Some things change, and some things don’t. On the precious metals market and the related ones, we currently have both. There are trends that were unaffected by last week’s developments, but there are certain markets that made powerful moves and flashed important signals. And in order to correctly determine the next direction for gold, silver, and mining stocks, we will examine thoroughly.

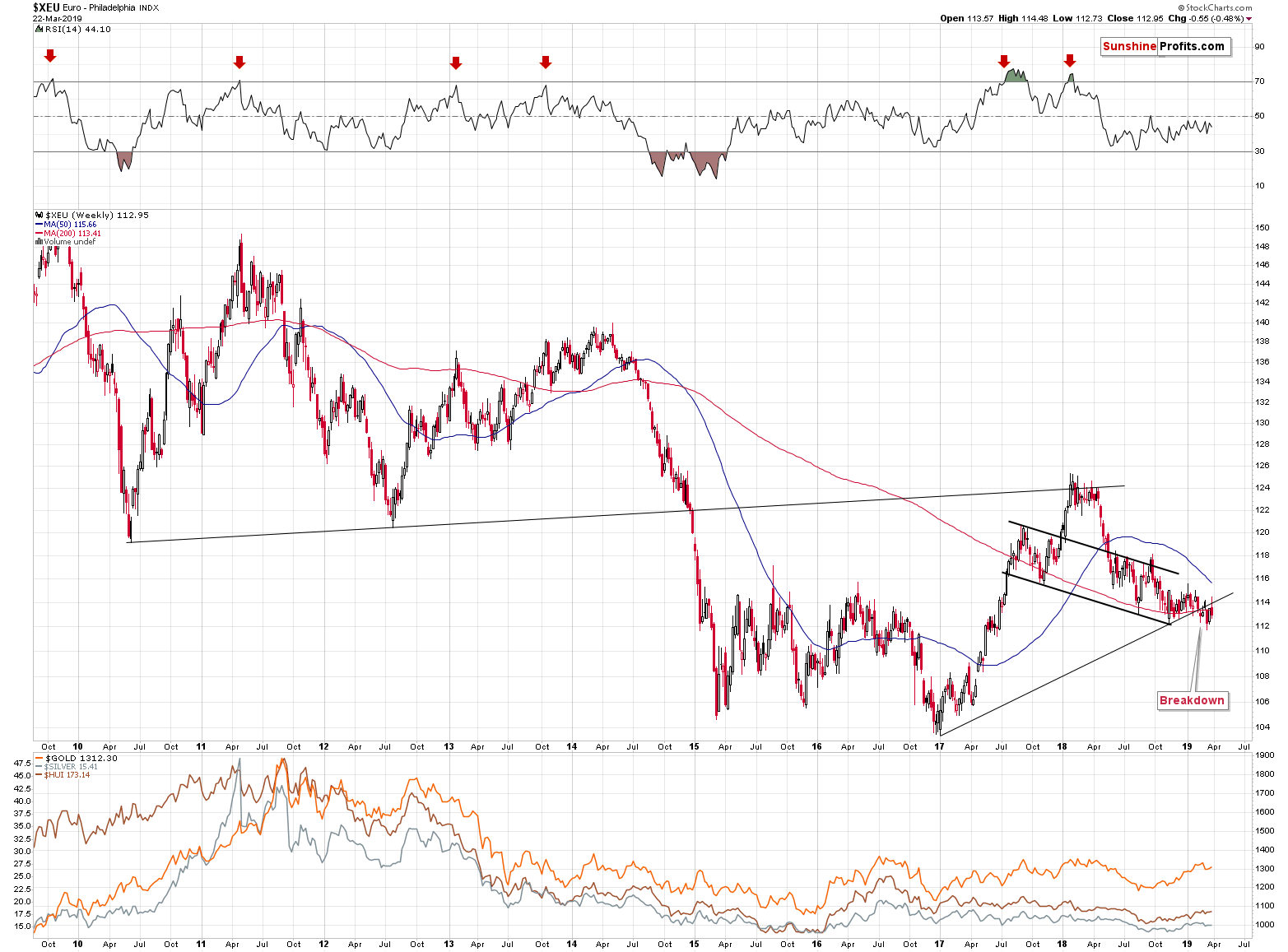

Let’s start with action. The key one took place in the currency market. The view is clearest in case of the euro.

