Gold & Silver Trading Alert originally sent to subscribers on May 14, 2014, 8:24 AM.

Briefly: In our opinion speculative short positions (half) are justified from the risk/reward perspective in gold, silver, and mining stocks.

Yesterday was another day during which the precious metals sector didn’t really decline (just a little) despite a move higher in the USD Index. Let’s check if the situation is bullish now (charts courtesy of http://stockcharts.com.)

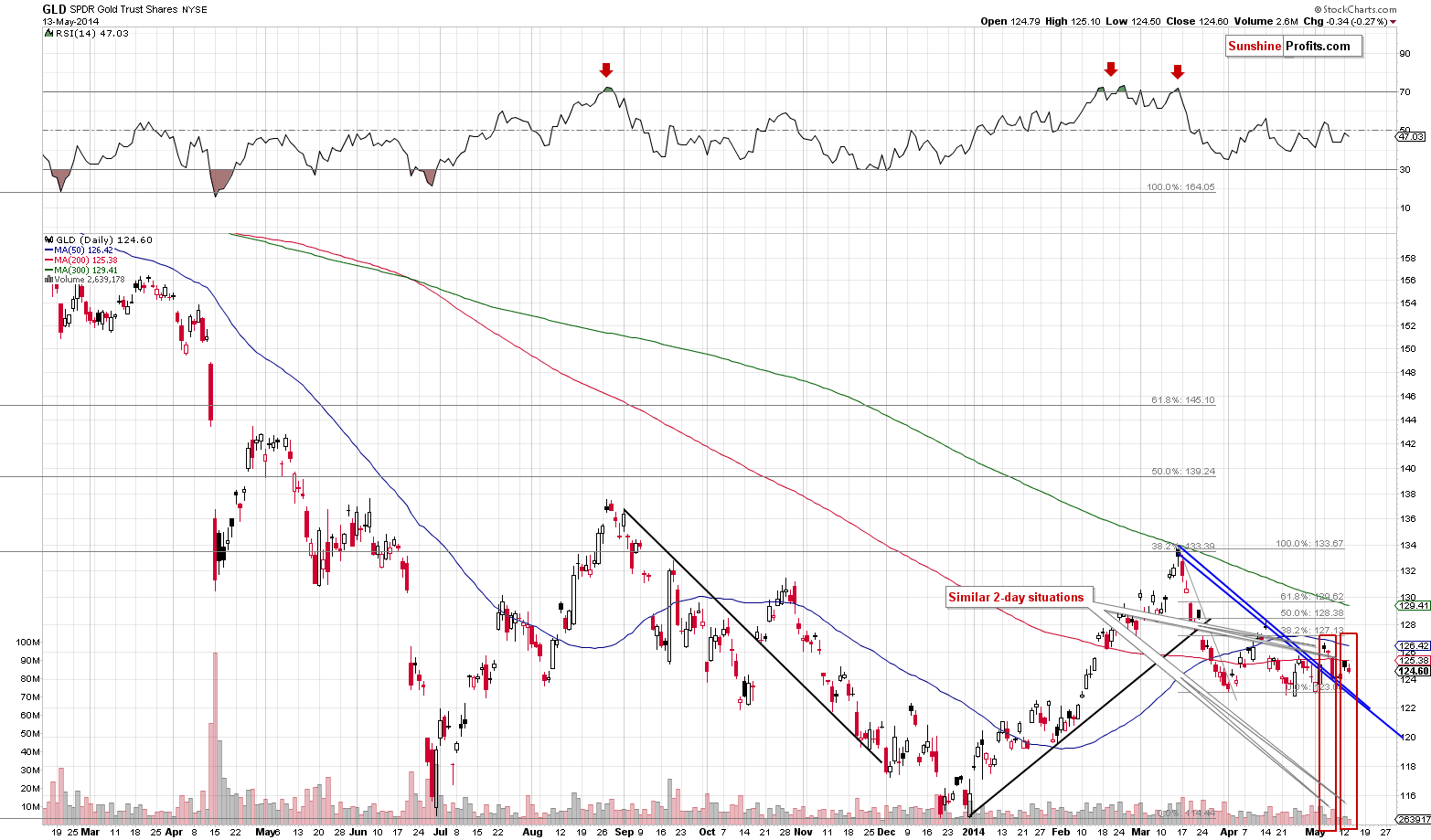

Starting with gold, we saw a small move lower, which might appear slightly bullish given that the move materialized on low volume. This might have been a suggestion that the move lower was not the true direction in which the market was moving, but that was not really the case. The above is the case, in general, for an opposite situation – if a given market moves higher on very small volume, then it indicates that the buying power is drying up and that prices are about to move lower. The situation is not symmetrical, because the price doesn’t stay at the same level when there are no buyers and no sellers – it declines. In short, yesterday’s price-volume action is only slightly bearish.

What’s more interesting is that the first 2 days of this week are quite similar to the first 2 days of the last week. We saw a sizable decline after this 2-day action last week, so we can say that it’s a quite bearish pattern on its own. There was only 1 situation similar to the last 2 days, so the implications are not strongly bearish, but the closeness of the situation and the level of similarity make it bearish.

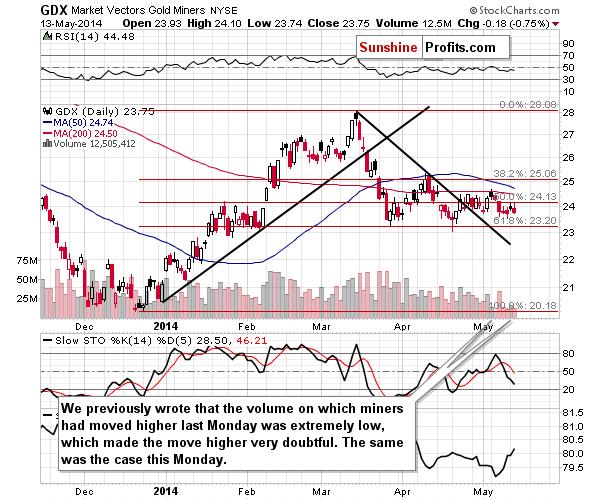

We can actually see a similar kind of 2-day pattern in the GDX ETF. Again, the implications are rather bearish. The mining stock sector is close to the March and April lows, and with each local high being lower than the previous one, it seems that we might finally see a breakdown this month.

The precious metals sector usually declines in the middle of May, so we have bearish implications also from this perspective.

On the other hand, the bullish fact is that the above-mentioned small-volume decline materialized when the USD Index moved higher and was already after a sizable rally.

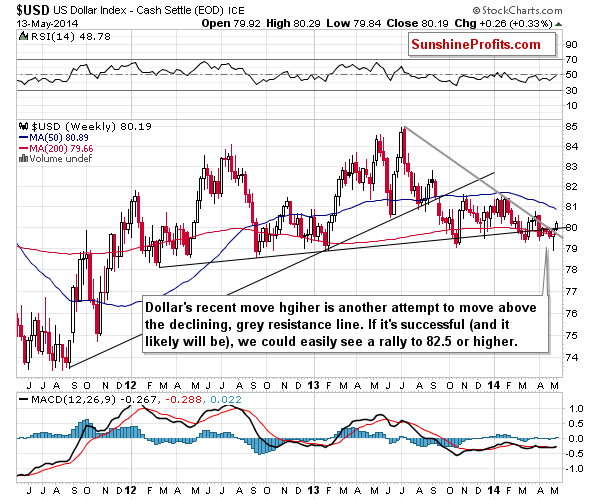

We previously commented on the USD Index in the following way:

The US dollar moved higher in the past few days and it’s about to take out the important declining resistance line that stopped the previous rally earlier this year. Once it moves above it, we are likely to see a strong upswing, which could translate into a big decline on the precious metals market. It seems quite likely in our view.

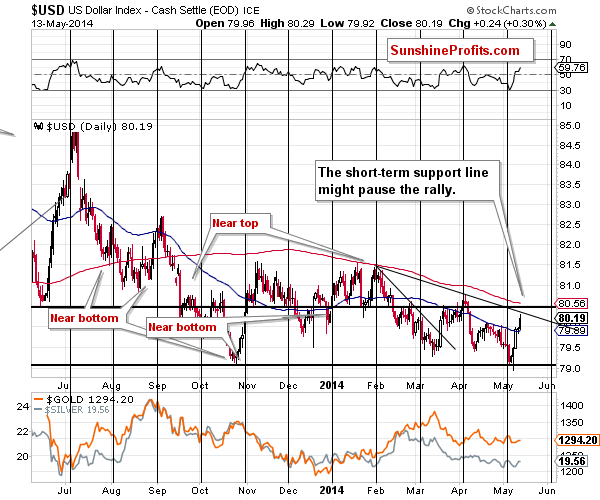

The USD Index moved higher and above the declining resistance line. It’s now more or less as much above it as it was during the previous attempt to move lower. Since the previous move failed, it seems to us that traders are waiting for some kind of confirmation that this breakout is a sustainable one. As such, it might not have had a bullish impact on the precious metals market just yet. It doesn’t mean, however, that we won’t see any in the coming days. There have been cases when precious metals’ reaction was simply delayed. This could still be the case, and we are not yet convinced that metals are showing true strength here.

The short-term USD Index chart reveals that there is one additional resistance lvel that needs to be taken out before the USD can rally much higher – the declining line based on the February and April highs. Once we have the USD Index above this line and the breakout is confirmed, traders should become convinced that the next move in the U.S. dollar is up, and that’s when we might see metals and miners finally respond to the USD Index’ strength (by declining).

Summing up, the outlook for gold, silver, and mining stocks remains bearish, but not extremely bearish, which means that we don’t increase the size of the short position just yet.

To summarize:

Trading capital (our opinion): Short positions (half) in: gold, silver, and mining stocks with the following stop-loss orders:

- Gold: $1,326

- Silver: $20.30

- GDX ETF: $25.20

Long-term capital: No positions.

Insurance capital: Full position.

Please note that a full speculative position doesn’t mean using all of the speculative capital for this trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts