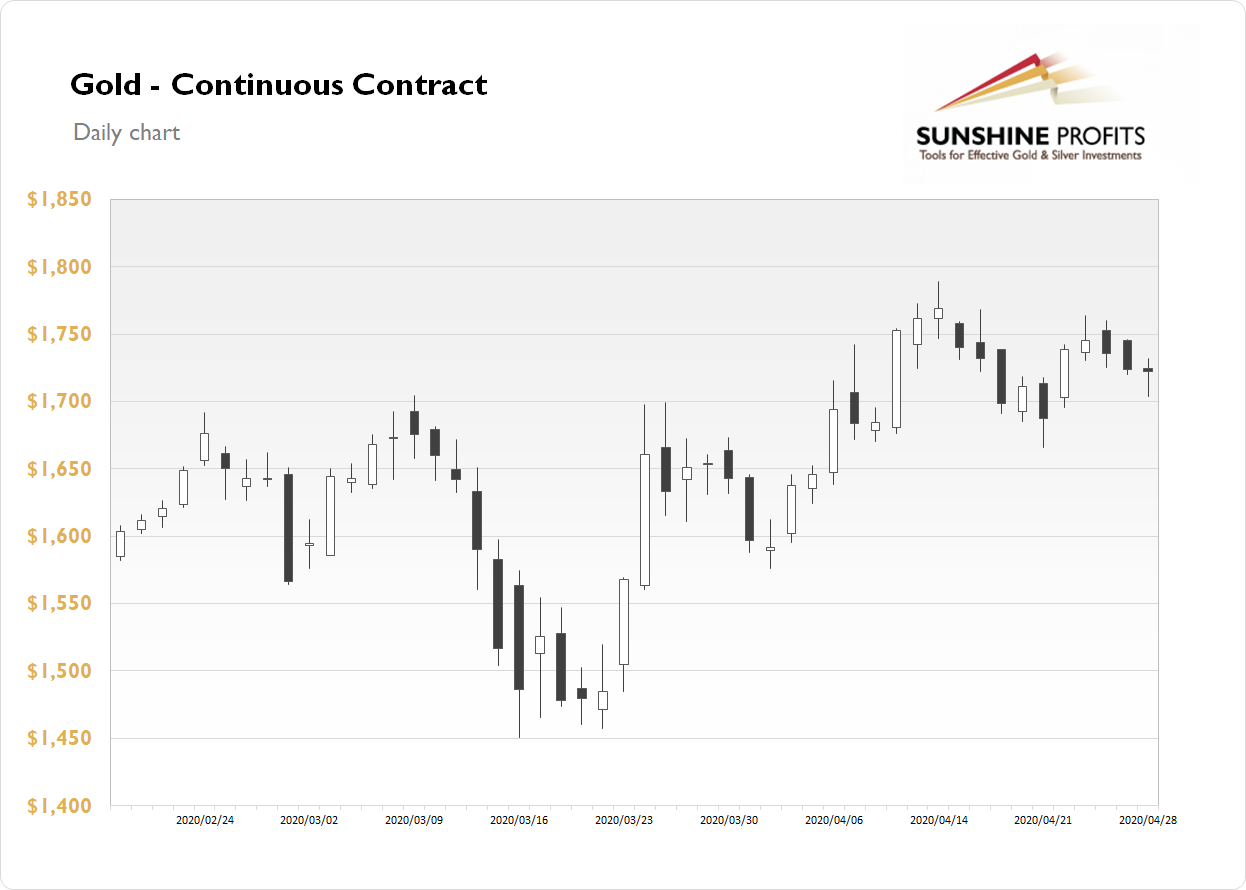

The gold futures contract lost 0.09% on Tuesday, as it slightly extended its short-term downward correction following last week's advance. The market has bounced off the mid-April local high. On April 14 it was the highest since November of 2012 and the daily high was at $1,788.80. Since then we've seen some profit-taking action and a potential downward reversal. But gold began acting as a safe haven asset again. This week gold is relatively weak.

Gold is basically going sideways since early April. It is trading above February-March local highs. So it looks like a consolidation within a medium-term uptrend. But if the price gets below $1,700 level, we could see more selling pressure.

Gold is trading 0.5% lower this morning. What about the other precious metals? Silver gained 0.78% on Tuesday and today it is up 0.1%. Platinum gained 2.39% yesterday and today it is gaining 0.7%. Palladium lost 0.85% on Tuesday and today it is gaining 0.9%. Precious metals continue to trade within a short-term consolidation.

The recent economic data releases have revealed more coronavirus damage to the economy. Today's Advance GDP number release has been generally in line with expectations. But investors will now wait for the FOMC Rate Decision and Monetary Policy update at 2:00 p.m. Take a look at our Monday's Market News Report to find out about this week's economic data releases.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care