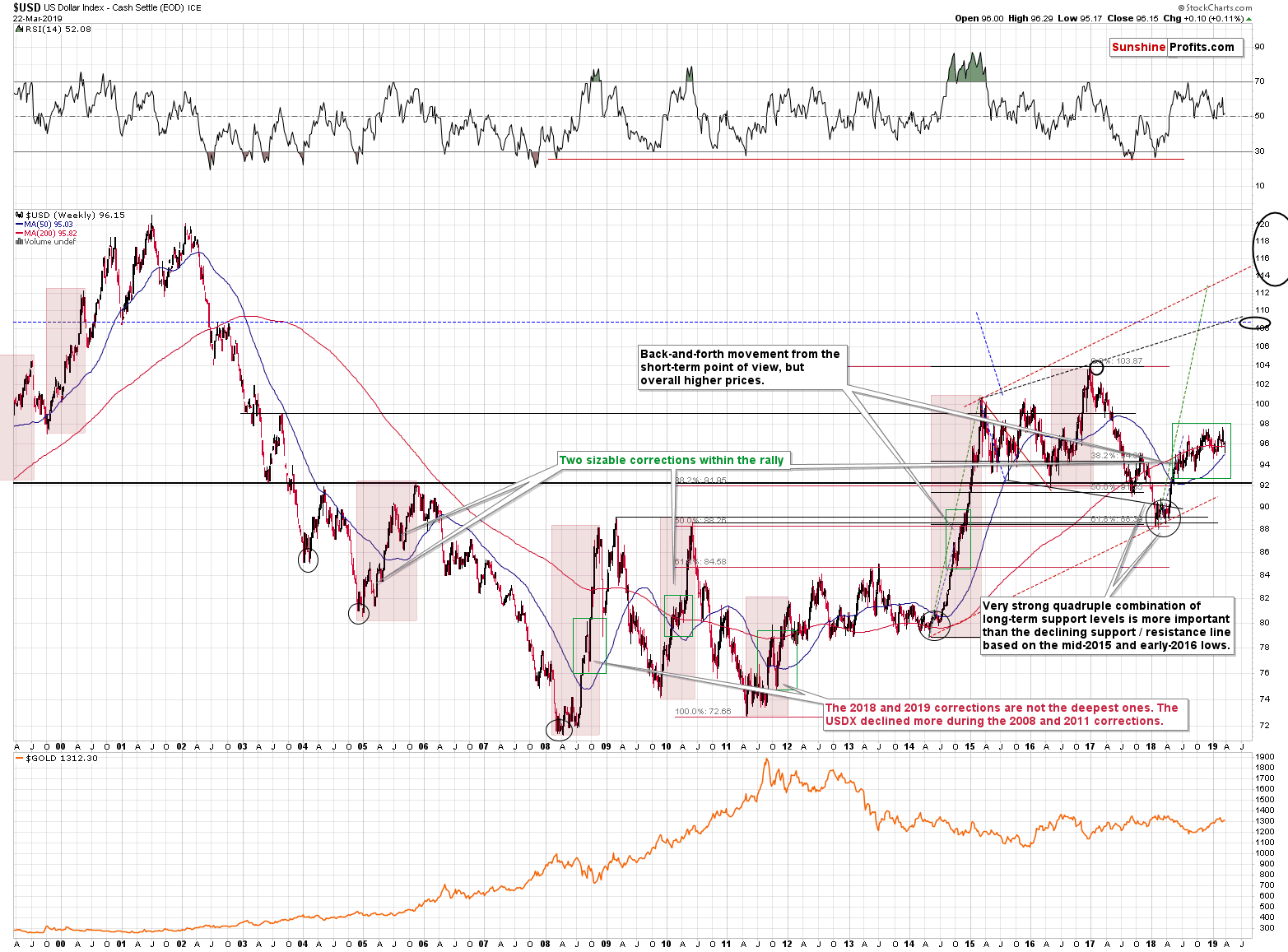

The USD’s Strong Performance

Last week, the European currency moved initially above the rising, medium-term resistance line and it ultimately failed in a profound way. Instead of a decisive comeback above the line, we saw a weekly reversal and an invalidation of the small breakout. This is practically as bearish as it gets and our short positions in the euro greatly benefited from the above.

The EUR/USD currency pair was not the only one that reversed last week.

The USD Index formed a bullish reversal and despite the mid-week Fed-induced decline, it ended the week 0.10 higher. This may not seem like much, but the fact that the US currency managed to rally at all instead of sharply plunging is astonishing. The Fed changed its course from hawkish to almost neutral, which was critically bearish for the US dollar.

