The full version of our analysis (with comments particularly valuable for Precious Metals Traders) is available to our Subscribers. Visit our archives for more gold & silver articles.

The Chinese market will have a significant impact on the price of gold and silver bullion in the foreseeable future. This week, the price of wholesale gold bullion and silver rose against the US dollar but slipped against other currencies as commodities gained and government bonds gained.

The Eurozone stocks were flat in spite of the gains of J.P. Morgan, Intel, and Alcoa gaining a stronger than expected quarterly results. The Asian stock market closed lower while the sterling hit an 11-week high against the dollar. Since the euro has advanced to the greenback, there are talks that the gold-dollar coupling may come to an end.

The rise in Eurozone stocks can mostly be attributed to Spain's bond sale at auctions. In Greece, Piraeus Bank will buy a stake in two domestic lenders. In Britain, gold price was flatted back to below £790 an ounce. The euro also rose to $1.28 against the dollar, its best performance since the early part of May. For Eurozone investors, this means paying almost 10% less compared to gold's all-high high just last month. Gold today is retreating towards €30,400 per kilo.

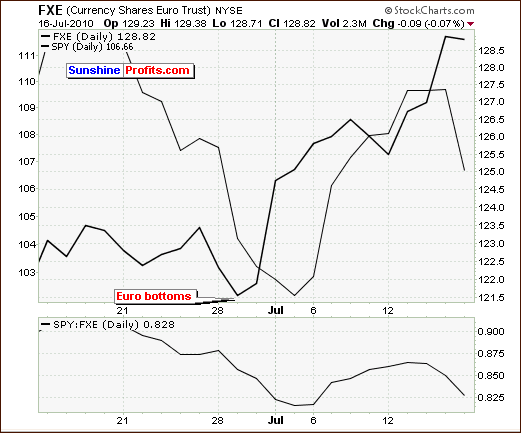

To demonstrate the relationship between Euro and US charts, please take a look at the chart below (charts courtesy of stockcharts.com).

When the Euro ETF (FXE) bottomed out on June 29, the SPY followed two days later. When the FXE got a boost in early July, the SPY followed this high during the second week of July.

Let us look at how metals fared. Silver opened at $18.42 an ounce while palladium and platinum both posted modest gains. The former opened at $466.00 an ounce while the latter was quoted at $1525.00. Rhodium was lower by $30; it is now quoted at $2350.00 per troy ounce.

Chinese Gold Consumption

Ong Yi Ling at Phillip Futures based in Singapore noted that weaker Chinese output figures, at 10.3 percent, is relatively good. "That could prompt the Chinese to buy some amount of gold. I see an uptrend in the gold-friendly country". Currently, households in China are the second-largest gold consumers in the world. Demand for gold in China nearly matches the private consumption in the United States, Middle East, and Western Europe combined.

This trend can be attributed to Beijing's initiatives to limit bank lending for speculations in real estate and stocks. French Bank Natixis noted that "Chinese investors that would previously have sought refuge in either equity or real estate markets have become significant buyers of precious metals instead". Data from Natixis reports showed that on the first half of 2010, trading volumes of gold in the Shanghai Gold Exchange rose by 49%. On the other hand, silver trading got a bigger boost, increasing five-fold. Gold sales from the China National Gold Group also rose by 40 percent during the first-half compared to that of last year's. One question remains though, "What will happen to private Chinese gold holdings once real estate and the equity markets in the country bottoms out".

Chinese Government Role in Gold Prices

There is reason to believe that the Chinese government has been significantly adding to its gold reserves for the last six years. Beijing has also been promoting the development of gold investment products and this has encouraged Chinese banks to sell golf throughout the country. These initiatives have a far-reaching effect on the global gold market.

While an average Chinese hold the least amount of gold amongst Asian nations, they save as much as 40% of their income. Most of this money is deposited at banks but as more people get more financially sophisticated, they will look for other means to grow their money. But with the equity market behaving more like casinos than safe investment mediums, the demand for an investment that will hold its value grows. Gold, in the Chinese mind, represents financial security.

As a result, gold buying in this nation may eventually make China one of the most important investment markets for gold. The only constraint in gold buying, in both the government and individual investors, is the limited size of the gold market. Long-term and persistent buying is the only way to acquire vast quantities of gold. Consequently, it is safe to assume that persistent gold acquisition will continue in China in the foreseeable future.

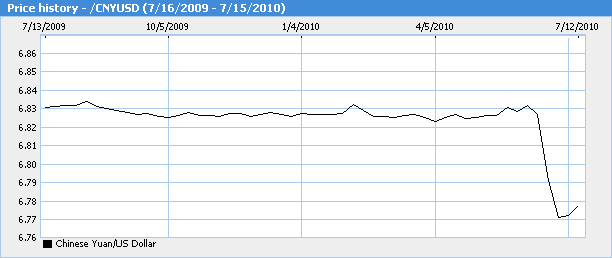

Yuan and the US Dollar

In talking about the Chinese economy, it is also important to tackle its currency. For years, the United States has been pressuring Beijing to let the yuan appreciate. Yet, there is no doubt that it remains undervalued despite recent concessions to let it rise slightly. Originally, the yuan was pegged to the dollar to capture a foreign exchange advantage. Chinese goods became cheaper than almost everywhere else.

The impact of the Chinese influence on the global economy cannot be underestimated. Yuan reform would significantly increase China's demand for commodities while reducing its demand for US T-bills. But the extent of the revaluation is hard to predict. What is clear, however, is that ending the yuan's peg to the dollar will allow the currency to appreciate against a basket of world currencies.

Once the yuan rises, it is possible that US and its European counterparts will find that it is just as cost-effective to keep certain jobs at home. Naturally, China will be against this because its economy growth depends on keeping these jobs itself. China has placated the West somewhat by buying sovereign debt from US and European countries. This seems like a Faustian bargain, the West keeps on borrowing from China as long as the latter gets the jobs.

China also did allow its currency to rise on July 21, 2005 but only on a very limited basis, about 17.5%. Analysts from the Capital Economics based in London thinks that appreciation will be quite slow, possibly amounting to only 2% by the end of 2011.

This may be seen as positive news for the world market but there are several considerations. It is possible that China thinks it is strong enough to withstand external pressure. Losing Western jobs and lower Chinese surpluses will result to weaker demand for foreign debt. Yet, it is important to look into a similar move done by China in 2005. Their actions didn't really affect Western stock markets. Of course, there are other factors at play from July 2005 to March 2006 including Chinese infrastructure build-out and the US housing boom. This can provide some lessons from what can happen next though. So what happened then?

The following occurred in the months following that decision: the price of gold increased dramatically, silver prices fell before it recovered strongly, iShares in MSCI Brazil Index (mostly driven by commodity companies) almost doubled in value, the S&P fell for three months before gaining in the next five months, the US dollar zigzagged, and copper prices boomed.

This time around, an appreciation by the yuan will benefit gold and copper prices. Resource-rich countries like Brazil, Canada, and Australia will be big winners. Commodities, especially gold, will gain the most if global recovery suffers a serious setback and equities become less attractive.

What's In Store for the Gold

During the short-term, gold will most likely go back to its inverse relationship with the dollar. Dan Smith of Standard Chartered also shared that "There is also an argument that the sell-off in gold from its (early June) high was overdone. Gold is treated as a safe haven by many investors. This aspect of gold investment is the most crucial thing to watch in the coming weeks. Francisco Blanch of Bank of America-Merrill Lynch predicts that gold prices will jump to $1,500 an ounce by the end of 2011. This can be attributed to the fact that "gold is the ultimate backstop to the sovereign crisis".

It is important to remember though that very little gold is held by emerging markets and most of their assets lie in US government and EU government bonds. Basically, there is a shortage of safe assets in the world. This means that the yields offered by UK gilts, German Bunds, and US Treasuries will remain low instead of skyrocketing upwards.

Meanwhile, inflation rose by 2.8% after the growth rate of 3.1% reported for May. These developments mean that authorities may not need to apply aggressive monetary and fiscal brakes as has been expected. Whatever the case, Citigroup predicts that China will continue to have single-digit growth rate for one year.

The lower growth rates can mean two things: it may be the "soft-landing" after China's economic growth burst or it may be a prelude to something worse. Right now, it is not clear which of the two is happening but it will become more apparent in the near future. The view over the short-term is still quite cloudy. Traders need to ensure that their portfolio is structure properly. Massive movements in the market can cause the price of gold and silver to plunge as they did in 2008.

On the other side of the globe, the United States is still talking about the "Great Deleveraging". To mitigate its impact, it may take as long as three or four years. However, the risks remain the same: risk of inflation, high unemployment rate, and continuous low interest rate. The Fed sees 1% or at under 2% inflation rate until 2014. However, the Fed is still debating the possibility of a worsening outlook in the US economy and they are looking at measures that can be implemented when such conditions arise. As a result, the "extension" of the deleveraging may or may not apply.

Before we analyze the chart above (source: http://blogs.stockcharts.com/chartwatchers/2010/07/the-midyear-update.html) it is first important to recognize that bond prices and its yields move inversely to each other. When yields are dropping, it means that there is a strong demand for it. Money must come from somewhere and over the last several years, this was bad news from equities. The yield is usually seen as an indicator of what's in store for the S&P 500. On the chart above, notice that the 10 year treasury yield spiraled downwards in the early part of 2009, this was just before the S&P 500 did. The same happened several months ago.

The strength of equities cannot be sustained for very long. One factor is the breakdown in the yield near the 3.10% level. Spike in yields is testing that breakdown as it fuels short-term rise in equity prices. How long this last will is another matter but many investors believe it is doubtful that it will go beyond the 3.10-3.20% level.

Near-to-medium Forecast

Two firms changed their projection for the yellow metal for the near-to-medium term. UBS cut its 30-day forecast from $1300 to $1230 an ounce while Goldman Sachs raised its six-month target of gold from $1275 to $1290. These are two divergent views. Other factors may also contribute to the rise or fall of gold prices.

Costs are falling in the United States, which might signal deflation. Food prices fell by 2.2% (the biggest in eight years), producer prices is down by 0.5% while energy costs also went to by 0.5%. The leading barometer of inflation, the core producer prices, declined 0.4%, which is the biggest since the second quarter of 2009. It is apparent while the Fed is fretting about the economy.

The interrelationship between currencies, the dollar, yuan, pound, and euro continues to influence the price of gold. The security of the bond markets can either push people into gold investing or pull them away from it. Summing up, the price of precious metals is likely to go up within several years because of demand pressure. But over the short-term, any fluctuation can happen. Detailed and up-to-date analysis of the latest market movements is available to our Subscribers. In order to stay up to date with our comments about the gold, silver and mining stocks that might influence your portfolio we strongly suggest that you sign up today to our free mailing list.

Thank you for reading.

Rosanne Lim

Sunshine Profits Contributing Author

--

This week's Premium Update includes an extensive explanation and continuation of the points made in the July 27th, 2010 Market Alert. In addition to providing you with reasoning behind our latest (profitable) trading suggestion, we focus on where the current rally can take gold, silver and mining stocks (targets for both: ETFs and spot prices) and what can one expect to take place once this rally ends.

We have analyzed 16 charts/tables including ones dedicated to the Euro and USD Indices, both key precious metals - gold (also from the non-USD perspective) and silver, main stock indices, the HUI Index, the GDX ETF and the Gold Miners Bullish Percent Index. Moreover, we comment on the recent changes in our correlation matrix and a new development in the GDX:SPY ratio.

Additionally, we explain two questions from our Subscribers regarding trading frequency and option types.

We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.