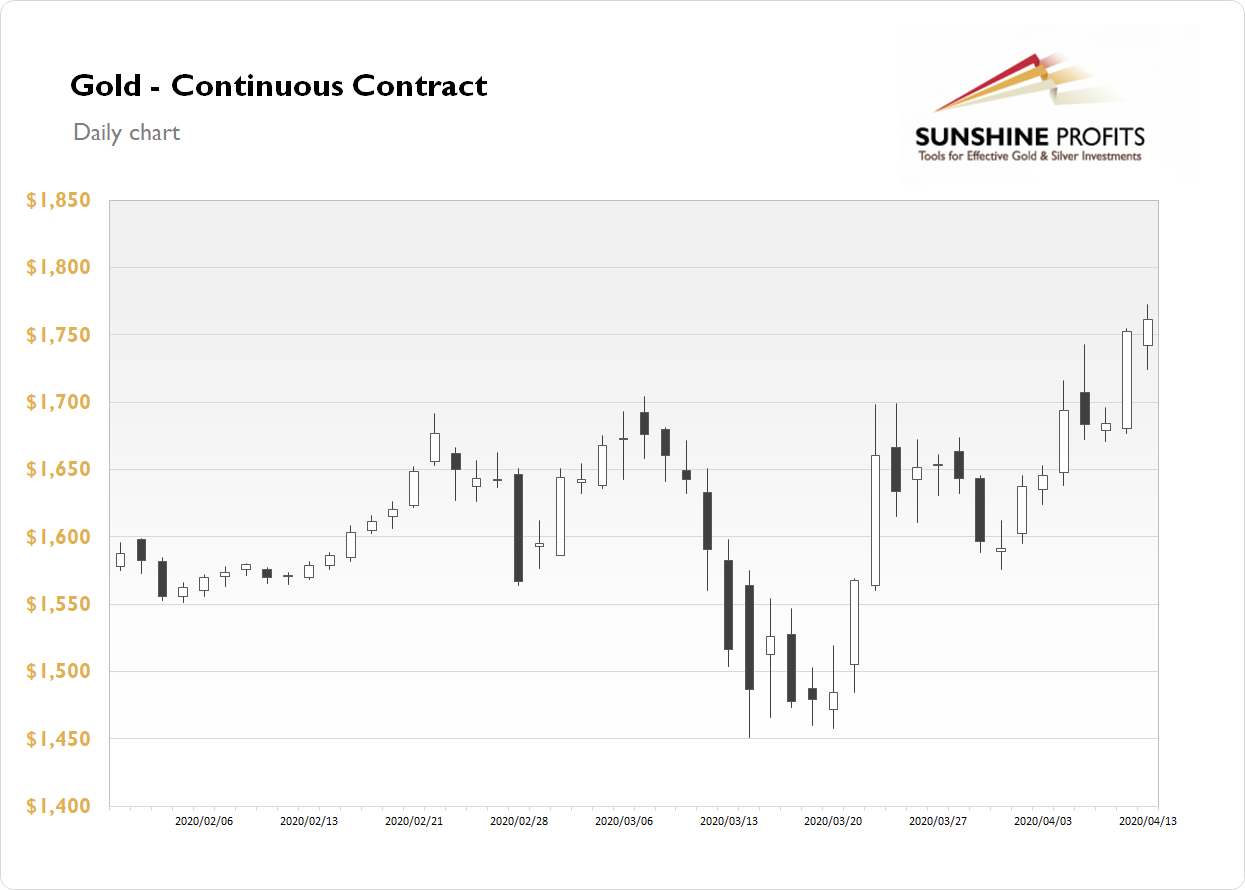

The gold futures contract extended its uptrend on Monday, as it gained 0.49%. The market broke above its short-term consolidation and it reached new medium-term highs above $1,700 level. Yesterday it was the highest since November of 2012. Mounting pandemic fears are supporting the demand side and gold is still acting as a safe haven asset.

Gold is 0.9% higher this morning, as it is further extending its medium-term uptrend. What about the other precious metals? Silver lost 3.21% yesterday and today it gains 1.3%. Platinum gained 0.2% yesterday and today it is up 3.6%. Palladium gained 2.9% on Monday and today it is gaining additional 3.2%.

Last week's Unemployment Claims number has been close to 7 million again. And we may see more bad economic data releases in the near future, as they will be revealing coronavirus damage to the economy. Investors will wait for tomorrow's set of economic data releases. We will get the U.S. Retail Sales number, among others. Take a look at our Monday's Market News Report to find out about this week's economic news releases.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care