We've raised some doubts about the bulls' power to succeed yesterday. Indeed, they gave up most of their gains before the closing bell. Today, we haven't seen even an upswing attempt that would fizzle out. So, is it a case closed? Given all the breaking oil news and data, what do the charts really reveal about oil going forward?

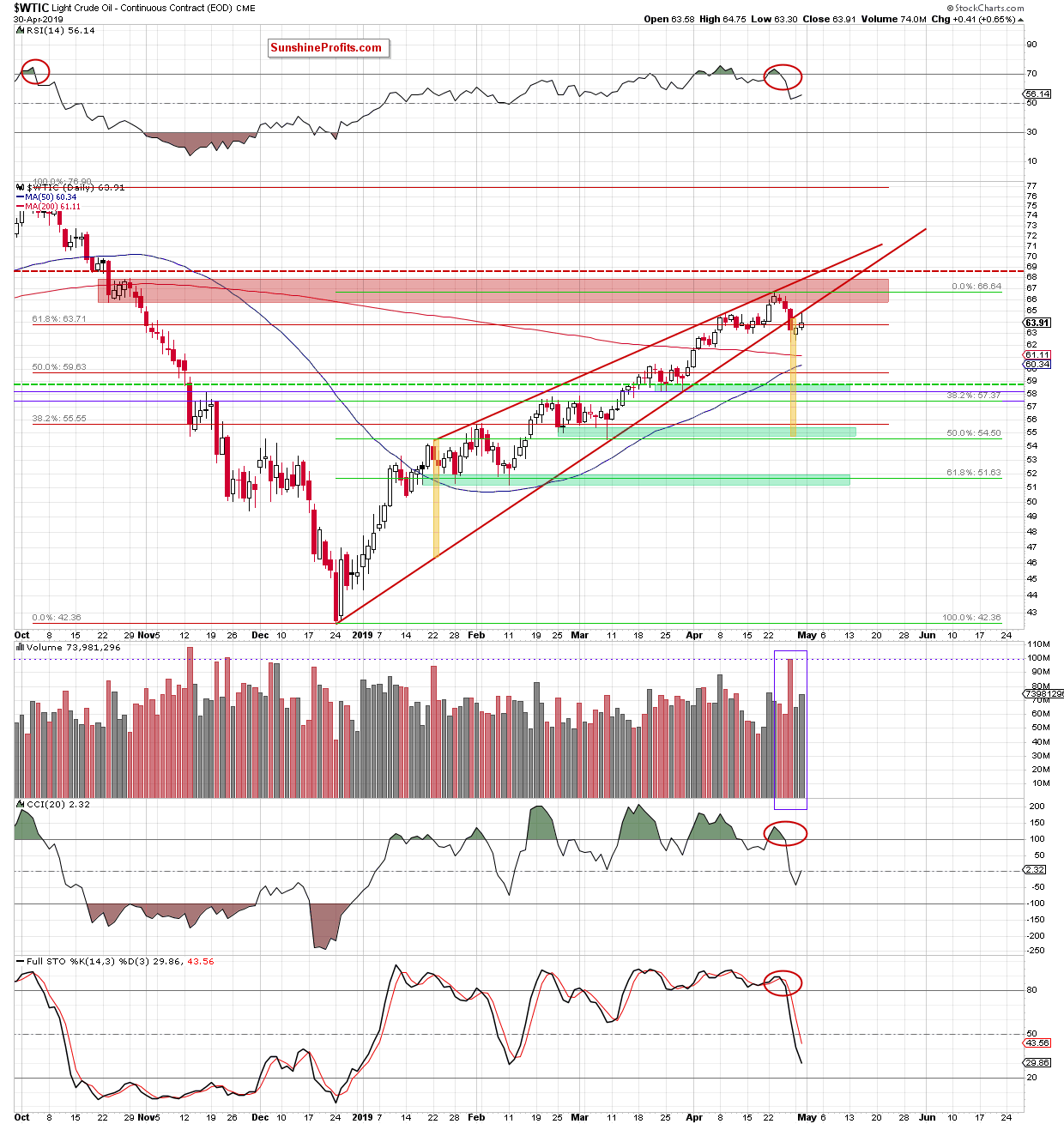

Let's take a closer look at the chart below (chart courtesy of http://stockcharts.com).

The daily chart shows that crude oil remains below the previously-broken lower border of the red rising wedge. Yesterday's upswing was bullish only at first sight and anyway, the bulls gave up most of their gains before the session was over. Our yesterday's reservations about the bulls' power (as expressed in the Alert's title) were justified. Our subscribers haven' t been surprised about the possibility of oil attempting to move higher and verifying its breakdown below the rising red wedge.

Earlier today, we've seen a tentative move lower and black gold currently trades at around $63.55. Even that is lower than yesterday's closing price.

The daily indicators continue to support the bears. Also the volume of yesterday's upswing was markedly lower than the volume of the preceding downswing. This is a clue doubting the commitment and strength of the bulls. And this is the second clue in a row as Monday's volume has also been much lower.

Let's discuss the targets of this oil downswing. Our subscribers have read these words on Monday. They remain up-to-date also today:

(...) Taking into account the shape of the current decline, black gold could move even lower than the first green support zone. It could visit the second green support zone because there the size of the decline would correspond to the height of the wedge that the oil price has broken down from.

Summing up, the outlook remains bearish. We've just seen a verification of the breakdown below the rising red wedge. The volume of yesterday's modest upswing was much lower than that of the preceding downswing and most of the gains evaporated before the session was over. The daily indicators remain on sell signals. The bearish divergences are in place and the short position is justified from the risk-reward point of view. Finally, today's price action doesn't have a whiff of bullish air and oil price volatility looks bound to pick up.

If you enjoyed the above analysis and would like to receive daily premium follow-ups, we encourage you to sign up for our Oil Trading Alerts also benefit from the trading action we describe. We encourage you to sign up for our daily newsletter, too - it's free and if you don't like it, you can unsubscribe with just 2 clicks. If you sign up today, you'll also get 7 days of free access to our premium daily Gold & Silver Trading Alerts. Sign up for the free newsletter today!

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Sunshine Profits - Tools for Effective Gold & Silver Investments