Based on the May 13rd, 2011 Premium Update. Visit our archives for more gold & silver articles.

We took a look at the Premium Update from this time last year and we saw that the more things change the more they remain the same. This time last year we wrote about the Greek crises and it seems that the European Unions strategy of playing for time and hoping that Mr. Ed will learn to speak Greek has not helped the situation much.

It was just a year ago that Europe bailed out Greece. A year later Germany is looking good with growth accelerating and unemployment lower than at any time since German unification. The European Central Bank is even raising interest rates to curb inflation. Things are more or less level in France and Italy, each of which recorded G.D.P. growth of 1.5 percent in 2010, well below Germanys 4.0 percent. But Greece is still a mess with an economy that shrank 6.6 percent, far more than the 1.9 percent decline in 2009. Greece has not managed to restore its creditworthiness and Greeks have not embraced the idea that they need to grit their collective teeth and suffer the austerity cuts for a better future. The cost of borrowing has risen and Greeces chances of renewed access to private lending on terms that the country can afford are not promising.

Recent anti-austerity strike in Greece and Standard & Poor's new warning about Portuguese banks exacerbated the euro-zone sovereign debt worries, sending the euro below $1.43 against the dollar and down more than 1% against sterling. Thousands Greek protesters took to the streets of Athens to demonstrate against the government's austerity measures, which were mandated by the European Union/International Monetary Fund bailout of Greek sovereign debt.

Like we said things havent changed much. Last year at this time we wrote:

The Greeks themselves are not exactly embracing the bailout, as evident by Greek demonstrations which turned deadly this week when three people were killed after protesters set fire to a bank in central Athens. Its hard to rescue a country that doesn't seem to want to be rescued.

This years May turmoil comes as fears grow that Greece could default on its debt next year without more help. The euro's drop, just a week after it hit a 17-month high versus the dollar above $1.49, accelerated after steep losses in stocks and commodities led to a stampede for the safe-haven dollar. (We can never truly understand investors who think that the dollar is a better safe haven than gold.) Speculation over whether Greece will receive more bailout funding kept risk appetite volatile with investors pricing in the possibility that the Hellenic Republic will eventually need to restructure its debt.

We believe that postponing the inevitable will not help the Greeks, but only make the debt restructuring hurt more when it finally does come. Greek debt is expected to exceed 160 percent of gross domestic product and could easily go higher. As of now, markets are refusing to touch Greek debt the latest indication is the recent S&P downgrade.

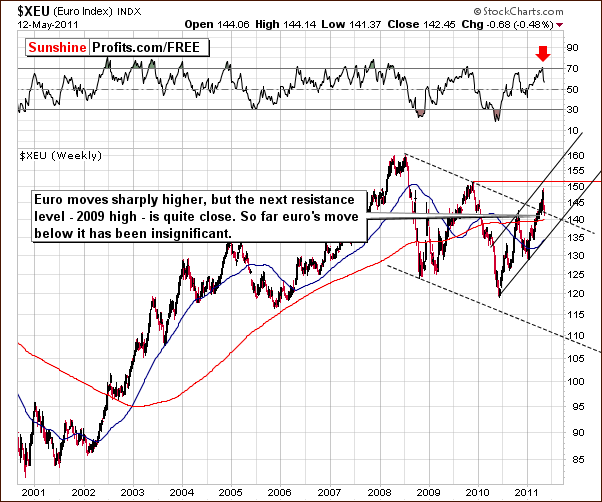

With so much happening in the markets lets turn to the technical part with analysis of the Euro Index. We will start with the long-term chart (charts courtesy by http://stockcharts.com.)

In the long-term Euro Index chart, we have seen some declines. Although it could be argued that the euro has moved below the declining support line, this is truly quite insignificant and barely visible in the chart. We view this as a correction within the rally and not as a decline at least not yet. There does not appear to have been any real change in the trend - only a temporary contra-trend move.

In short-term USD Index chart, we see the usual reflection of what has happened in the Euro Index. The highs of November 2010 seen in the Euro Index correspond to lows here in the USD Index.

The 50-day moving average is also in play here - we can see that it has provided support and resistance for the USD Index level on several occasions in the past and may very well do so again. At the moment of writing these words, USD Index has in fact moved slightly higher, but its below 76 and points made above remain up-to-date.

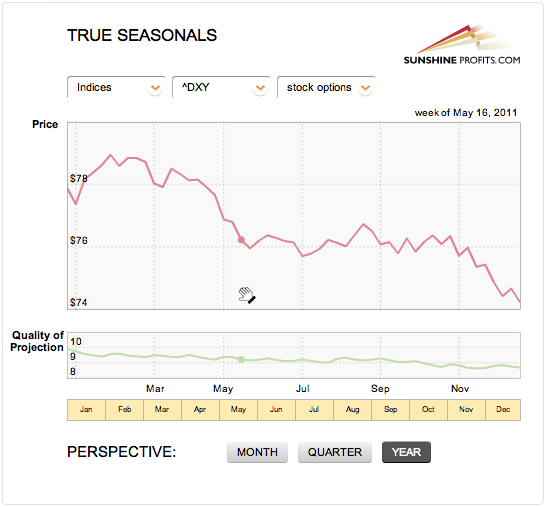

Before summarizing, lets take a look at the general seasonal tendencies in the USD Index.

Please note that the end of May on average marks the end of the decline we are close to this point, but not yet at it, so further declines or a re-test of the previous bottom is quite likely. (In case youve been wondering, yes, the chart above is actually a screenshot taken from our new soon-to-be-released version of the website. In short this is not an ordinary seasonal chart that you might have seen on the Internet. Its much more in-depth as it takes into account derivatives expirations influence on the prices of a given asset - and actually our website is the only place that provides these charts.)

Summing up, even though it may appear that support and resistance lines have been broken in the currency markets, such is not the case. The USD Index did rally slightly but is tied to the Euro Index which has not invalidated its previous breakout. The key factor here is that the very long-term Euro Index chart is still bullish and it follows that the sentiment for the USD Index is therefore bearish.

Since gold is positively correlated with the euro, a short-term rally in the yellow metal is quite possible (this takes into account the intraday decline seen on Friday). This would be very much in tune with the seasonal tendencies present on the dollar market.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

With so much volatility and erratic price movements in silver, the fact that we have just seen new signals coming from our unique indicators truly sheds light on the short-term situation. Meanwhile, the general stock market appears poised for another rally, but not all parts of the precious metals sector are likely to be impacted in the same way by this likely move - this week's update includes our comments on that interesting matter along with an update of our target prices for silver.

Finally, today's Premium Update includes True Seasonal chart for gold that greatly helps to put all other factors into proper perspective. We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.

Back