The latest edition of the In Gold We Trust report lists four scenarios for gold. What are they?

On Monday, we provided a short summary of the annual “In Gold We Trust” report. However, we did not manage to cover the whole 169-page publication. Hence, today we would like to address the four scenarios for gold mentioned by the authors of the publication. These alternatives are as follows:

- Scenario A: “Relatively strong real economic growth”. The U.S. economy begins to grow strongly, while inflation remains in an acceptable range. The gold price should trade in a range from $700 to $1,000.

- Scenario B: “Muddling through continues”. Real U.S. GDP growth and consumer price inflation remain in a range of 1-3 percent. The gold price should remain in a range from $1,000 to $1,400 in this scenario.

- Scenario C: “High inflationary growth”. The U.S. economic growth accelerates significantly (due to the implementation of Trump’s fiscal stimulus), but so does inflation. In this scenario, the price of gold should trade in a range from around $1,400 to $2,300.

- Scenario D: There is either a recession, or stagflation. The significant weakness in the U.S. dollar sends the price of gold soaring. Gold prices between $1,800 up to $5,000 appear possible in this scenario.

What is striking in these scenarios is a huge price range. We know that making predictions is very difficult (especially about future), but saying that gold prices should trade somewhere between $1,400 and $2,300 (it’s a range of $900) is not very useful. You see, we may similarly say that gold will trade this year in a range between $0 and $10,000, but it will not make us a great forecaster.

Another controversial issue is the assumption that high inflationary growth would be necessarily positive for the yellow metal. It’s true that gold is a hedge against high and accelerating inflation, but a lot depends on the level of real interest rates. If real economic growth speeds up, gold may not shine.

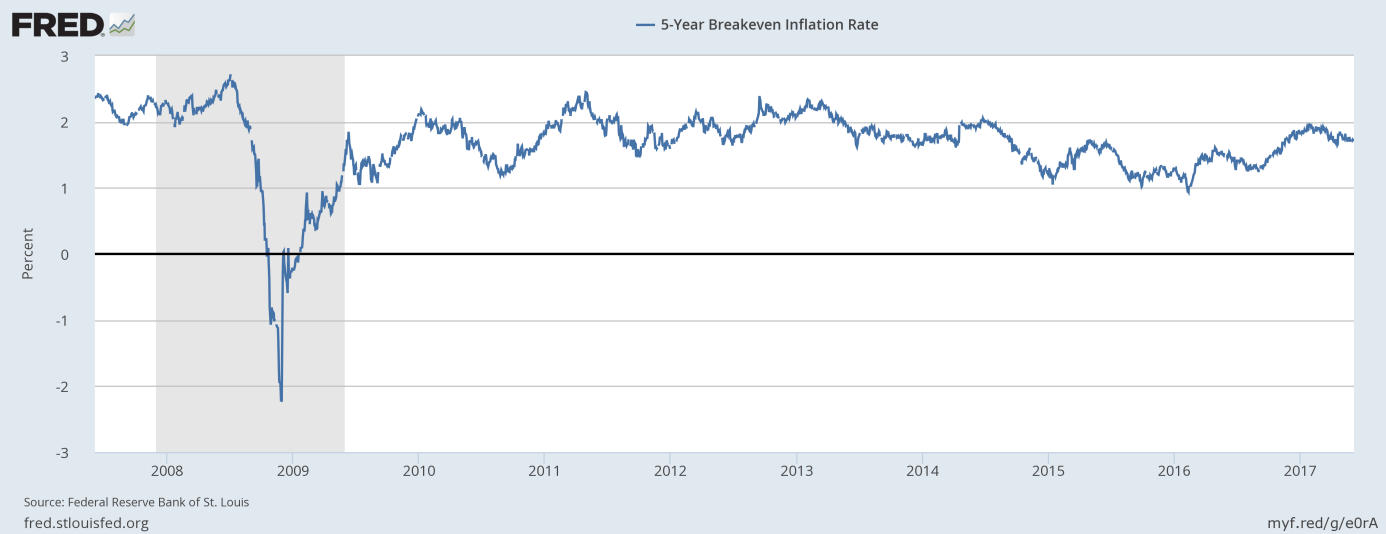

Which scenario is the most probable? Well, investors expect more of the same, at least when it comes to inflation. As one can see in the chart below, the break-even inflation rate (which represents a measure of expected inflation derived from 5-Year Treasuries with Constant Maturity Securities and 5-Year Treasuries indexed by inflation) have been trading sideways over the last few years.

Chart 1: 5-year break-even inflation rate over the last ten years.

Therefore, we should neither expect the price of gold to be at $700 (!) nor $5,000 (!!) in the near future. Gold prices should remain in a range of $1,100 and $1,300 for a while. Today’s events may be a breakthrough. When geopolitical threats vanish, the price of gold may go south, especially that there are more upside risks on the macroeconomic front. On the other hand, new Comey’s revelations or May’s defeat in the U.K. could send gold prices up. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview