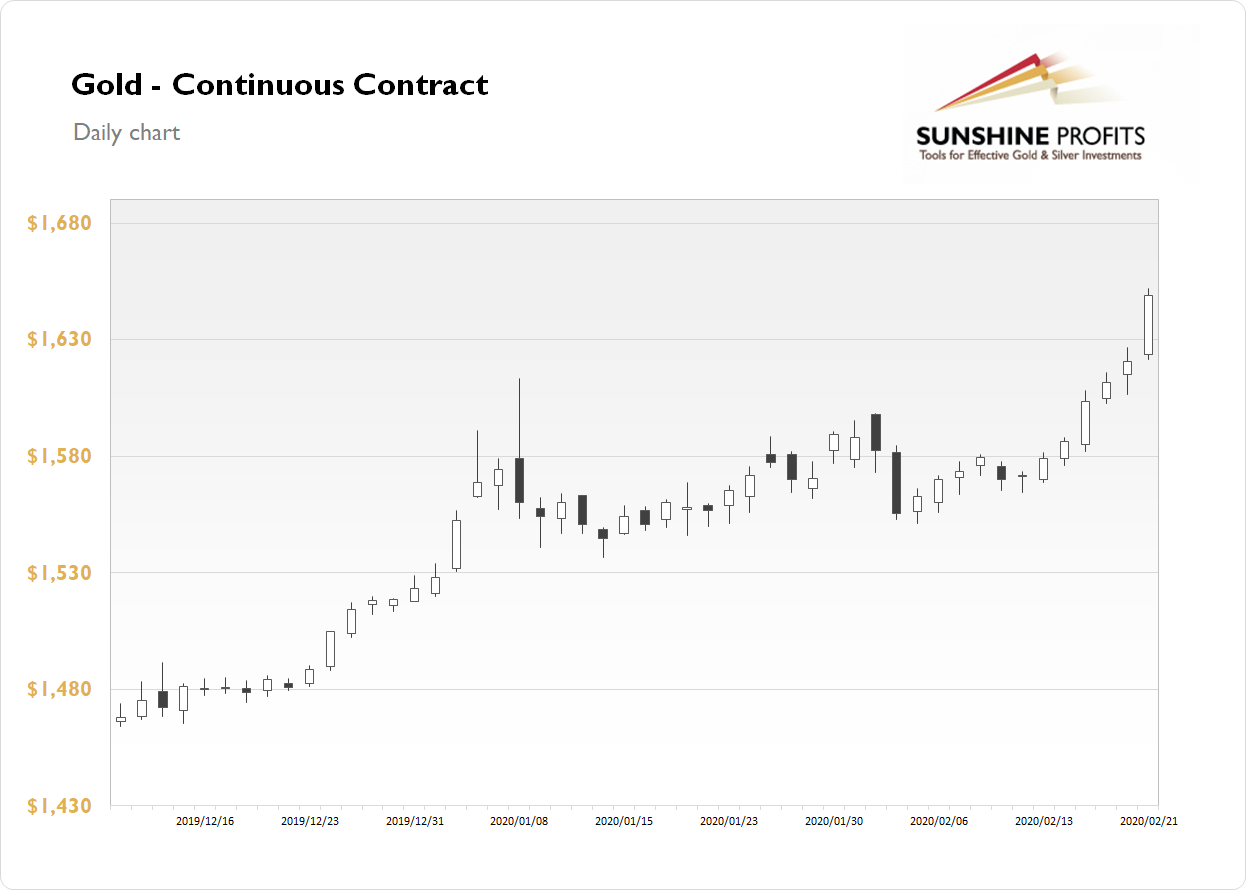

The gold futures contract gained 1.69% on Monday, as it further accelerated its uptrend following breaking above $1,600 mark. The price of gold is the highest since early 2013. Investors keep buying the safe-haven asset amid corona virus outbreak, economic slowdown fears. Today gold is retracing some of that rally following bouncing off $1,700 mark.

Gold is retracing some of its recent rally this morning, as it is declining by 0.5%. What about the other precious metals? Silver gained 1.87% on Monday, as it got back to the early January local high. It was just below $19. This morning it is 1.3% lower. Platinum lost 0.19% on Monday, and it is 0.7% lower right now. The metal bounced back off $1,000 mark again. Palladium accelerated the uptrend recently and on Thursday and Friday it went sideways. Yesterday it lost 3.23%. Palladium price is 1.1% higher today.

The financial markets went risk-off since Friday, as corona virus fears came back again. Investors will now wait for today's CB Consumer Confidence number release. But will the economic data be more important than the mentioned virus scare in the coming days? There will be series of news releases this week. Take a look at our Monday's Market News Report to find out more!

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care