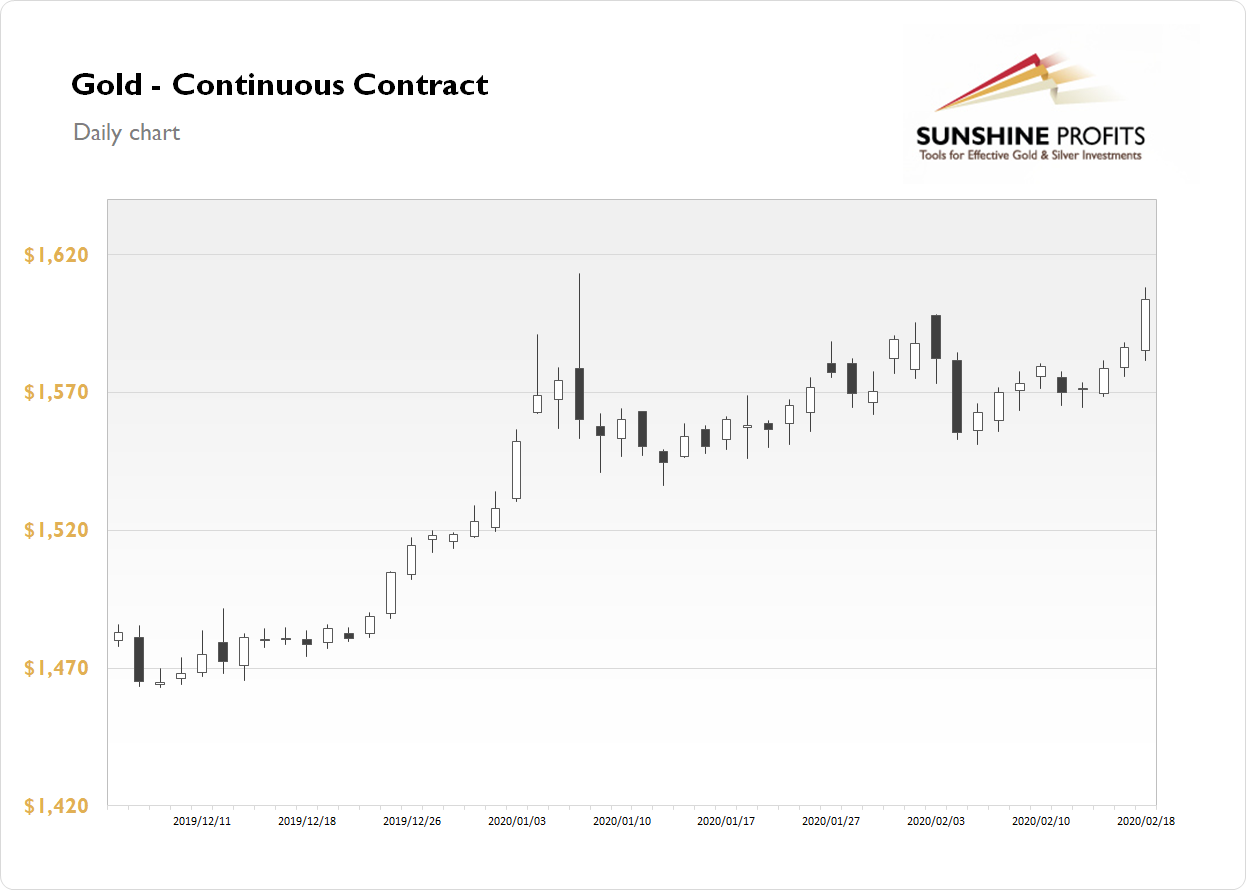

The gold futures contract gained 1.08% on Tuesday, as it accelerated its recent advance. The yellow metal broke above February 3 local high and $1,600 level, but it closed slightly below January 8 high of $1,613.30. Investors keep buying the safe-haven asset despite record-breaking stock market and rising U.S. dollar.

The recent China virus fears didn't scare risk-on assets' investors, however gold kept extending its short-term uptrend. This morning it gains 0.1%. What about the other precious metals? Silver gained 2.35% on Tuesday, as it got close to January local highs. The price is now above $18 mark and it's 0.2% higher this morning. Platinum gained 2.59% on Tuesday, and today it is gaining 1.3%. The metal is back above $1,000 mark again. Palladium accelerated the uptrend yesterday, as it gained 7.81%. Today, it is gaining additional 6.1%.

The financial markets will now wait for this week's most important economic data release - we will get the FOMC Meeting Minutes at 2:00 p.m. Take a look at our Monday's Market News Report to find out more!

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care