This essay is based on the Premium Update posted September 12th, 2009. Visit our archives for more gold articles.

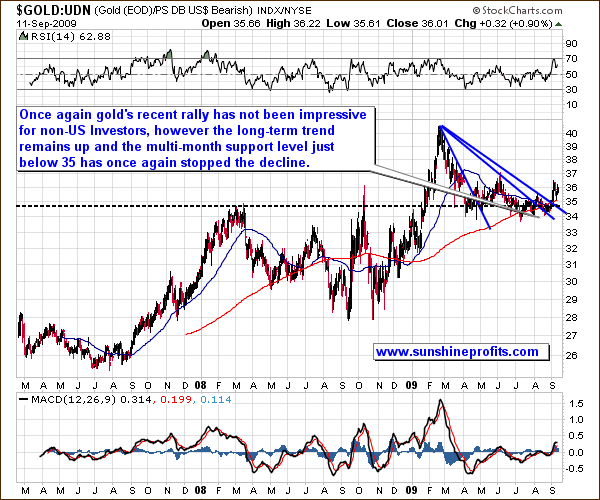

This week gold finally touched $1,000 (as indicated one of the previous essays) so without further ado, we will get right to the charts. Let's begin with the chart (courtesy of http://stockcharts.com) that features gold in other currencies than the U.S. Dollar.

Gold

Here's a quick reminder of the ratio featured in this chart (price of gold divided by the value of the UDN ETF.)

UDN is the symbol for PowerShares DB US Dollar Index Bearish Fund, which moves in the exact opposite direction to the USD Index. Since the USD Index is a weighted average of dollar's currency exchange rates with world's most important currencies, we may use the gold: UDN ratio to estimate the value of gold priced in "other currencies".

Looking at the price of gold from the non-US perspective, you realize that there is no need to worry about the health of the gold bull market. The price of the yellow metal in the other currencies is not near its previous highs. But those folks who are concerned that there is no bull market in gold because it does not rise equally in all currencies should relax. For now, the fundamental situation of the precious metals market is stable, which means that the bull market is charging ahead. Besides, bull markets usually end when everyone and their brother and the shoeshine boys too, jump in causing a parabolic spike in the price. We are still far from seeing anything like that.

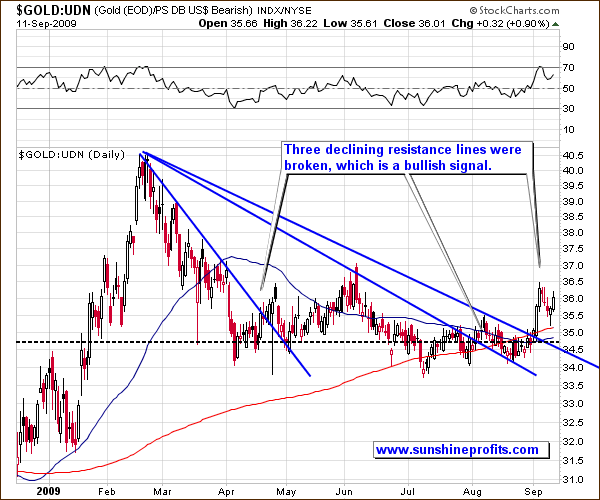

The gold / UDN ratio is quite bullish. It seems to have finally managed to move (and verify) above the support level at the 34-35 area.

Additionally, the three declining trend lines have been broken, a bullish signal indicating higher values of the ratio in the future.

As you can see in the short-term chart, the breakout above the highest of the resistance lines was verified this week, as the value of the ratio touched its 200-day moving average, and bounced. The recent rally is much more visible in the gold(USD) chart than here, but the overall implications are bullish as well.

Summing up, although the value of gold priced in most currencies other than USD is not at its previous highs yet, it does not automatically mean that the bull market is over. On the contrary, I expect PMs to do well in the future regardless of the fiat currency in which they are priced.

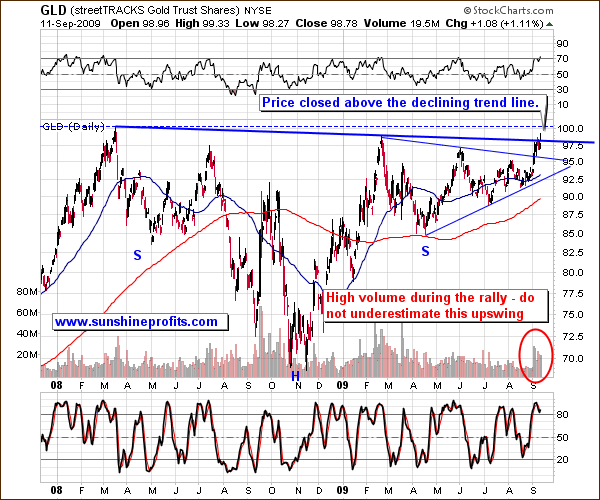

As far as the value of gold in the U.S. Dollar is concerned, please take a look at the following chart:

Gold closed above the declining trend line, an encouraging sign. Naturally, we will need to wait for a confirmation - three consecutive closing days above this level, or even better, three consecutive closing days above the previous high (marked on the chart with dashed line).

The volume is visibly higher than in the previous few months, which confirms the significance of the last-two-weeks' move. This is why I am not concerned about the overbought RSI, as I would normally be. The volume, the length of the previous consolidation and the seasonal tendencies - all suggest higher prices. The RSI is no crystal ball, although it is very useful during consolidation periods. Please note that at the beginning of 2008 it was overbought for the first time that year, but prices continued to rise much higher after that.

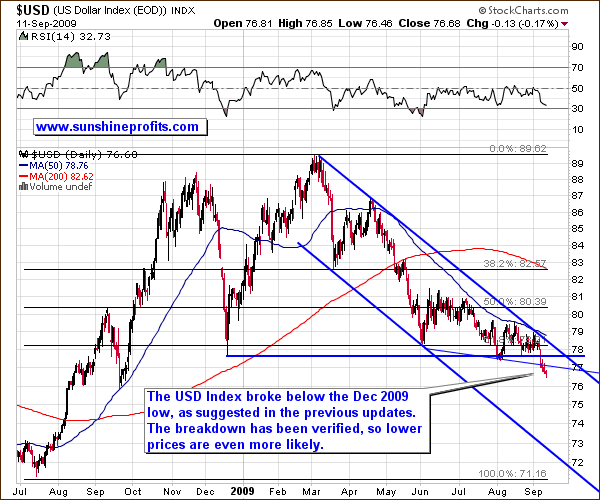

USD Index

The USD Index, one of the key drivers of precious metals prices, has now broken below the December 2008 low, and below a minor support line (declining, blue, thin line on the chart). The trend was down before the breakdown, and in the previous essays I told you this was likely to happen.

The USD stayed below the support levels for a few days, thus making the recent move meaningful, but I can't rule out a re-test of the previous lows. This would mean a brief upswing above the 77 level. This could be negative for the PM sector, but if gold first verifies the breakout above the 2008 high, I would not be concerned about a possible sell-off.

Summary

Precious metals moved higher this week and gold managed to close above the $1000 barrier, a significant development. I think it won't be long before $1,000 is the new floor of the gold price and not the ceiling.

Although gold seems to be overbought on a short-term basis, there are several things (high volume over the past several days) to suggest that the regular methods of analysis (the RSI Indicator, for example,) may not be appropriate here.

Again, should gold move above $1000 and verify this level as a support, a small upswing in the USD Index, and/or a decline in the general stock market, may not necessarily mean a return to three digits for the yellow metal. Even if that were to take place, I would expect gold to bounce back quickly and move north of $1000 once again. I will leave the detailed analysis of these key short-term drivers of gold prices to my Subscribers.

The analysis of the price of gold in currencies other than the U.S. Dollar confirms that a bigger move may be just around the corner.

To make sure that you get immediate access to my thoughts on the market, including information not available publicly, I urge you to sign up for my free e-mail list. Sign up today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

P. Radomski

--

One of the the key drivers of precious metals prices that is particularly important here is the general stock market. Naturally, this week's Premium Update covers its analysis - with the influence on PMs in mind.