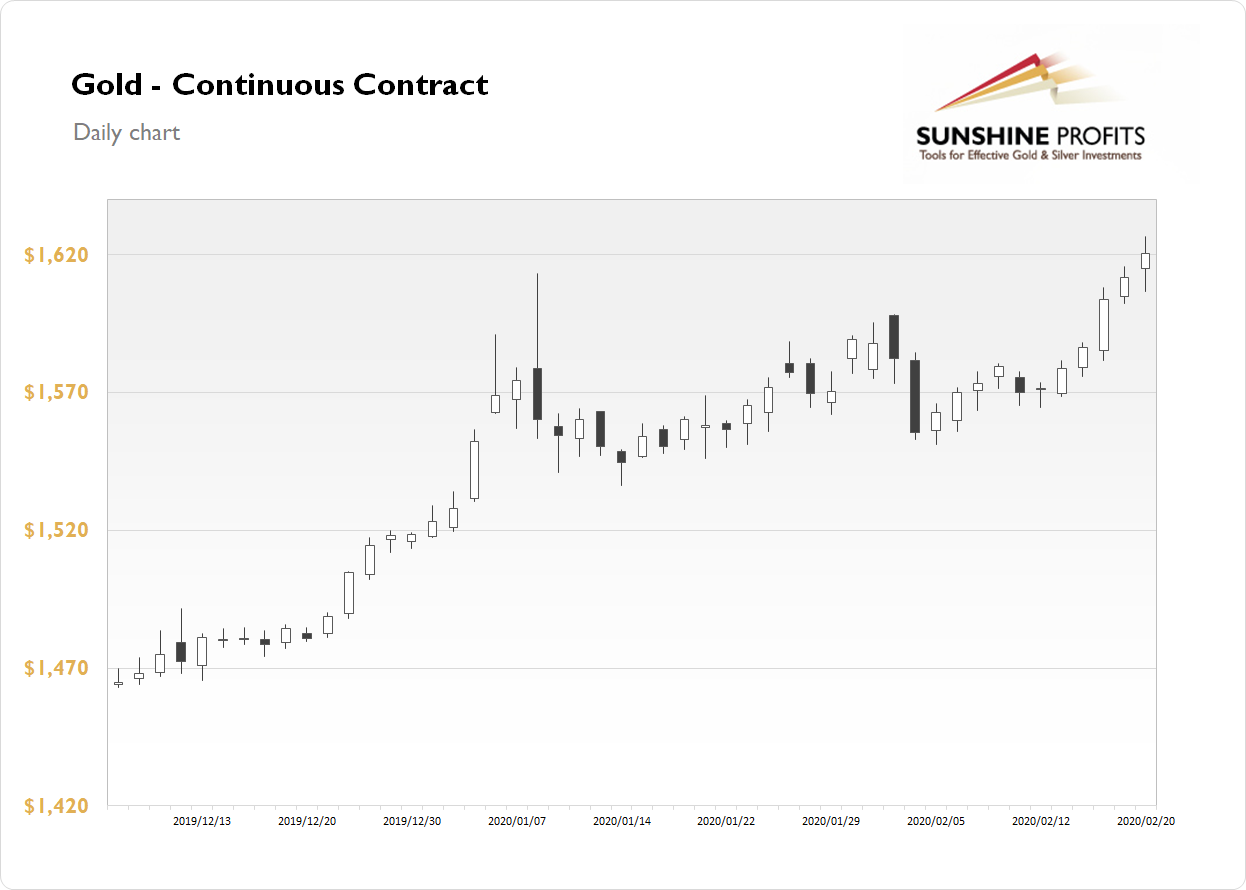

The gold futures contract gained 0.54% on Thursday, as it extended the recent advance even further above $1,600 mark. The price of gold has reached new medium-term high of $1,626.50. It is the highest since 2013. Investors keep buying the safe-haven asset despite rising U.S. dollar. Today gold is higher again.

Gold is extending its short-term uptrend again this morning, as it is gaining additional 0.9%. What about the other precious metals? Silver gained just 0.04% on Thursday, as it remained above the late January local high. This morning it is 0.7% higher. Platinum lost 2.54% yesterday, and today it is 0.6% higher. The metal got back below $1,000 mark. Palladium accelerated the uptrend recently and yesterday it went sideways, as it gained just 0.11%. Palladium price is 0.9% higher today.

The financial markets went risk-off yesterday despite a better-than-expected Philly Fed Manufacturing Index release. Was it just profit-taking action or some downward reversal? Falling stock prices gave additional boost to gold price advance. Today, the markets will await the important Flash Manufacturing PMI and Flash Services PMI numbers release at 9:45 a.m. We will also have the Existing Home Sales release at 10:00 a.m.

Thank you.

Paul Rejczak

Stock Trading Strategist

Sunshine Profits - Effective Investments through Diligence and Care