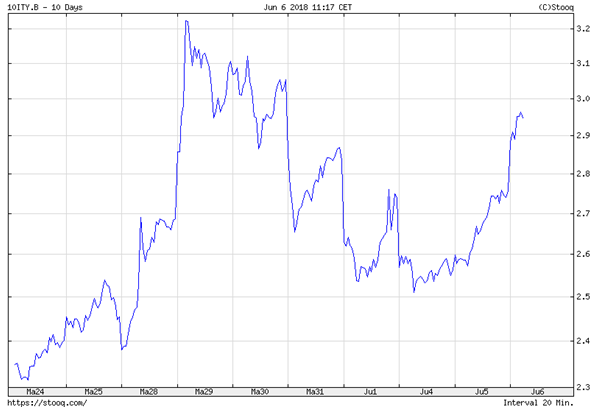

However, the 10-year Italian yields are now lower than a few days ago, as one can see in the chart below. The news government does not want to leave the Eurozone and anti-euro Paulo Savone did not become a powerful finance minister. Instead, he was nominated as EU affairs minister, while pro-euro Giovanni Tria will be responsible for Italy’s finance.

Chart 1: 10-Year Italian Treasury Yield over the last ten days.

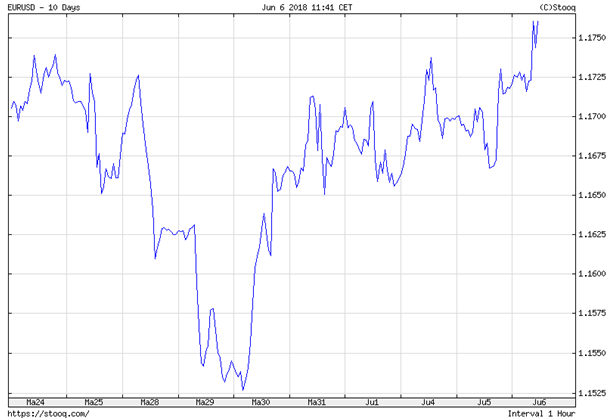

Thus, the euro has rebounded against the U.S. dollar, as the next chart shows.

Chart 2: EUR/USD exchange rate over the last ten years.

…While U.S. Labor Tightens

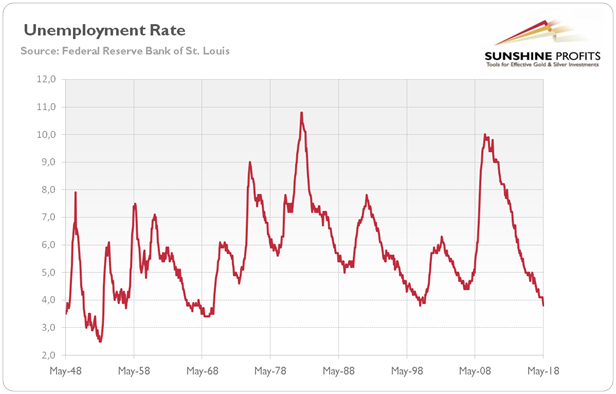

Let’s move overseas. The Labor Department released employment report on Friday. It showed that U.S. labor market tightened further. The nonfarm payroll employment increased by 223,000 in May, much more than increase in April (159,000) and the 12-month average gain of 191,000. Moreover, employment gains in March and April combined were 15,000 more than previously reported. Importantly, the unemployment rate edged down from 3.9 to 3.8 percent, the 18-year low, as one can see in the chart below. Last but not least, the average hourly earnings rose by 8 cents in May. As a result, the wages have increased 2.7 percent over the last twelve months.

Chart 3: U.S. unemployment rate from May 1948 to May 2018.

It means that U.S. economy has still plenty of vigor, despite the fact that the current economic expansion is one of the oldest ever. It is not good news for gold, which shines during economic perturbations.

Implications for Gold

What does the recent development imply for gold? On the one hand, the formation of Italy’s government, which is definitely less anti-euro, is positive for the yellow metal. We mean that the euro was thrown a lifeline, so it limits the potential for dollar’s further appreciation. On the other hand, the strong U.S. employment report in May is rather negative for gold. It implies that the American economy has more room for expansion. And declining unemployment rate combined with rising wages increases the probability of three more interest rate hikes this year. The market odds that Fed will raise the federal funds rate this month are above 90 percent. Investors also expect hike in September. And the renewed fears about the economy overheating boost the chances of another hike in December. More hikes should translate into higher real interest rates and stronger greenback, which should put the gold prices under downward pressure. Gold has been so far resilient in light of strong U.S. jobs data, but the eased situation in Italy and renewed fears of trade wars helped. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our gold mailing list yet, we urge you to sign up. It’s free and if you don’t like it, you can easily unsubscribe. Sign me up!

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview