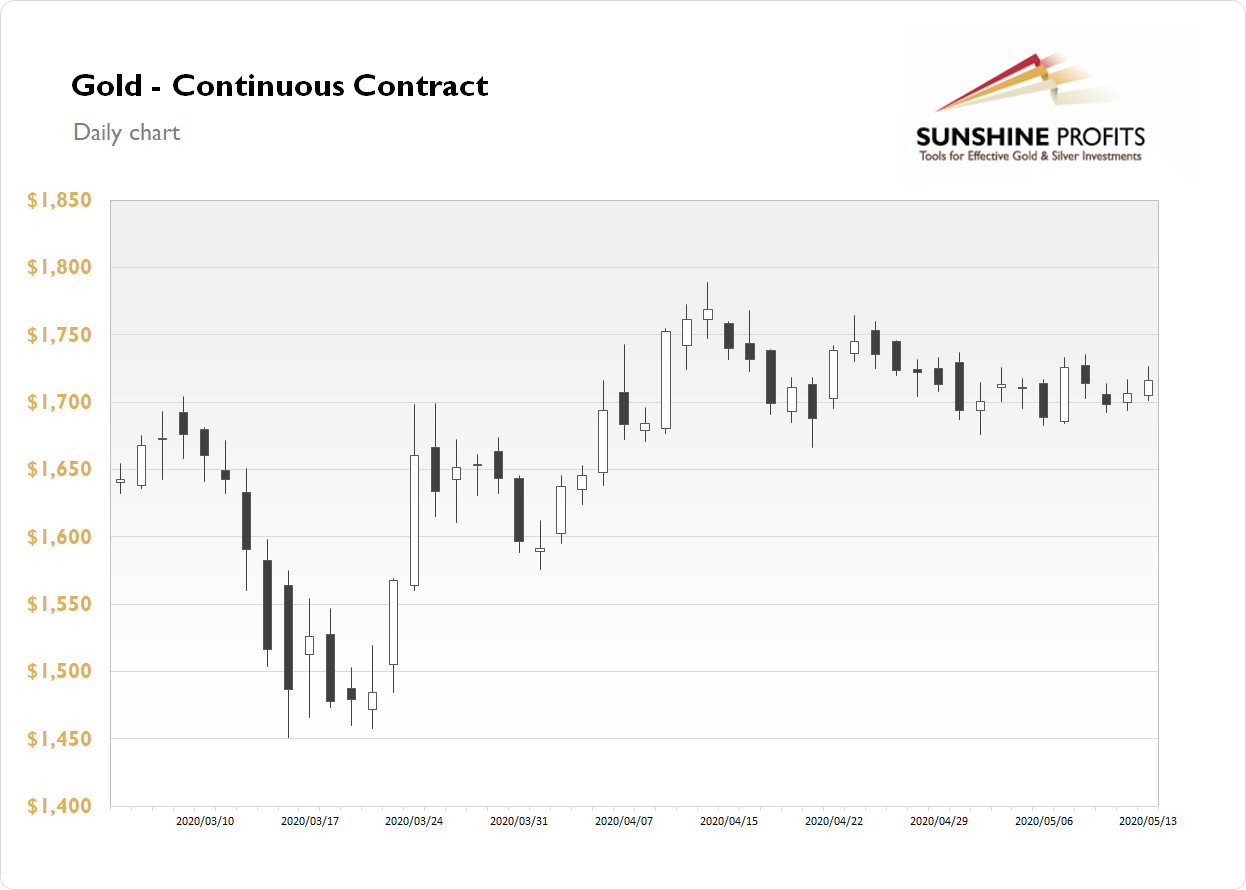

The gold futures contract gained 0.56% yesterday as it extended its Tuesday's advance. However, the market continues to fluctuate within a short-term consolidation. Gold price remains close to $1,700 level. It is still trading within a flat correction after its April's advance. On April 14 it was the highest since November of 2012 and the high was at $1,788.80. Since then we've seen some profit-taking action and a potential medium-term downward reversal.

The price of gold is basically going sideways along $1,700 mark since early to mid April and it's trading above February-March local highs. So it still looks like a consolidation within a medium-term uptrend.

Gold is 0.1% down this morning, as it continues to trade along $1,700 mark. Global financial markets took a little breather this week as investors were cashing their profits amid renewed coronavirus crisis worries. What about the other precious metals?: Silver lost 0.24% on Wednesday and today it is 0.4% lower. Platinum lost 0.98% and today it is up 0.1%. Palladium lost 2.44% and today it is 0.7% lower.

Last Friday's Nonfarm Payrolls and the Unemployment Rate along with this week's inflation numbers releases have confirmed coronavirus damage to the U.S. economy. Today we will await the weekly Unemployment Claims release at 8:30 a.m. The number has been gradually decreasing but it remains relatively very big. Take a look at our Monday's Market News Report to find out about this week's economic data announements.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care