Visit our archives for more gold & silver articles.

The gold naysayers are still out there in droves, other than Lady Gaga who is ensconced after surgery in a custom-designed, 24-carat gold plated wheel chair.

There is no denying that gold is off to its worst yearly start in a quarter century and that just in February investors sold 106 metric tons of gold from gold ETFs. (Even so, this is just a small portion of the fund’s holding and gold has gone up since then, a bullish sign) The newspapers headlines are full of eulogies for the gold bull market saying it’s finished, washed up, over.

This sort of stuff gets us, contrarians, excited. The best time to buy into the gold market is when investors are at their most bearish.

Still, legendary investor George Soros reduced his stake in a gold ETF by 55 percent in the last quarter, but we don’t know if he has piled back in or not. Soros Fund Management LLC owned about $97 million of the yellow metal through the SPDR Gold Trust as of Dec. 31, according to regulatory filing. John Paulson, the largest SPDR investor, kept his gold holding valued at around $3.4 billion, unchanged last quarter, his filing showed.

Gold has underperformed so far this year. That is the unsavory truth. (We note that gold didn’t decline for all investors. Gold priced in yen rose this year and the same was the case in terms of the British pound.

With global stock markets at a four-year high and the dollar near its strongest in seven months, eight of 13 analysts surveyed by Bloomberg said they expect gold prices will be lower in 2014 than this year. The median estimate of the 13 analysts is for a record annual average of $1,700 in 2013, falling to $1,638 in 2014.

There seems to be a general sentiment that the world economy is improving. Many are speculating that the Fed is going to stop printing money after 2013 (through QE that is).

That’s nice. But things are not always what they seem. We don’t see reasons for this enthusiasm about economy recovery just yet. We don’t see an end to quantitative easing. The Fed is increasing its already large $3 trillion holdings of Treasury and mortgage securities by $85 billion a month. Bernanke has made it clear in his most recent testimony before Congress last month that he will not make any changes until unemployment rates fall to 6.5% or lower. He plans to hold short-term interest rates near zero and has no plans to increase rates.

The truth is that fundamentals since gold reached its apex a year and a half ago have not changed. Central banks around the world are accumulating more gold, and announcing much more quantitative easing than even before.

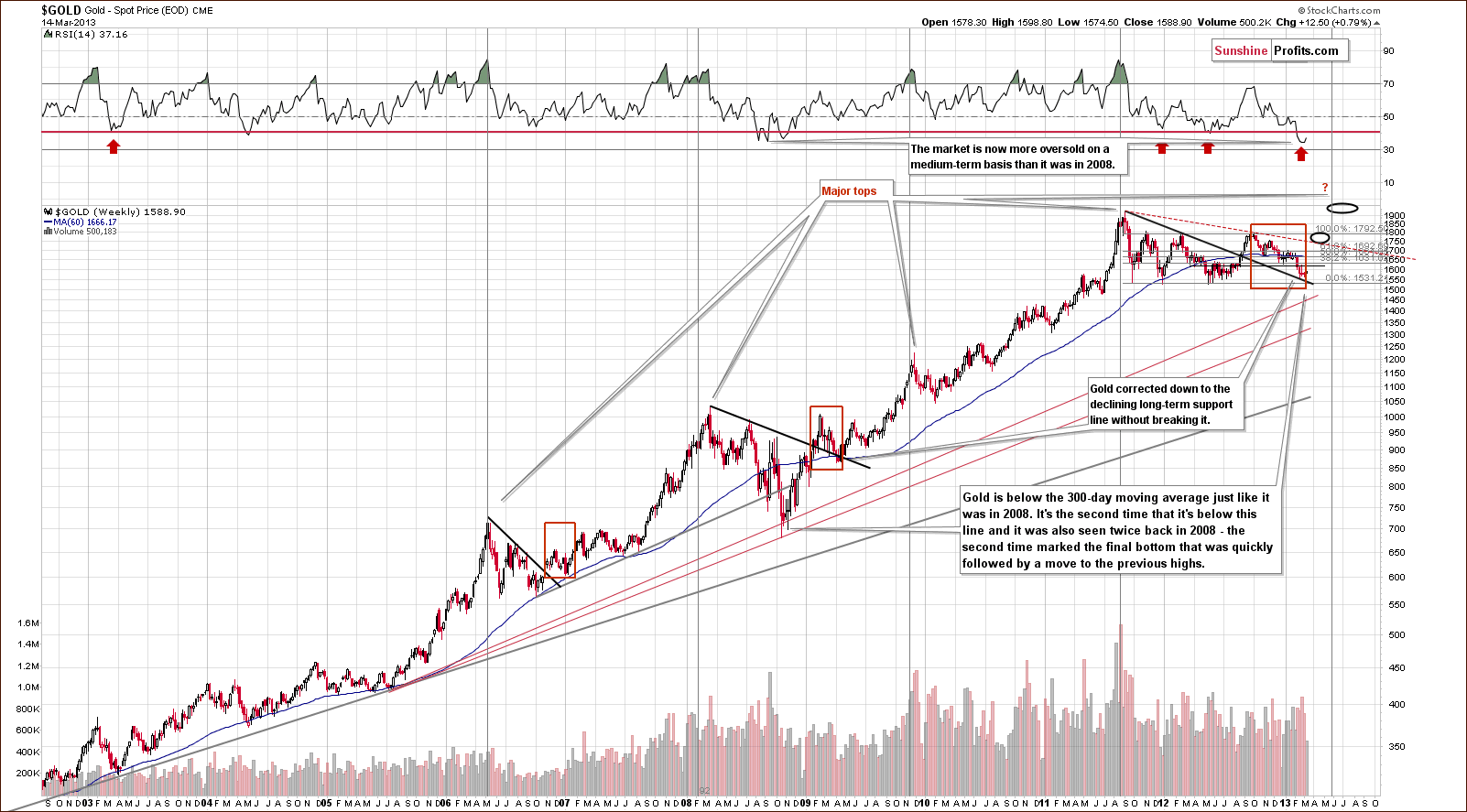

With fundamentals unchanged, let’s see how technical situation looks like for the yellow metal – we’ll start with its long-term chart (charts courtesy by http://stockcharts.com.)

In this chart, we see that in addition to reemphasizing that the RSI suggests that the situation is as extreme as 2008, we must also discuss the 300-day moving average. While a move below this level is not bullish for gold on its own, recall that in 2008, gold moved below this level twice and the second time marked the final bottom.

We are now in this situation once again. This is the second time gold is visibly below this important moving average. This consolidation period was longer, but it still is the second move below the average and in 2008, a rally was subsequently seen.

Other than adding this observation virtually nothing changed on the above chart since we previously commented on (Gold Price in March 2013) and we continue to have a bullish outlook as gold is above the declining medium-term support line and 2012 lows.

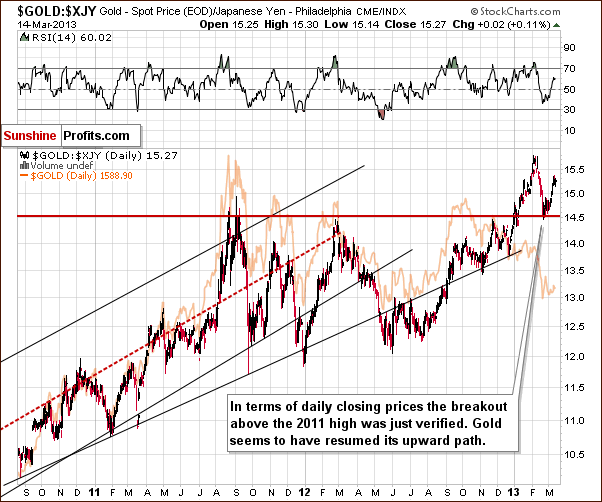

We have already mentioned that even though the yellow metal’s performance seems relatively poor this year, it is not so in currencies other than the USD. Japanese Yen seems to be the best example hence we’ll turn to gold priced in this currency now.

In this chart we see a clear breakout and a verification of the breakout above the 2011 high. With this breakout just being verified, the outlook is clearly bullish at this time.

On a side note, we would not be surprised if some websites provided this chart as an example when what a breakout or verification are – it’s that clear.

Let’s have a look at the yellow metal from the euro perspective now.

Here, we see a small breakout above the declining resistance line. On Friday, when the above chart was made available to our subscribers, we wrote that if [the breakout was] confirmed, the outlook would be very bullish for the weeks ahead – and we expect to see this confirmation shortly.

We now see that this was indeed the case and the technical picture has improved.

Summing up, we continue to have a bullish outlook for the yellow metal. The yellow metal remains above key support lines from both the USD and non-USD perspectives. We also saw a breakout for gold priced in euro this week, and it seems that the final bottom for recent declines may already be in for the precious metals. In case of the speculative capital, having a stop-loss order “just in case”, is still suggested, though.

Please keep in mind that the situation on the precious metals market may change quickly and what you read above may become outdated before you read our next free essay. That's why our premium subscribers receive daily Market Alerts +extra ones as soon as anything important takes place - they remain covered at all times. Moreover, our subscribers read full versions of our articles that we call Premium Updates - they are much more in-depth and thorough than free commentaries posted in this section, so by reading them you are better and earlier prepared when major changes regarding gold and silver occur. Premium Updates include price targets and trading suggestions as well. Our subscribers also enjoy up-to-date and tailor-made (!) gold stocks ranking, silver stock ranking and more. Traders particularly value the ability to track the accurate SP Indicators dedicated to the precious metals market without the weekly lag. We encourage you to join our subscribers and also enjoy all of the above-mentioned benefits.

Thank you for reading. Have a great weekend and profitable week!

Sincerely,

Przemyslaw Radomski, CFA