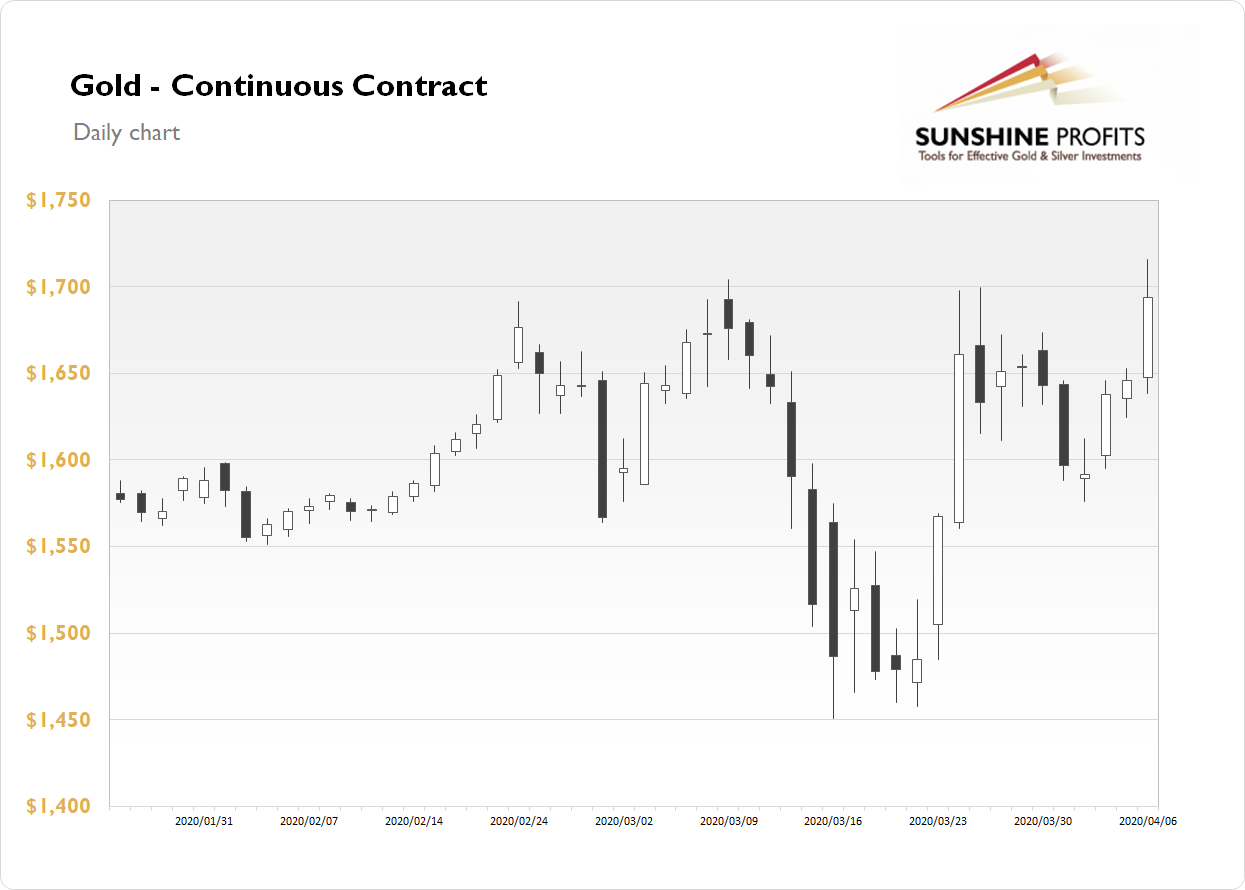

The gold futures contract extended its uptrend yesterday, as it gained 2.93%. The market has reached the highest since December of 2012 following breaking above $1,700 mark. However, the daily close was at $1,693.90 and the yellow metal remained close to its previous local highs. Mounting pandemic fears are supporting the demand side and gold is acting as a safe haven asset.

Gold is 0.1% lower this morning, as it is fluctuates following Monday's rally. What about the other precious metals? Silver gained 4.66% yesterday and today it is 1.1% higher. Platinum gained 1.94% on Monday and today it is up 0.5%. Palladium lost 1.39% yesterday and today it is trading 2.4% higher.

Friday's U.S. Nonfarm Payrolls along with the Unemployment Rate releases have been worse than expected. However, it wasn't that surprising after the recent Unemployment Claims numbers. And we may see more bad economic data releases in the near future, as they will be revealing coronavirus damage to the economy. Take a look at our Monday's Market News Report to find out about this week's economic news releases.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care