The third most common reason behind investing in gold is portfolio diversification because the yellow metal is considered to be a good diversifier. What does this mean? Well, generally, diversification allows investor to obtain a desired return without taking as much risk as with an individual security. Thus, a good diversifier is a portfolio addition reduces overall risk in a portfolio. Why is gold believed to have this quality? The answer lies in low or negative correlation with other assets. It is correlated neither to stocks nor bonds nor commodities (excluding silver; there is an occasional link with crude oil as you can read in our report on gold crude oil and silver).

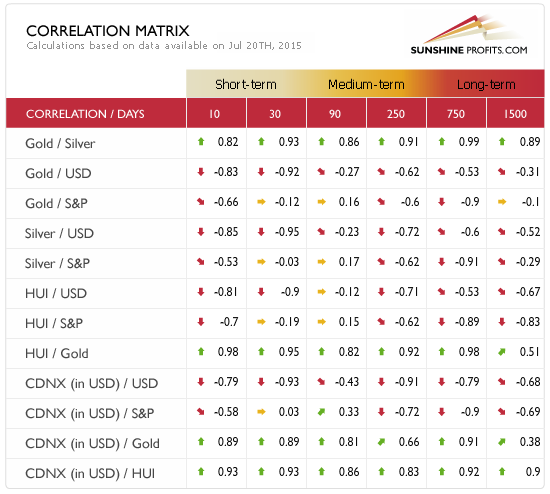

The Correlation Matrix presented below, which is a very useful tool for gold, silver and gold stock correlation analysis, shows that gold is generally positively correlated with silver, negatively correlated with the U.S. dollar and not correlated with the stocks (represented by S&P index), although the precise strength of correlation varies depending on the length of the time horizon.

Picture 1: Correlation Matrix (based on data available on July 20, 2015)

In addition, gold has no credit risk and has lower volatility than stocks or commodities. Thanks to these features, gold can improve the risk-return characteristics of a financial portfolio. Because gold does not generally move with other assets (there are different economic forces which determine the price of gold and other financial assets), it reduces the portfolio’s volatility.

To make it clear: including gold in a portfolio does not necessarily boost returns (however, according to the WGC, by investing 9 percent of a portfolio using high risk correlations in gold, investors would have reduced their losses by 13 percent). The aim is rather to reduce risk at a given level of expected profits (i.e. to increase risk-adjusted returns). Since gold is virtually uncorrelated with stock returns, it adds no systematic risk to an investor’s portfolio (so it shows the characteristics of a zero-beta asset, according to McCown and Zimmerman, 2006). Yet, gold has a positive risk premium, which makes it a very useful addition to the investor’s portfolio.

What is important is that the gold’s correlation with other assets is not stable, but changes during periods of financial distress in a way that benefits investors. While the correlation between bonds and stocks tends to increase during economic turmoil, gold usually becomes negatively correlated with other asset class in such times. This means that the diversification benefits of gold are maintained and may even increase in during severe crises.

It should be clear now that being a good diversifier and a hedge or safe-haven are two sides of the same coin. If gold was not a hedge (safe-haven), there would be no point in holding it in a portfolio on average (in times of turmoil), and if gold was not a good diversifier in normal and critical times, it would not be a hedge and a safe-haven.

Additionally, gold usually exhibits a relatively high positive skewness. What does that mean? Skewnessis an asymmetry from the normal distribution in a set of statistical data (i.e. one side of distribution does not mirror the other). There is negative and positive skewness, depending on whether data points are skewed to the left (negative skew) or to the right (positive skew) of the data average. While most equity markets demonstrate negative results in this matter, gold is positively skewed, which means that including gold in a portfolio may also improve its skewness (i.e. reduce the possibility of extremely negative outcomes). In other words, if gold is positively skewed its volatility is higher on the upside than on the downside (due to flight-to-safety), while most assets are negatively skewed and fall harder than they rise compared to price increases. It means that in the gold market there is a greater chance of a, say, 5% rise in one day than there is a 5% fall any other day. All in all, the above is simply another way of saying that gold is a good hedge in times of extreme distress as it is then when it shines exceptionally well.

All these features are strong arguments for including gold in investment portfolios. However, the question remains: how much of wealth should investors allocate into the yellow metal? There is no simple answer, because everything depends on the investment objective and horizon, portfolio structure, willingness and ability to take risk, liquidity requirements, tax issues and country. The estimates vary from 2 to even 25 percent. For example, Sherman (1982) suggests a weighting of 5 percent, while Chua (1990) proposes as high as 25 percent. More recent research by Lucey, Poti et al. (2006) found an optimal weight of between 6 to 25 percent (for investors concerned mainly with downside protection), depending on the time and the other assets. Bruno and Chincarini (2010) suggested allocating 10% of the portfolio in gold for non-US investors. The WGC believes that 5-6% allocation is optimal for investors with a well balanced portfolio. You will find our take on the above in our gold portfolio report – we name the part of the portfolio where gold is used as a hedge the “insurance” part of the portfolio.

To sum up, gold has low or negative correlations with other assets, so it is a good diversifier. Including yellow metal in a portfolio may improve its efficiency, in terms of higher reward-to-risk ratios. The optimal weight of gold in portfolio is a subject of debate; however, even if one doesn’t take into account gold’s explosive potential in the long term, in our opinion, it still seems to be a good idea to own it (with 5-10 percent allocation or so). Naturally, when the major cycles are taken into account, much greater exposures to the precious metals market may (and are likely to) become justified when the appropriate time comes.

If you enjoyed the above analysis and would you like to know more about the most important factors influencing the investment demand for gold, we invite you to read the August Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview