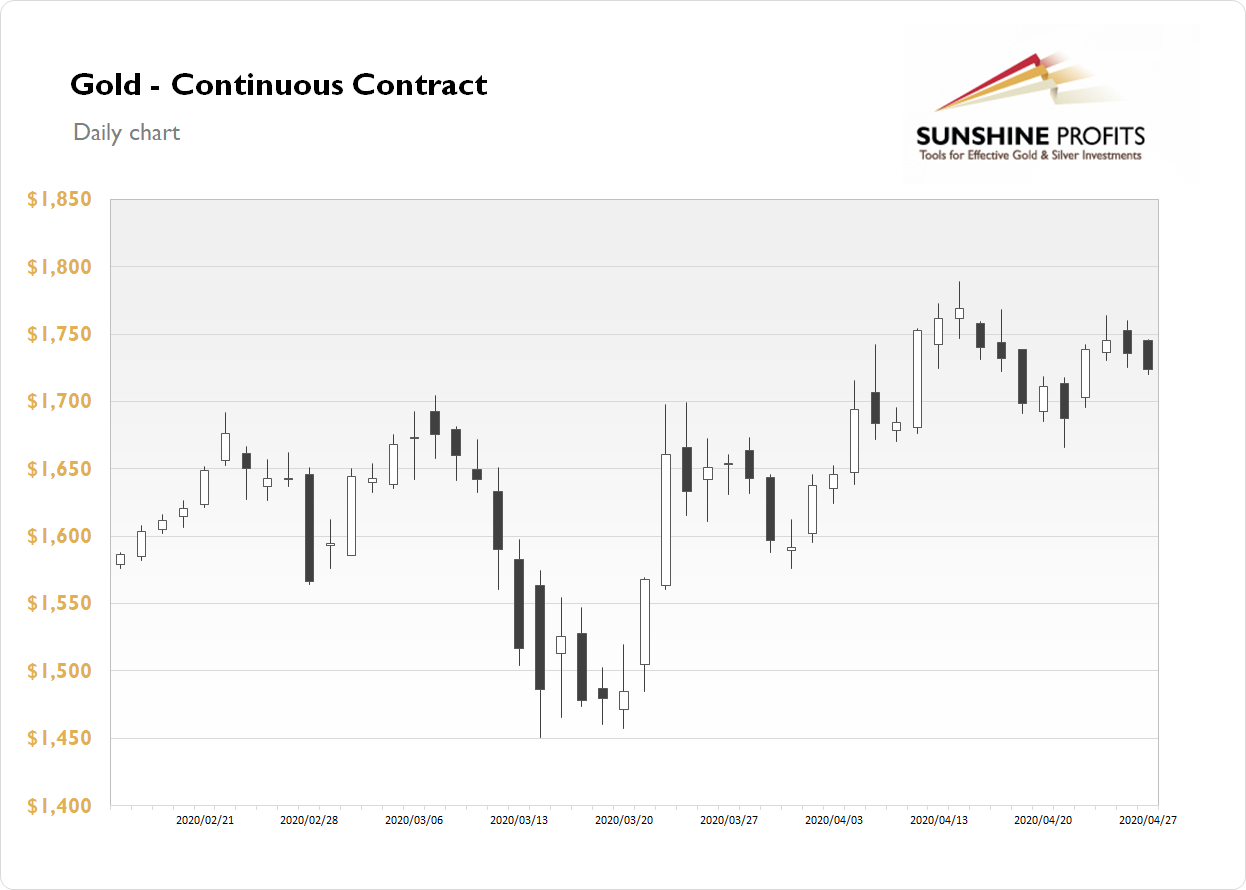

The gold futures contract lost 0.68% on Tuesday, as it extended its short-term downward correction following last week's advance. The market has bounced off its mid-April local high. On April 14 it was the highest since November of 2012 and the daily high was at $1,788.80. Since then we've seen some profit-taking action and a potential downward reversal. But gold began acting as a safe haven asset again. It rallied and got closer to the mentioned medium-term high. Yesterday it has retraced a part of last week's rally.

Gold is basically going sideways since early April. It is trading above February-March local highs. So for now, it looks like a consolidation within a medium-term uptrend. However, if the price gets below $1,700 level, we could see more selling pressure.

Gold is down 0.2% this morning, as it trades along yesterday's daily low. What about the other precious metals? Silver lost 0.35% on Monday and today it is down 0.3%. Platinum gained 0.4% yesterday and today it is gaining 0.7%. Palladium lost 4.56% on Monday and today it gains 0.8%. So precious metals continue to trade within a short-term consolidation.

The recent economic data releases have revealed more coronavirus damage to the economy. Today we will get the important CB Consumer Confidence number at 10:00 a.m. It will likely be much below the previous value of 120. But investors will wait for tomorrow's FOMC Rate Decision and Monetary Policy update. Please take a look at our Monday's Market News Report to find out about the coming economic data releases.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care