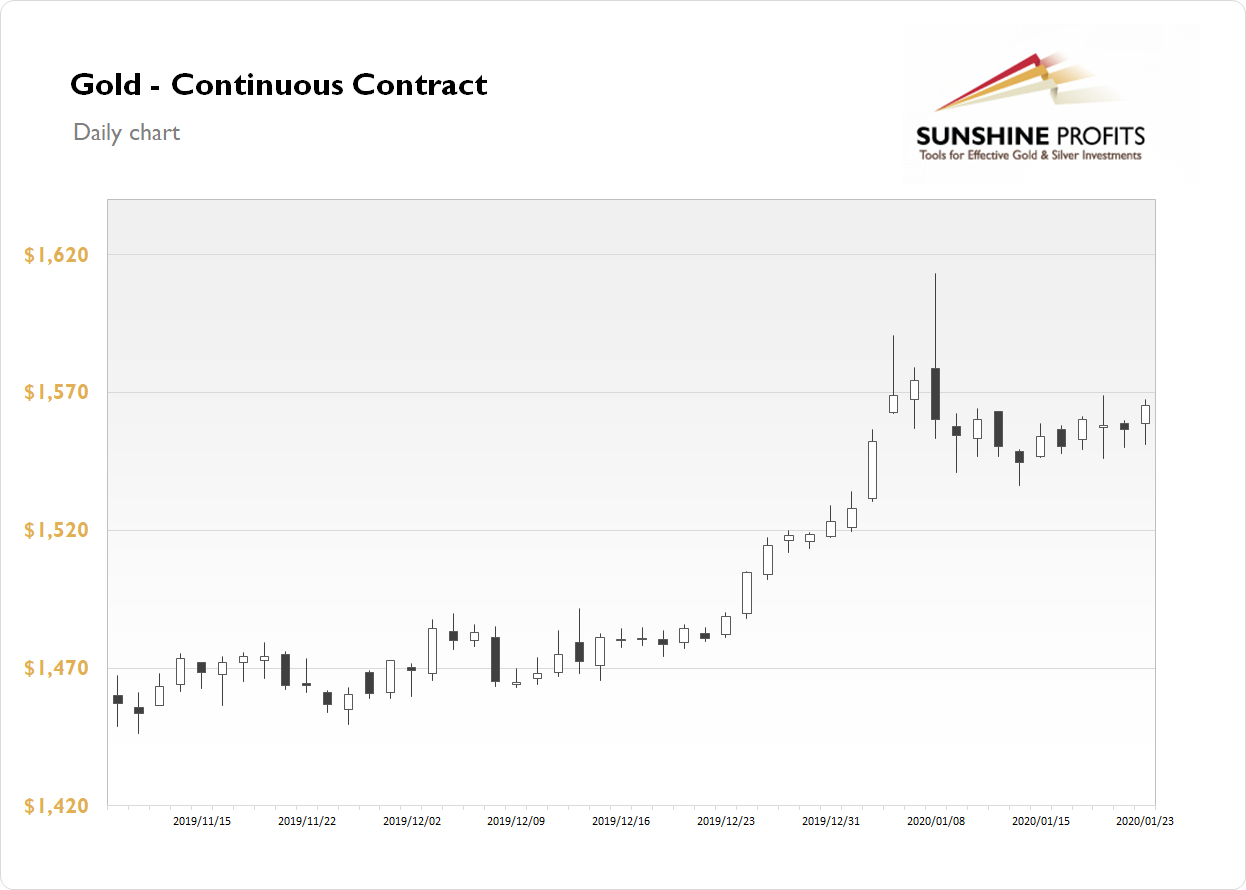

The gold futures gained 0.56% on Thursday, as it got closer to its recent local high of $1,568.80. The yellow metal closed above $1,560 mark for the first time since January 8 run-up followed by a sharp downward reversal. On Wednesday, it has bounced off $1,550 level. Overall, the market continues to trade within a short-term consolidation.

The gold price is currently 0.2% lower, as it is retracing some of yesterday's advance. What about the other precious metals? The silver was relatively weaker than gold, as it failed to break above the last week's Friday's local high. Yesterday it was unchanged and it remained below $18 mark. The platinum is unchanged, as it is still trading above $1,000 mark, and the palladium hovers along the new record high (-0.1%).

Today, the financial markets are watching series of economic data releases from Europe. We will also have the important Retail Sales number in Canada at 8:30 a.m. and the Flash Manufacturing PMI, Flash Services PMI numbers in the U.S. at 9:45 a.m.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care