This month, the London Bullion Market Association published a new edition of its quarterly journal called “Alchemist.” What can we learn from this publication?

Most of the pieces focus on internal LBMA news or regulation updates, however, there is always one analytical text. In this edition, Kirill Kirilenko, a precious metals analysts at CRU International, wrote an interesting article entitled “The Interplay Between US Interest Rates and Gold”, which examines gold’s behavior during previous Fed rate-hike cycles.

Between January 1971 and December 2008, there were seven episodes of rate-hike cycles including three or more consecutive increases in the federal funds rate with no intervening cuts. Data shows that gold rallied through five of these cycles and fell through only two of them. Moreover, the average price gains significantly exceeded the average losses during rate-hike cycles: 133 percent versus 7 percent per each cycle. It suggests that gold is either very resilient to rate hikes or it thrives in the environment of rising interest rates.

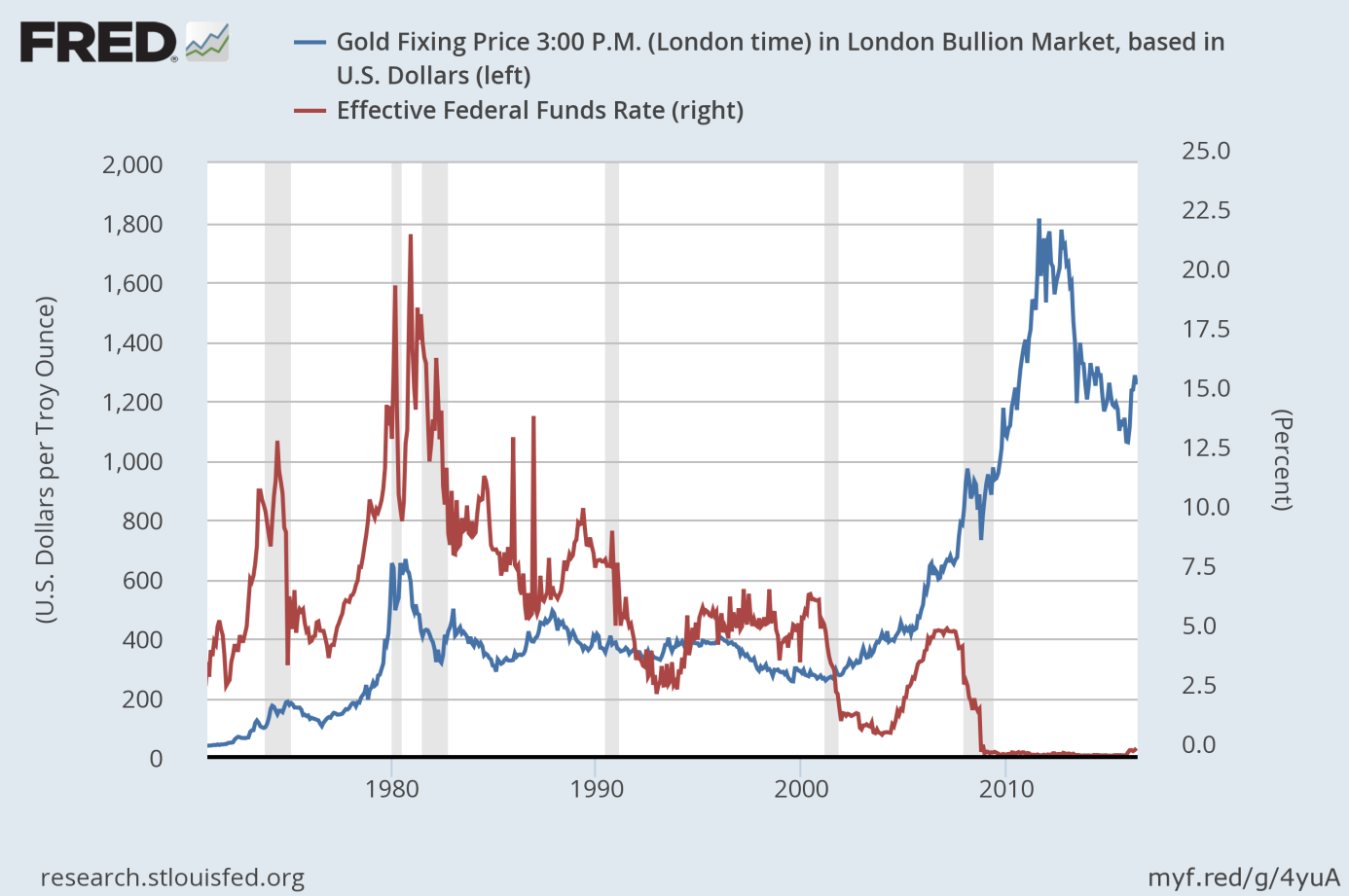

However, investors should not draw conclusions too quickly, as the gold market is complex and many factors (not only the Fed rate-hike cycles) affect the price of the yellow metal simultaneously. For example, the price of gold increased the most during rate-hike cycles which accompanied high inflation (between 1971 and mid-1974, as well as between 1976 and 1980). In the last cycle, from mid-2004 to mid-2007, gold also gained (as one can see in the chart below), but investors should remember that it was during a gold bull market. It was also the period when the U.S. housing bubble began to pop and when gold ETFs were introduced.

Chart 1: The price of gold (blue line, left axis) and the effective federal funds rate (red line, right axis).

