Gold & Silver Trading Alert originally sent to subscribers on May 6, 2014, 6:08 AM.

Briefly: In our opinion speculative short positions (half) are justified from the risk/reward perspective in gold, silver, and mining stocks.

The precious metals sector moved higher on Monday, but the way it moved higher might have surprised even the most experienced market participants. What’s next? Let’s take a closer look (charts courtesy of http://stockcharts.com.)

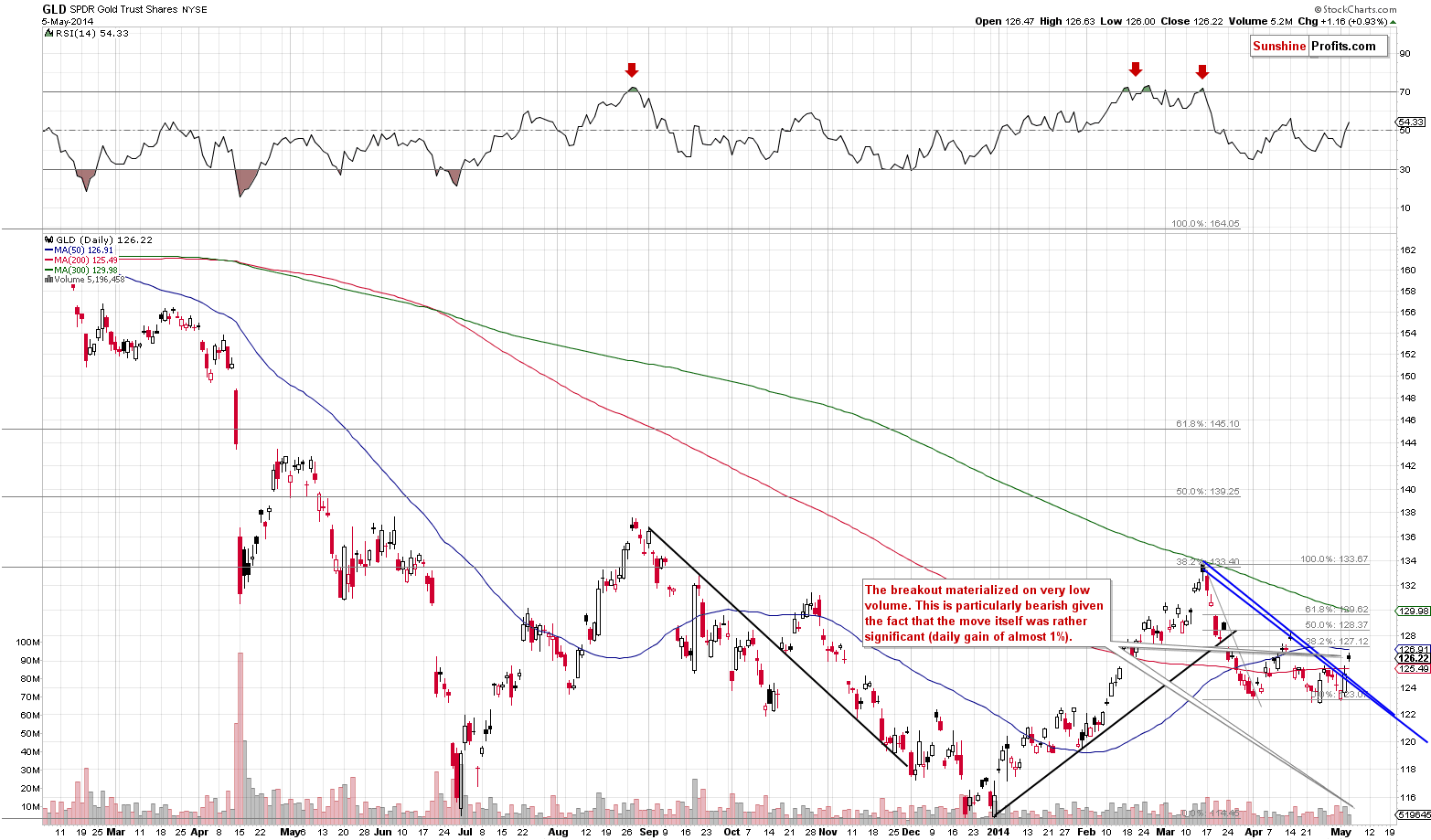

As you can see on the above GLD ETF chart, the ETF moved significantly higher yesterday… So the situation is now bullish… Or is it? The breakout materialized on volume that was so low that it was a strong bearish signal on its own. This tells us that gold indeed rallied based on some important news (escalation of the conflict in Ukraine), but that this move was just “an accident” within a decline, which decline is about to resume.

Yesterday, we wrote the following:

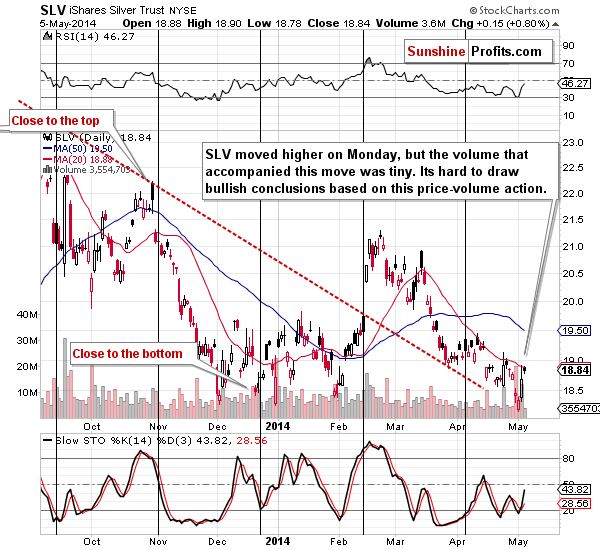

Silver rallied strongly on Friday, which didn’t change anything, as silver is known to rally temporarily just ahead of serious declines. What we saw was simply a move back up to the 20-day moving average, after which silver moved lower once again.

However, silver moved higher again early on Monday, which may mean more upside in the short term. “May,” nothing more.

We saw an upswing yesterday, but the volume – just as it was the case with the GLD ETF – was really low, which means that this is not really the true direction, in which the market is about to move.

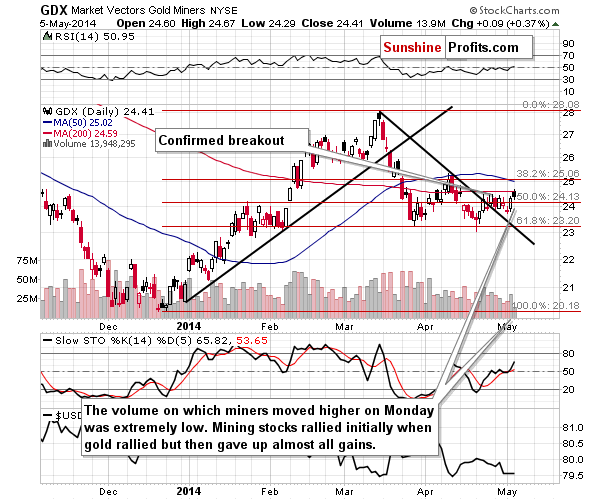

Initially, mining stocks moved higher, just like silver, but the move materialized on tiny volume and the gains were largely reversed later in the day. This means that the direction of the move is highly doubtful. The above is especially the case given that gold moved about $10 higher. If mining stocks decline when gold rallies, we have a bearish sign, and that’s exactly what we saw yesterday later in the session.

That’s particularly interesting given that there was no change in the Euro Index and the USD Index. The former is likely to decline based on the long-term declining resistance line, and the latter is likely to rally based on the support levels that were just reached and on the cyclical turning point.

Taking everything into account, it seems that we will see a decline in the precious metals market shortly. The precious metals market acted bullish in the pre-market action yesterday, but the following hours provided bearish signs. At this time we think it’s a good idea to re-open the short positions in the precious metals sector.

To summarize:

Trading capital (our opinion): Short positions (half) in: gold, silver, and mining stocks with the following stop-loss orders:

- Gold: $1,326

- Silver: $20.30

- GDX ETF: $25.20

Long-term capital: No positions.

Insurance capital: Full position.

Please note that a full speculative position doesn’t mean using all of the speculative capital for this trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts