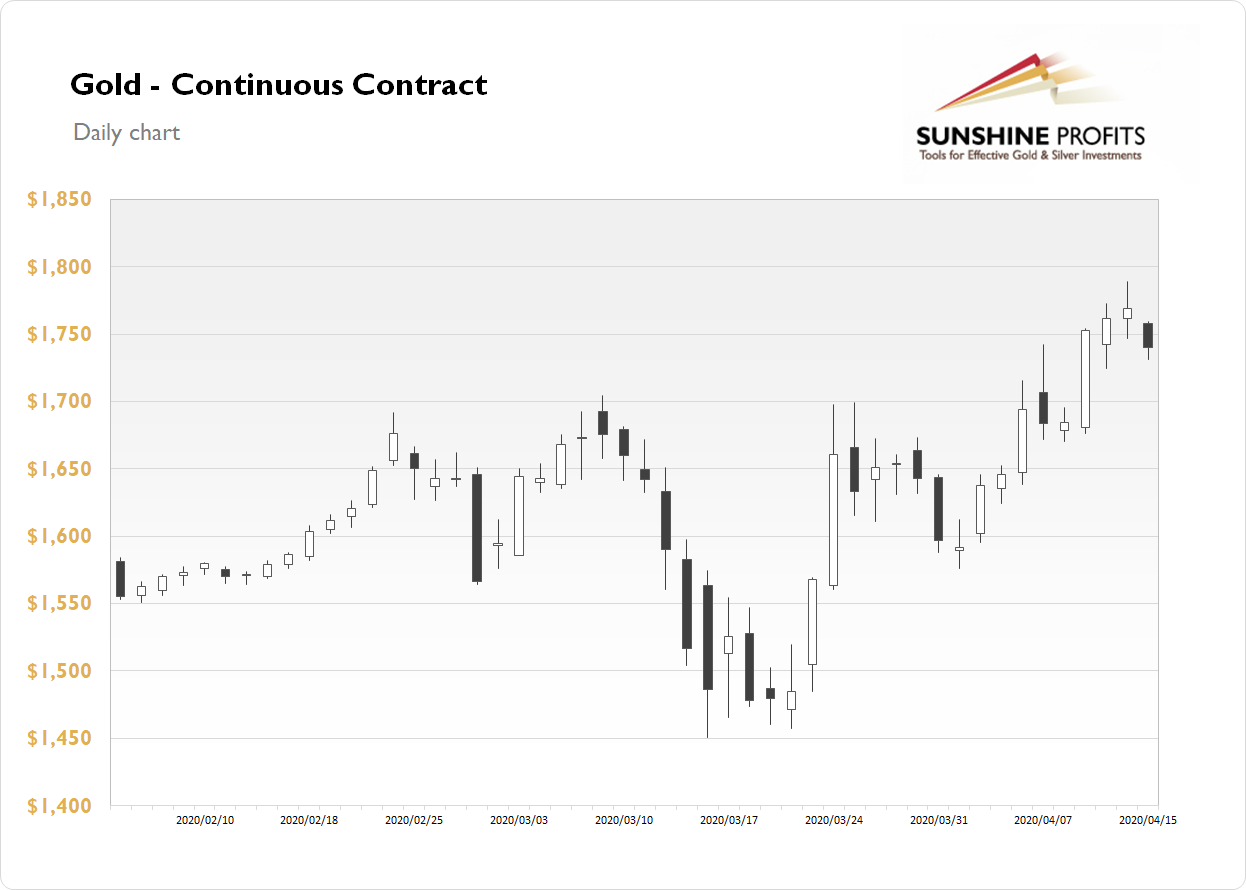

The gold futures contract lost 1.62% on Wednesday, as it retraced some of its recent adavance. The market broke above the short-term consolidation and it reached new medium-term high last week. On Tuesday it was the highest since November of 2012. The high was at $1,788.80. Mounting pandemic fears are supporting the demand side and gold is still acting as a safe haven asset.

Gold is 0.9% higher this morning, as it is gets closer to the medium-term high again. What about the other precious metals? Silver lost 3.87% yesterday, as it extended its short-term consolidation. Today it is up 0.9%. Platinum lost 1.84% on Wednesday and today it trades 1.7% higher. Palladium lost 1.46% yesterday and today it is trading 1.8% higher.

Yesterday's U.S. Retail Sales number release has been worse than expected. And We may see more bad economic data releases in the near future, as they will be revealing coronavirus damage to the economy. Today investors are waiting the weekly Unemployment Claims release at 8:30. We will also get Housing Starts, Building Permits and the Philly Fed Manufacturing Index. Take a look at our Monday's Market News Report to find out about this week's economic news releases.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care