Lowering or increasing by fewer percentage points or increasing the interest rates later, means that the USD is less valuable as a currency. The interest rates are the benefit that one may gain by owning a given currency. If there’s less to gain, the currency itself should be less valuable. There’s more to the interest rate – currency valuation link than just that, but the above is enough to explain why the USDX should have declined last week. Investors were expecting more interest rate hikes in the near future and they were informed that the rates will not be increased this year. Also, Fed has made the decision to first taper and later to end its balance sheet normalization (aka quantitative tightening). This was a bearish surprise, so the USDX should have declined, and since the change was profound, it should have declined profoundly. And it ended the week on a positive note. This is an extremely bullish sign for the following weeks.

The action that we saw last week was the bullish sign for the US dollar. The implications for the precious metals market are bearish.

What about the things that didn’t really change? Let’s take a look at the short-term picture throughout the precious metals universe.

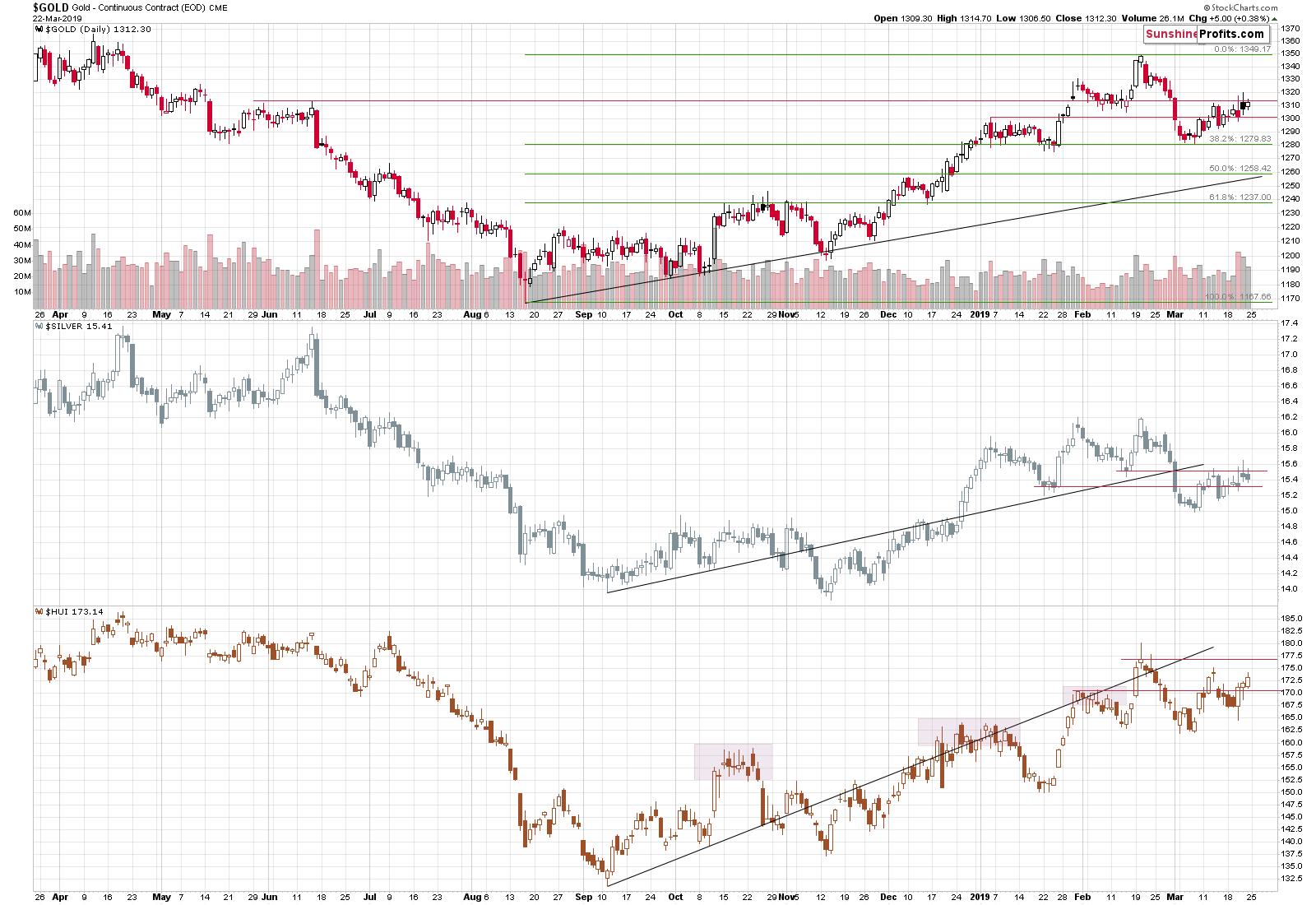

Feeling the Pulse of Gold

As far as the daily price moves are concerned, nothing really changed. Gold and gold miners moved a bit higher and silver moved a bit lower. None of them broke above or below any important support or resistance level, so technically nothing really happened.

There may be two questions regarding the relative performance here, so we will address them.

The first issue is why didn’t gold decline last week, even though USD moved higher, and the second issue is the last few days of gold miners’ outperformance of gold. When looking for answer to these or other similar points, now or in the future, we would like to point your attention to our Gold Trading Tips: they’re designed to help you make your gold trading decisions easier and more profitable.

Gold’s Resilience Last Week & Miners’ Outperformance Explained

Beginning with the former, the gold-USD link doesn’t provide really meaningful signals if there is a clear factor that influences both: gold and the US dollar. The whole point of the gold-USD analysis is to check when gold reacts to one of its major drivers in the appropriate way. If it reacts less than it should, it tells us that gold may not really want to move in a certain way. But, if it wasn’t USD to which gold was actually reacting, but there was something else that drove its price, then the discussion of the gold-USD link becomes rather pointless. Instead, we should focus on the thing that was the true trigger of price moves and estimate gold’s reaction relative to it. It’s usually the case that the gold-USD link is disrupted by something related to the EU as the EUR/USD currency pair influences the USD Index to such a great extent. This time it was the Fed’s shocker that was the most likely reason for last week’s price moves. The key question, therefore, is not whether gold moved strongly relative to the US dollar, but whether it moved adequately with regard to the Fed announcement. And gold’s reaction was very weak, which means that the implications are bearish.

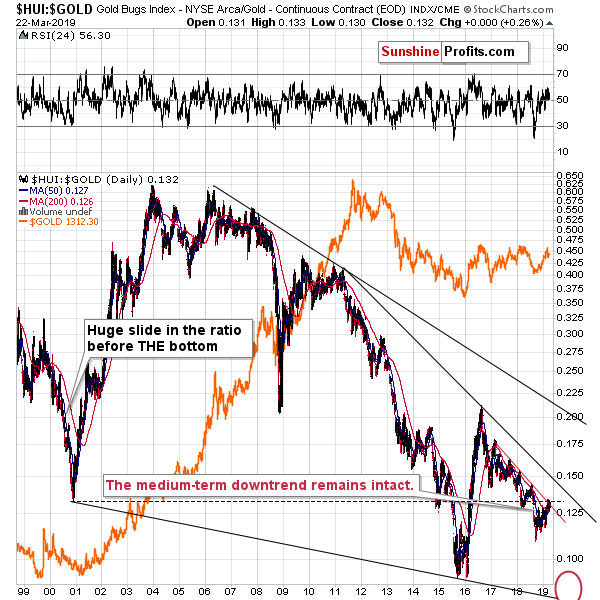

As far as miners’ outperformance is concerned, please note that it’s only a very short-term phenomenon that doesn’t change anything from the medium-term point of view.

Looking at the last 20 years of the HUI to gold ratio performance, it’s clear that the trend has been down since about 2006. In particular, the stable downtrend started in 2011 after gold topped. The 2016 rally was an exception that was followed by decline’s continuation. The miners to gold ratio moved a bit higher this year, but it appears to be nothing more than just a counter-trend rally, just like several similar rallies in 2017 and 2018. The downtrend remains in place. This means that another short-term decline that takes the ratio below the 2018 low appears to be just around the corner.

Summary

Summing up, the medium-term trend for gold appears to be down based on the signals that we discussed in today’s analysis. Naturally, there are many additional factors that need to be considered, especially with regard to the short term and the timing of the likely turnaround (hint: it’s very close) and you’ll find details in the full version of the analysis – in today’s Gold & Silver Trading Alert.

Thank you.

Przemyslaw Radomski, CFA

Editor-in-chief, Gold & Silver Fund Manager

Sunshine Profits - Effective Investments through Diligence and Care