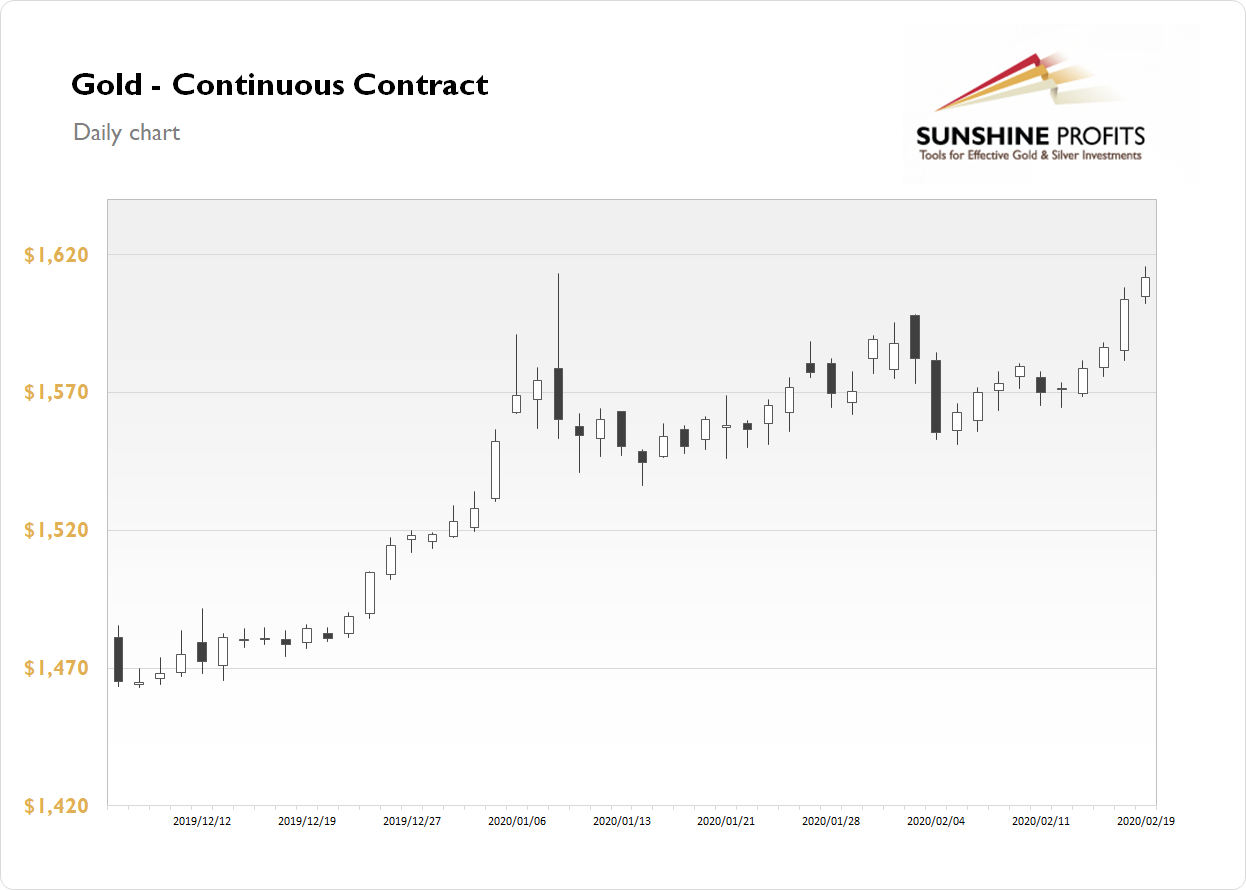

The gold futures contract gained 0.51% on Wednesday, as it further extended its short-term uptrend. The price of gold broke slightly above its January 8 local high of $1,613.30, before closing the highest since the first half of 2013. Investors keep buying the safe-haven asset despite record-breaking stock market and rising U.S. dollar.

Gold is extending its short-term uptrend this morning, as it gains additional 0.4%. What about the other precious metals? Silver gained 0.89% on Wednesday, as it broke slightly above its late January local high. The price remains above $18 mark. But it is declining 0.2% this morning. Platinum gained 1.07% yesterday, and today it is 0.7% lower. The metal remains at $1,000 mark. Palladium accelerated the uptrend once again on Wednesday, as it gained 2.95%. However, it retraced most of its intraday advance yesterday. Palladium is 1.3% lower today.

The financial markets fluctuated following yesterday's FOMC Meeting Minutes release. Stocks remained close to record highs, and gold extended the uptrend. However, the Fed news wasn't a market-mover. Today we will wait for the Philly Fed Manufacturing Index release at 8:30 a.m. Will the data show coronavirus-related contraction? Take a look at our Monday's Market News Report to find out more!

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care