On Sunday night, Angela Merkel failed to build a coalition government. What does it mean for the gold market?

It turns out that the Free Democrats surprisingly pulled out of negotiations about forming a new government in Germany. The free-market party cited irreconcilable differences between them and its potential partners. The parties could not overcome distinct views on immigration, taxation, climate, the future of the EU and so on. It means that the three-party coalition (or actually, a four-party, as the CDU is a sister party to the CSU) will not emerge in the largest EU’s economy.

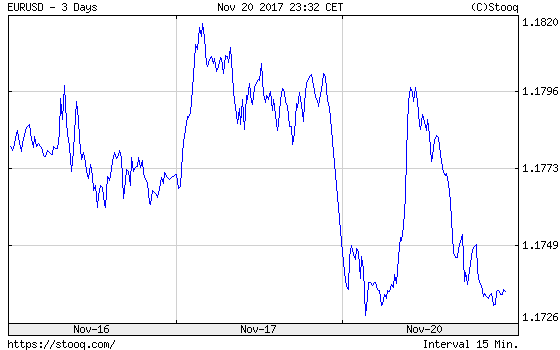

Well, what does it mean for the gold market? Nothing positive, actually. The euro depreciated about 0.7 percent in a response to a failure to build a coalition. The shared currency rebounded afterwards, but it may come under downward pressure now. Indeed, it fell again yesterday, as one can see in the chart below.

Chart 1: EUR/USD exchange rate over the last three days.

As the yellow metal is positively correlated to the euro (both assets are alternatives to the U.S. dollar), it is not good news for the gold market. As the next chart shows, the price of gold declined yesterday. Actually, Monday was the worst day in two months for the yellow metal. It confirms that the so-called currency channel dominates the safe-haven channel right now.

Chart 2: Gold prices over the three last days.

Surely, the FDP’s exit may only be a political trick to force more concessions, but the move increased political uncertainty. Now, the future of the euro depends on the next moves – the CSU/CDU may offer more compromises to the FDP, which would be the best for the German economy. Angela Merkel could also appease the Socialists to build a so-called grand coalition or form a minority government. However, the German president could reject it and order a new election. A minority government implies a lot of instability and uncertainty, as well as a new election, so it would be negative for both the euro and gold.

Summing up, Angela Merkel failed to form a coalition in Germany. It weakens her position further and raises concerns about the political future of the EU’s largest economy. It adds, thus, downward pressure on the euro and supports the U.S. dollar. It is possible that the increased political uncertainty would boost some safe-haven demand for gold, but we believe that the negative impact of a stronger greenback against the euro will dominate. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron, Ph.D.

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview