Visit our archives for more gold & silver articles.

Last Tuesday we posted an essay entitled Gold & Silver Mining Stocks Hold Well Despite Metals’ Correction and we summarized it in the following way:

The correction in the precious metals market may not be over at this point, but when it is over, miners might finally outperform the underlying metals once again.

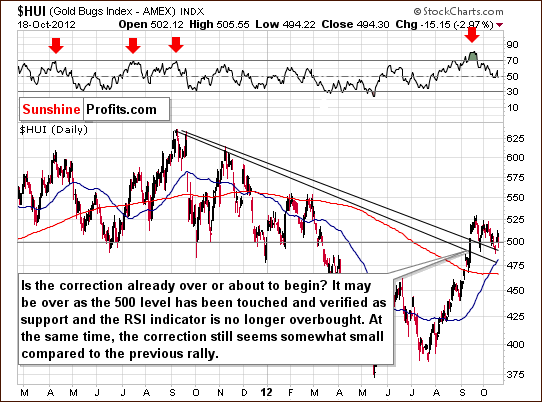

Let’s see if this is still the case by examining the HUI Index chart (charts courtesy by http://stockcharts.com.)

In this week’s medium-term HUI Index chart, we have mixed implications for the short term, but the outlook is definitely bullish for the medium term. The recent declines have not been that significant given the corresponding move in gold prices – and in case of the last several days – moves in the general stock market.

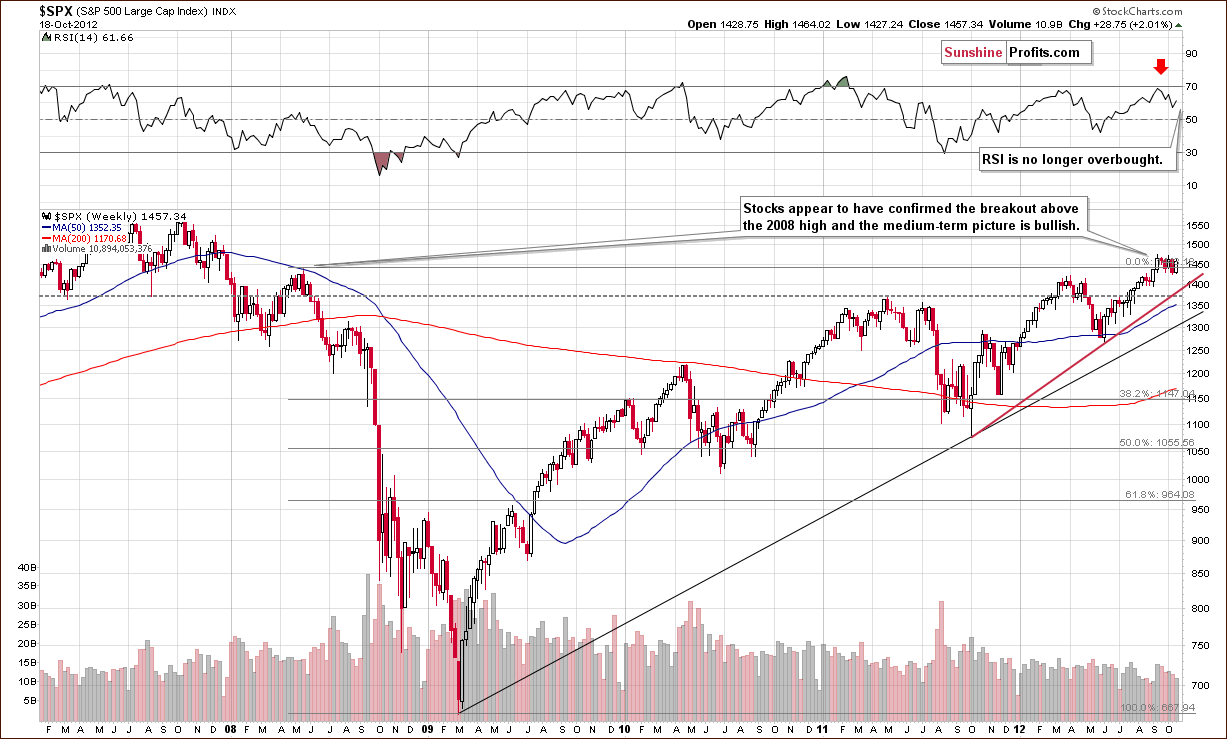

Speaking of the general stock market, let's take a look at how stocks fared recently.

