In today’s article we will focus on the investment demand and its determinants. The financial press and academic literature describes many incentives for gold investment: an inflation hedge or a safe-haven against financial crises or geopolitical turmoil (insurance against tail risks). Gold is also perceived as a great portfolio diversifier due to lack of correlation with other assets, and a bet against the U.S. dollar. And don't forget about those who think that gold investment demand is driven by central bank’s actions, changes in the interest rates or the stock market valuations. Add interdependence between these factors and you get a real Gordian knot.

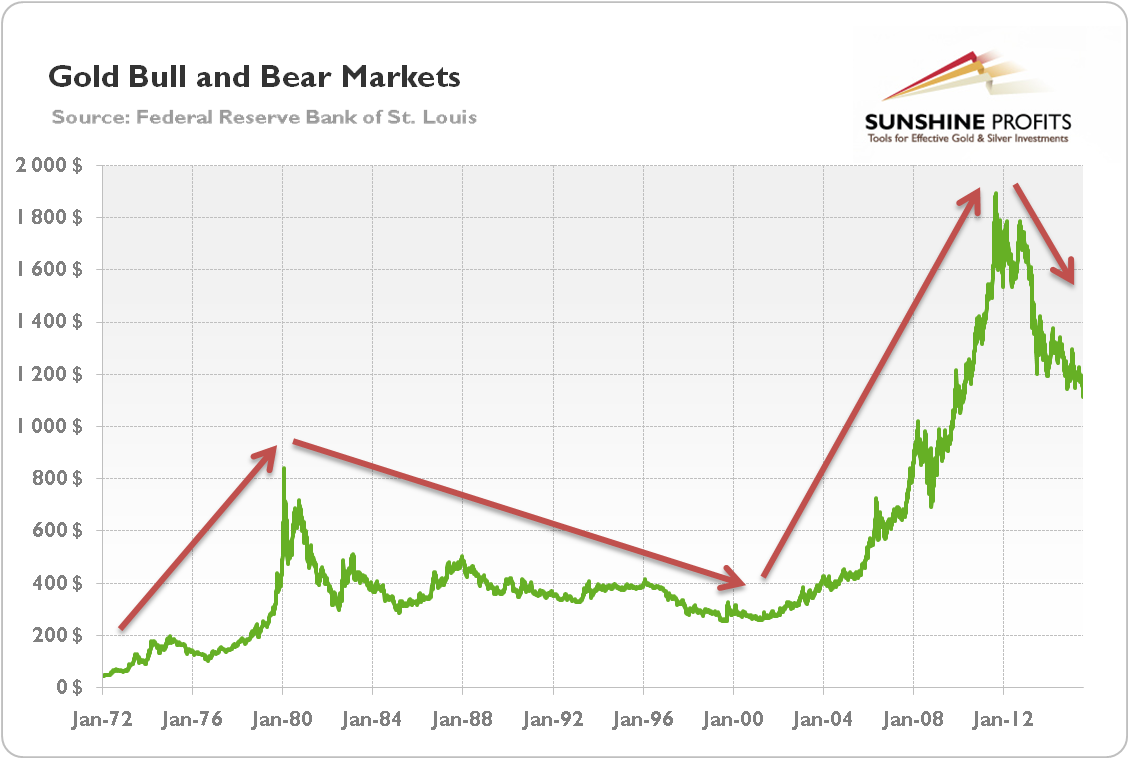

Let us try to untie it, starting from a few general remarks about investment demand in gold. The first point will be obvious, but there are gold bugs who still do not accept the existence of gold market cycles. Just as with other asset classes, there are bull markets, when the gold price goes up, as well as bear markets, when the gold price goes down (see chart 1). During the times of consolidation gold prices move within a well-defined pattern.

Chart 1: Gold bull and bear markets (from 1972 to 2015, London daily morning fixing)

This means that the gold price does not have to rise all the time (and the gold price decreases are not necessarily caused by market manipulation). Indeed, it would be a rather surprising development, given that gold is perceived as a safe-haven or an inflation-hedge. Continuous growth would require a permanent crisis situation (like endless hyperinflation), which is impossible, since the very definition of crisis is an unstable, temporary period or turning point. In other words, most of the time we do not find ourselves in extreme circumstances (which would not be called extreme in that case), which explains why gold price moves in cycles.

Second, investors should avoid simple, single-driver explanations of the gold prices because the yellow metal’s performance depends on many, often interrelated factors. For example, gold may behave like an inflation-hedge, but the U.S. inflationary periods are often associated with low real interest rates and/or weak greenback. Therefore, what looks like the hedge against inflation on the surface, may in reality be the broader insurance against the monetary system based on the U.S. dollar. Of course, rising inflation may cause a drop of trust in dollar and the rise in the gold prices; however it is not always one of the reasons behind investors’ concerns.

There is another important point: the relationship between gold price and its factors are not constant - it evolves overtime. For example, gold responded to high inflation in the late 70s, but it did not in the 80s, because Volcker renewed trust in the U.S. dollar.

Fourth, investors should remember that the relationship between the gold price and its factors always depends on the broader economic situation. So, although gold is highly correlated with some variables, like U.S. dollar exchange rate, investors should remember that correlation does not imply causation and, for example, both low gold prices and a strong greenback may be the consequences of something else, like the high credibility of the Fed or high faith in the dollar-based monetary system.

Fifth, because gold prices depend on many factors, investors should be aware of the ceteris paribus assumption, which is widely used in economics and gold investment analyses. This Latin phrase means “other things being equal or held constant”, and is used to simplify the reasoning. For example, we can presume that the rise in economic uncertainty, e.g. on the future of the Greek debt-crisis and the Eurozone, will increase the gold price, other things being the same. However, other things are never static. In fact, many different and often opposing factors affect the gold price simultaneously. Therefore, the absence of a sudden increase in gold prices after the referendum in Greece was conducted does not necessarily mean that gold lost its safe-haven demand. Rather, other factors – e.g. expectations of the Fed’s hike or the appreciation of the U.S. dollar – were also in force and simply outweighed the supportive role of increased fears of Grexit.

The last point concerns the opportunity costs. Each investment decision entails some opportunity costs and gold is no different here. The opportunity cost of an asset is what you give up by owning it. In case of gold, the opportunity cost is a return that investors could achieve by purchasing other assets (like stocks or bonds) or bank interest rates that investors could get by leaving money on deposit. This is why there is a strong inverse relationship between gold and real interest rates. Investors simply choose to buy or sell gold by comparing the expected real return on gold to that of other liquid financial assets. The opportunity costs can also explain the inverse relationship between gold and the U.S. dollar. In certain periods investors see gold as the ultimate safe-haven, but sometimes they regard the greenback as equally good or even better insurance. Therefore, the strong faith in the U.S. dollar simply makes gold less attractive compared to the greenback, or increases the opportunity costs of investing in gold.

To sum up, investors should remember that the gold price moves cyclically and depends on many opposing factors. This is why the analysis of the gold market requires the use of ceteris paribus clause. The opportunity costs explain why there are correlations between gold and some other variables (like real interest rates) and why the relationship between the gold price and its factors is not constant, but evolves over time. There is no single Holy Grail explaining the price of gold. Instead, it depends on many interconnected factors and the broader economic situation.

If you enjoyed the above analysis and would you like to know more about the most important factors influencing the investment demand for gold, we invite you to read the August Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview