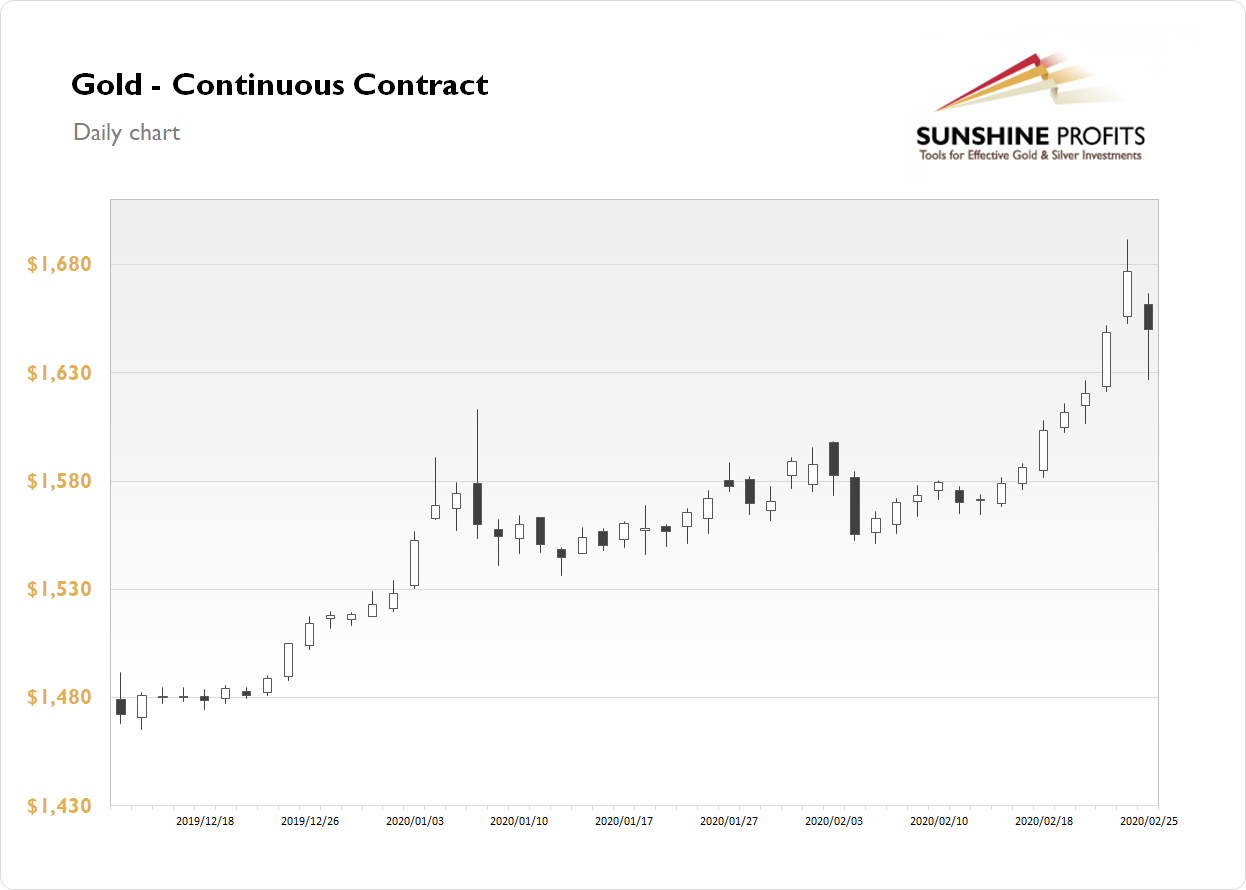

The gold futures lost 1.59% on Tuesday, as it erased its Monday's rally. The price of gold has also retraced most of Friday's advance, before closing 23 dollars above the daily low. It clearly shows how high short-term volatility is. Investors were buying the safe-haven asset amid corona virus outbreak, economic slowdown fears recently. But gold is retracing a big chunk of that rally after bouncing off $1,700 mark.

Gold is gaining 0.2% this morning, as it fluctuates after yesterday's decline. What about the other precious metals? Silver lost 3.63% on Tuesday, as it retraced most of the recent advances. The price fell below $18 mark, before closing above it. Silver is currently 0.5% lower. Platinum lost 4.30% on Tuesday, and right now it is trading 0.7% lower. The metal bounced off $1,000 mark and now it gets closer to $900. Palladium was the only gainer yesterday, as it rallied 5.02%. The metal extends the short-term uptrend today, as it is gaining additional 0.8%.

The financial markets went risk-off since Friday, as corona virus fears came back again. Yesterday's CB Consumer Confidence release has been slightly worse than expected and it added fuel to a fire. The stock market has sold off again. But the economic data releases seem less important than the mentioned virus scare recently. Nevertheless, today we will have the usually important New Home Sales number release at 10:00 a.m. Take a look at our Monday's Market News Report to find out more!

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care