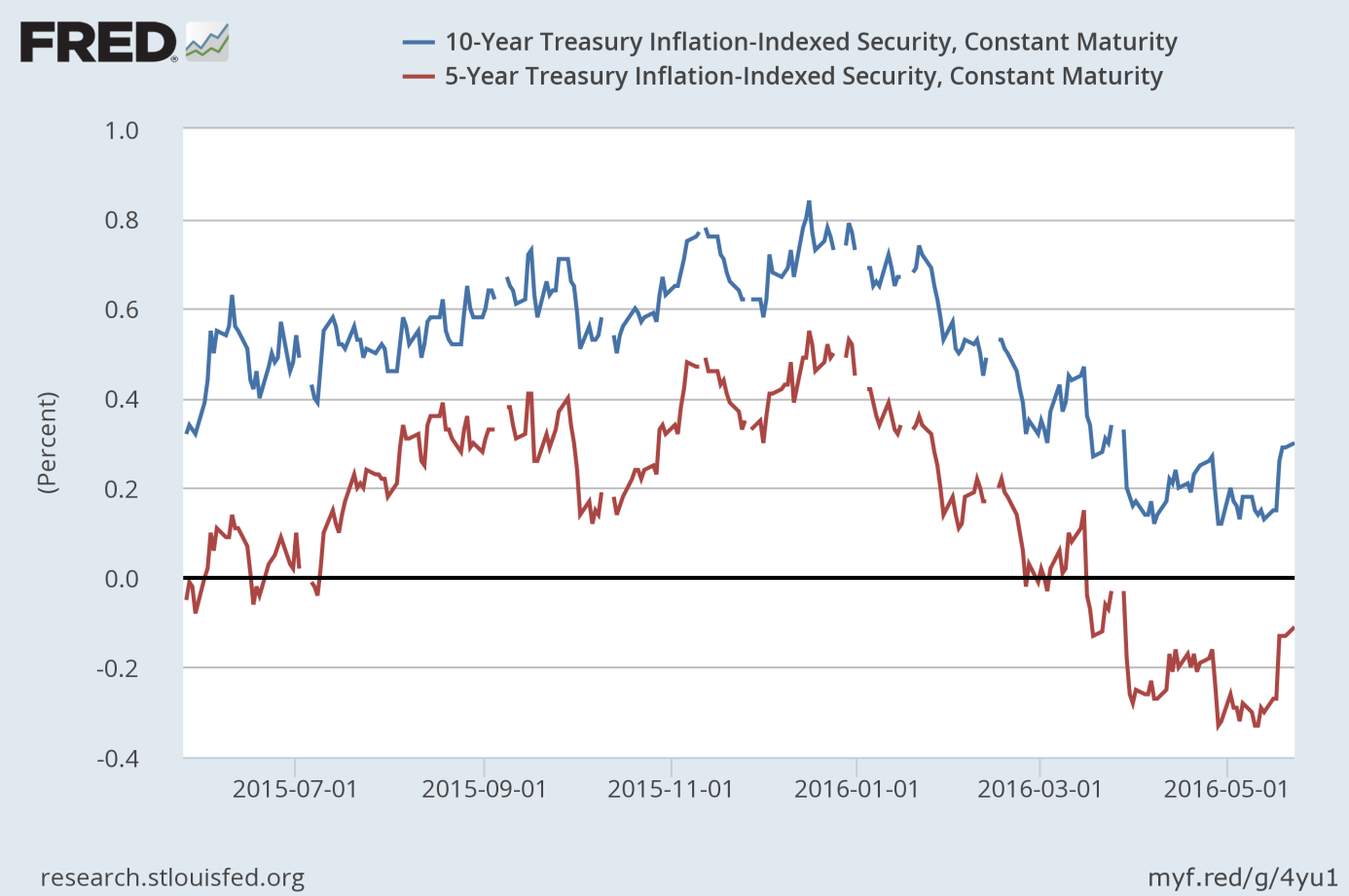

Nowadays, these factors are absent. In particular, there is no rampant inflation. Therefore, the positive behavior of gold during rate-hike cycles does not have to repeat. This is why the author of the mentioned report argues that the current rate-hike cycle will be bearish for gold. The Fed acts proactively compared to reactive actions in the 1970s when inflation got out of control. Consequently, the Fed’s actions are likely to raise real interest rates, which would make gold less attractive for investors than other financial assets. Indeed, real interest rates, proxied by inflation indexed Treasury rates, have been increasing since mid-May, as the chart below shows.

Chart 2: The 10-year Inflation-Indexed Treasury rate (red line) and the 5-year Inflation-Indexed Treasury rate (blue line) from May 2015 to May 2016.

Therefore, it seems that the recent surprisingly hawkish Fed minutes were a game-changer for the gold market. However, the U.S. is the only major economy where interest rates are expected to rise. In contrast, in other main economies interest rates are expected to fall or to remain near zero. Negative interest rates remain a risk factor bullish for gold. There is also a possibility of renewed market turmoil (for example, due to the upcoming referendum on Brexit) and safe-haven bids for the shiny metal.

The key takeaway is that the relationship between interest rates and the price of gold is very complex. Historically, gold gained during the Fed rate-hike cycles, however, mainly due to other factors accompanying the increases (like rampant inflation). It suggests that the current rate-hike should be bearish for gold bulls, unless inflation gets out of control or we will see market turmoil boosting safe-haven demand for gold. However, the current rate hike will be very gradual, which would reduce its negative impact on real interest rates and gold.

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview