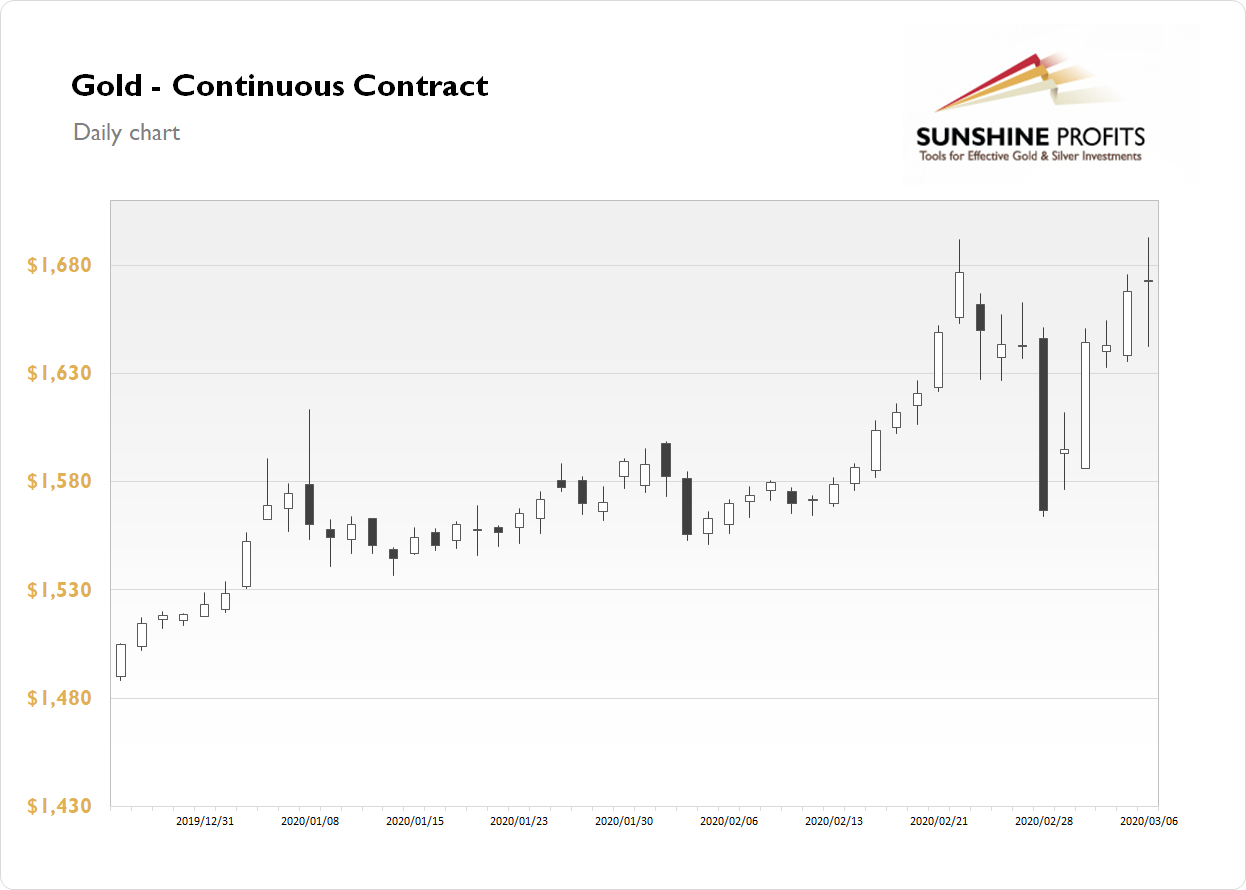

The gold futures contract gained 0.26% on Friday after breaking slightly above the February 24 high of $1,691.70. Friday's daily high was at $1,692.80, but closing price was $1,672.40. Recently the gold price collapsed to the low of $1,564 despite an ongoing corona virus scare. However, the market has retraced all of the decline last week, as virus fears have reappeared. Gold continued higher this morning, but then the market has managed to retrace all of its overnight advance.

Gold is gaining 0.1% this morning, as it trades within a short-term consolidation following Thursday's-Friday's rally. What about the other precious metals? Silver lost 0.75% on Friday and today it is trading 2.8% lower. Platinum gained 3.55% on Friday. It bounced after the previous Friday's sell-off. This morning it is down 4.1%. Palladium lost 1.22% on Friday and it is 6.3% lower.

The financial markets continue to trade mostly on corona virus news. In addition, Friday's OPEC Meeting's negative outcome caused the oil prices crash. So last week's scheduled economic data releases haven't moved markets. What about the coming week? We will have the U.S. inflation data releases on Wednesday and Thursday, and the ECB monetary policy release on Thursday. Take a look at our today's Market News Report to find out more!

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care