At the moment of writing these words, we have the S&P 500 at 1413, which is a bit below the 2008 high, but considerably above the red rising support line that you can see on the above chart. Consequently, even if what we've seen so far this week is a beginning of a major decline in the stock market (which we don't think is likely because of the upcoming elections – The Powers That Be definitely don't want to see plunging stocks right before voters go to their booths), we will see a pause quite soon.

As mentioned above – the US election is just around the corner and this is a short-term reason to believe that a rally in the stocks will be seen in the following weeks, not a major decline. The open-ended Quantitative Easing program is a medium-term reason for a rally. Does it have to do anything with the title of this essay i.e. mining stocks? It sure does – for instance juniors are highly correlated with the general stock market, so the above is a positive factor for the former. This is confirmed by the coefficients in the correlation matrix (third line from the bottom), that can be found in our previous article.

In the long-term miners to gold ratio chart, we see that the ratio held quite well recently. The implication here is – once again – that declines in the mining stocks may not be as painful as in the metals themselves. After all, mining stocks rallied on Friday even though gold didn't. If a rally is indeed ahead in the general stock market, the miners may not be greatly affected by declines in the precious metals.

On the other hand, they may see daily declines (when metals decline) followed by a quick reversal (when metals do nothing and stocks rally) to the upside or simply small declines as compared to the metals. This is one of the reasons for which last week we suggested (in a Market Alert) closing short positions in the mining stocks and keeping those in gold and silver open.

We summarized our latest essay by saying:

Is the correction in gold over? Not likely.

At this point (with HUI at 490) it may be close to being over in case of mining stocks even though the short-term picture is rather blurry. The medium-term picture looks very favorable, though. If one wants to invest in the mining stocks in the medium- or long-term, then the question is if one should choose junior mining stocks or big precious metals producers (like companies that are included in the HUI Index).

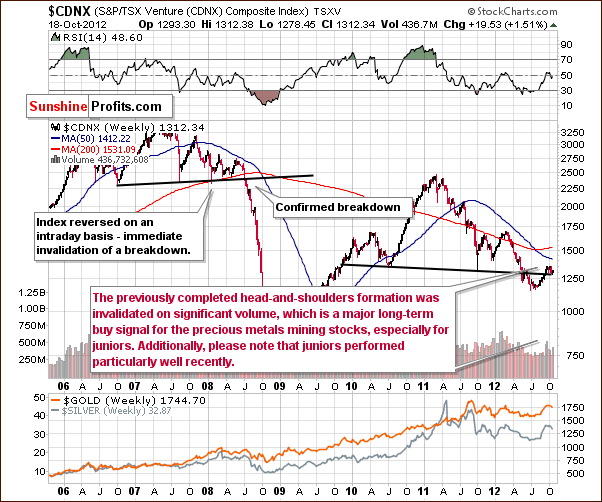

At this point it seems that juniors offer greater potential not only because of the situation in the general stock market, but because of their own technical situation.

In the Toronto Stock Exchange Venture Index (which is a proxy for the junior miners as so many of them are included in it), the outlook remains bullish even with the declines seen in precious metals’ prices over the last two weeks. The index remains above its support line, and the outlook makes the picture bullish.

Summing up, even though the short-term outlook for mining stocks is a bit unclear, the medium term case is very bullish in our view – especially for the junior mining stocks.

Earlier today we have sent out a Market Alert with updated price targets for the current decline in gold and silver and we provided specific instructions for a set of orders that currently seems to provide a very high probability of a win-win situation almost regardless of the short-term price swings in the whole metals sector. Here's a quote:

Thanks to the above combination of orders you are very likely to make a profit in the coming days and weeks. If the situation develops as it was the case recently (metals decline and miners don't), the short position will become even more profitable, while the long position (…) does more or less nothing. If anything changes - miners plunge along with metals or the whole precious metals sector starts to rally, one of the stop-loss orders will be triggered and you will automatically be pushed to the right side of the market - so you will be on the correct side of the market after making a profit anyway.

Also, speaking of mining stocks, please note that our subscribers also enjoy up-to-date and tailor-made (!) gold stocks ranking and silver stock ranking.

We encourage you to join our subscribers and also enjoy all of the above-mentioned benefits.

Thank you for reading.

Przemyslaw Radomski, CFA

Back