Gold & Silver Trading Alert originally sent to subscribers on May 7, 2014, 7:08 AM.

Briefly: In our opinion speculative short positions (half) are justified from the risk/reward perspective for gold, silver, and mining stocks.

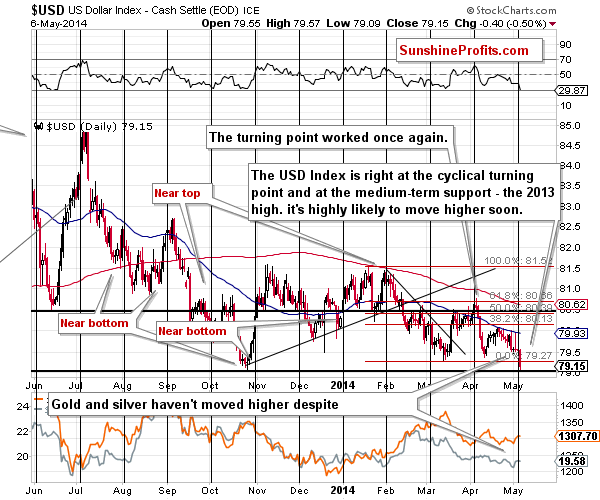

The most important thing that we saw in the markets yesterday was the major decline in the USD Index and the lack of proper response from gold, silver and mining stocks. Such a bullish factor should have made precious metals move much higher – but they didn’t… Or did they? (charts courtesy of http://stockcharts.com.)

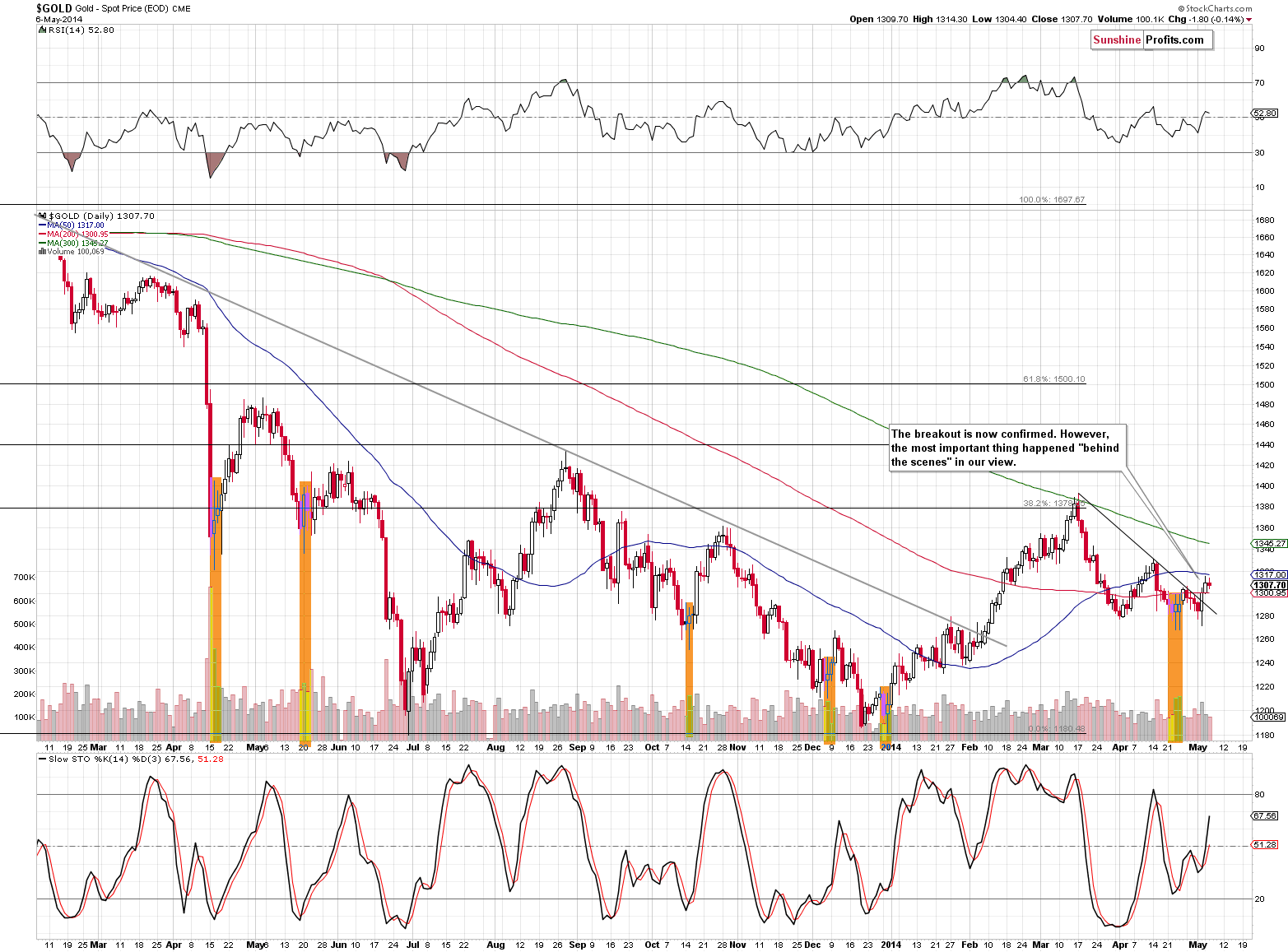

Gold didn’t even rally on Tuesday. It declined by $1.80, which is odd and bearish given that the USD Index declined heavily. The decline itself wasn’t significant, but we can point out that gold didn’t move above the 50-day moving average. Basically, the Tuesday session was bearish on its own.

Since the currency markets were so important on Tuesday, let’s take a look at both: the USD and Euro Indices.

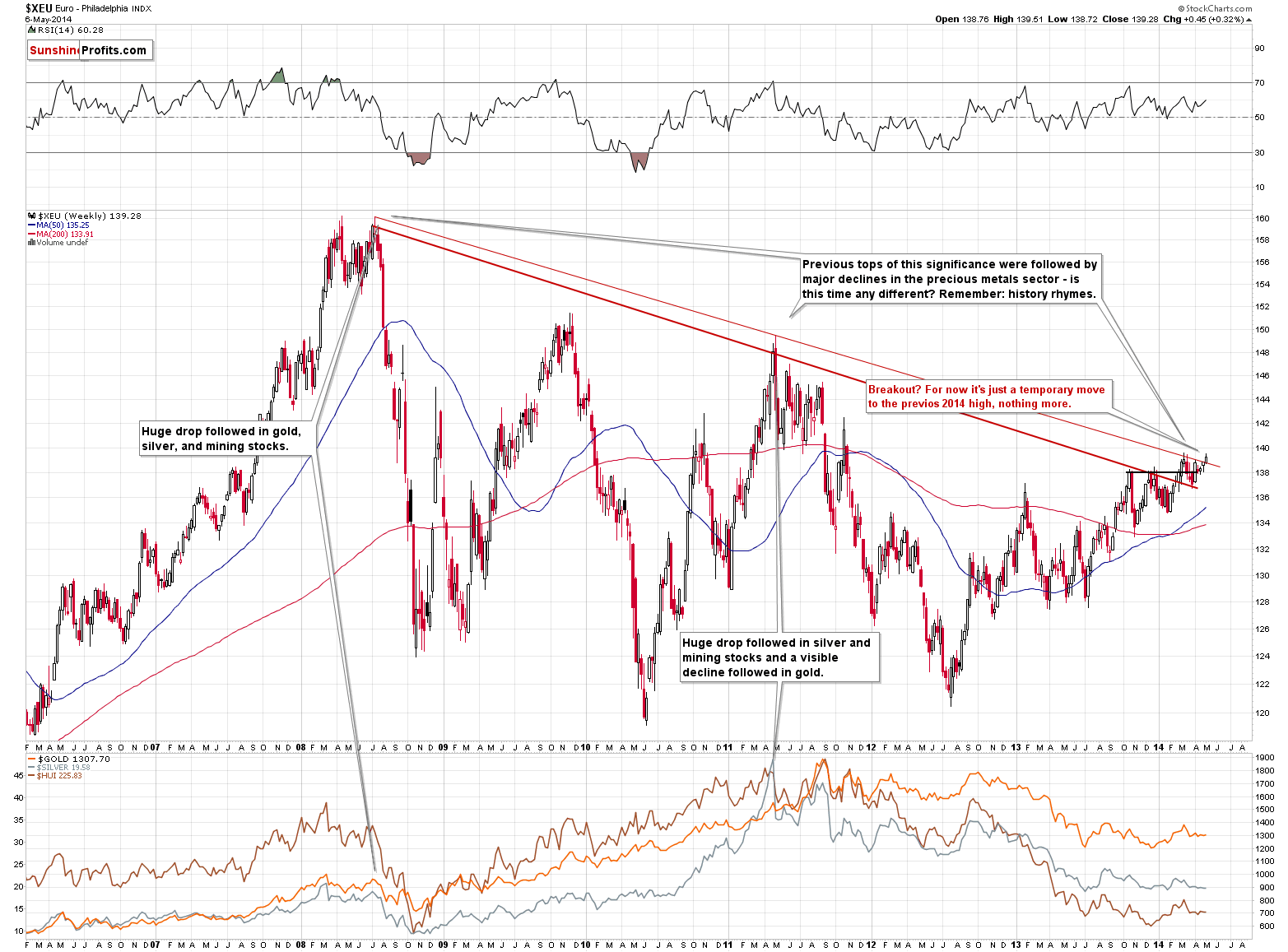

Generally, we saw a breakout above the declining, long-term resistance line in the Euro Index. At this time, however, the breakout is unconfirmed, and without meaningful implications. What’s more important, though, is how gold and silver reacted. They didn’t. Gold and silver moved just a little higher and that’s highly visible underperformance in case of gold and silver. They are not even close to moving to their 2014 highs.

Meanwhile, the USD Index moved significantly lower. In this case “significantly” means that it moved to the 2013 low, and that’s a major support level. Gold and silver are not even close to their previous highs, and this means that they are underperforming the USD Index, and as soon as the latter rallies, the former will decline. Are there any sings suggesting that metals are about to move lower? Yes! The cyclical turning point for the USD Index suggests a move higher as the current move has definitely been down. This means that when things change, the precious metals market will get a bearish push and that it will then decline significantly. The outlook for the precious metals market, therefore, remains bearish.

Summing up, the way precious metals market reacted to the U.S. dollar’s move lower (to the 2013 lows) is a bearish sign, and it confirms the bearish outlook that we outlined in previous alerts.

To summarize:

Trading capital (our opinion): Short positions (half) in: gold, silver, and mining stocks with the following stop-loss orders:

- Gold: $1,326

- Silver: $20.30

- GDX ETF: $25.20

Long-term capital: No positions.

Insurance capital: Full position.

Please note that a full speculative position doesn’t mean using all of the speculative capital for this trade. You will find details on our thoughts on gold portfolio structuring in the Key Insights section on our website.

As always, we'll keep you - our subscribers - updated should our views on the market change. We will continue to send out Gold & Silver Trading Alerts on each trading day and we will send additional Alerts whenever appropriate.

The trading position presented above is the netted version of positions based on subjective signals (opinion) from your Editor, and the automated tools (SP Indicators and the upcoming self-similarity-based tool).

As a reminder, Gold & Silver Trading Alerts are posted before or on each trading day (we usually post them before the opening bell, but we don't promise doing that each day). If there's anything urgent, we will send you an additional small alert before posting the main one.

Thank you.

Sincerely,

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts