Forex Trading Alert originally sent to subscribers on August 6, 2015, 4:53 AM.

Although the Institute of Supply Management showed that its non-manufacturing PMI increased to 60.3 in July, beating analysts’ forecasts for a reading of 56.2, disappointing ADP report (which showed that non-farm private employment rose 185,000 last month, missing expectations for an increase of 215,000) weighed on investors’ sentiment and pushed the USD Index below 98. As a result, EUR/USD bounced off the short-term support, but will we see further improvement in the coming days?

In our opinion the following forex trading positions are justified - summary:

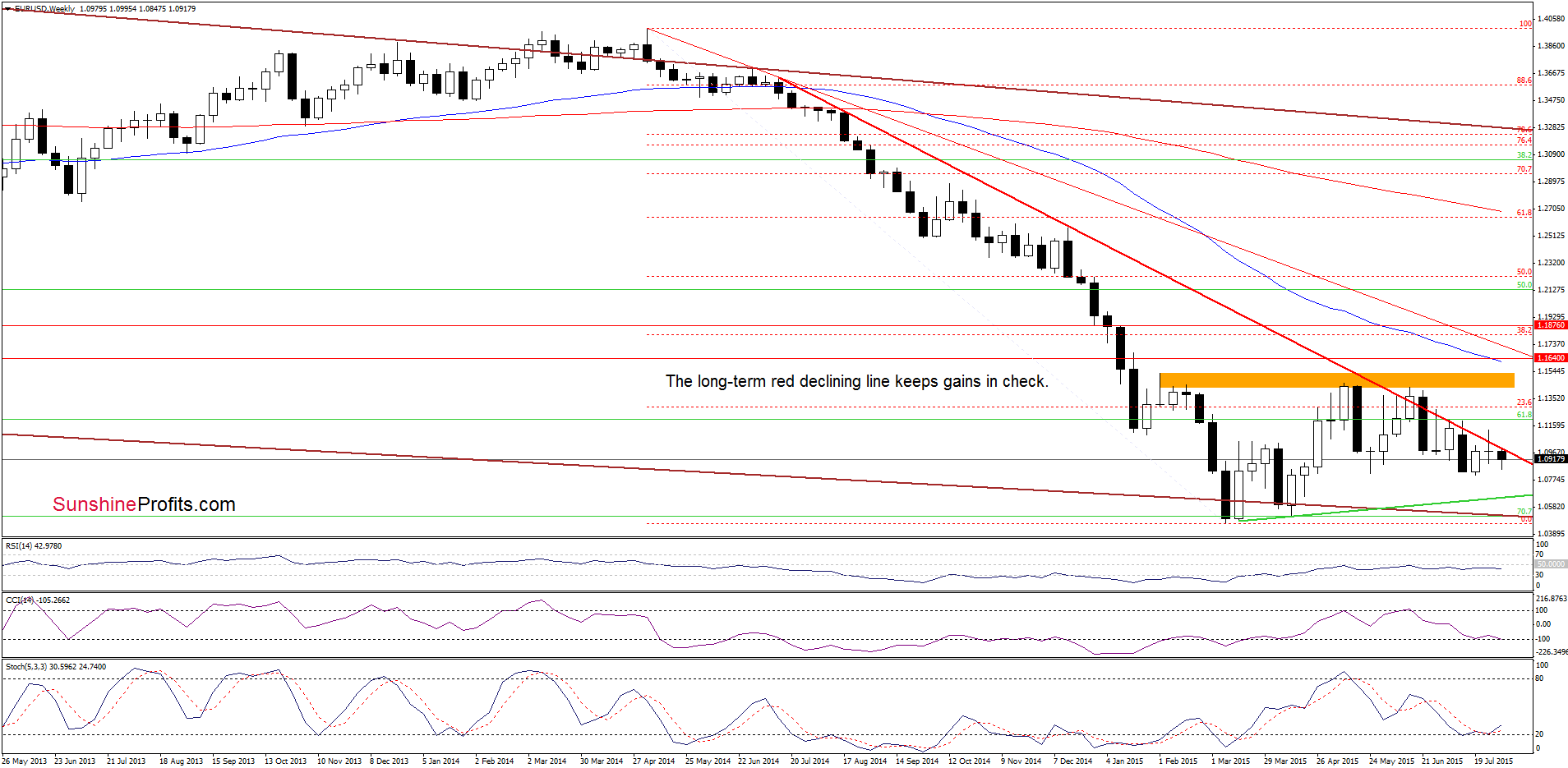

EUR/USD

The medium-term picture hasn’t changed much as EUR/USD is still trading under the long-term red declining resistance line.

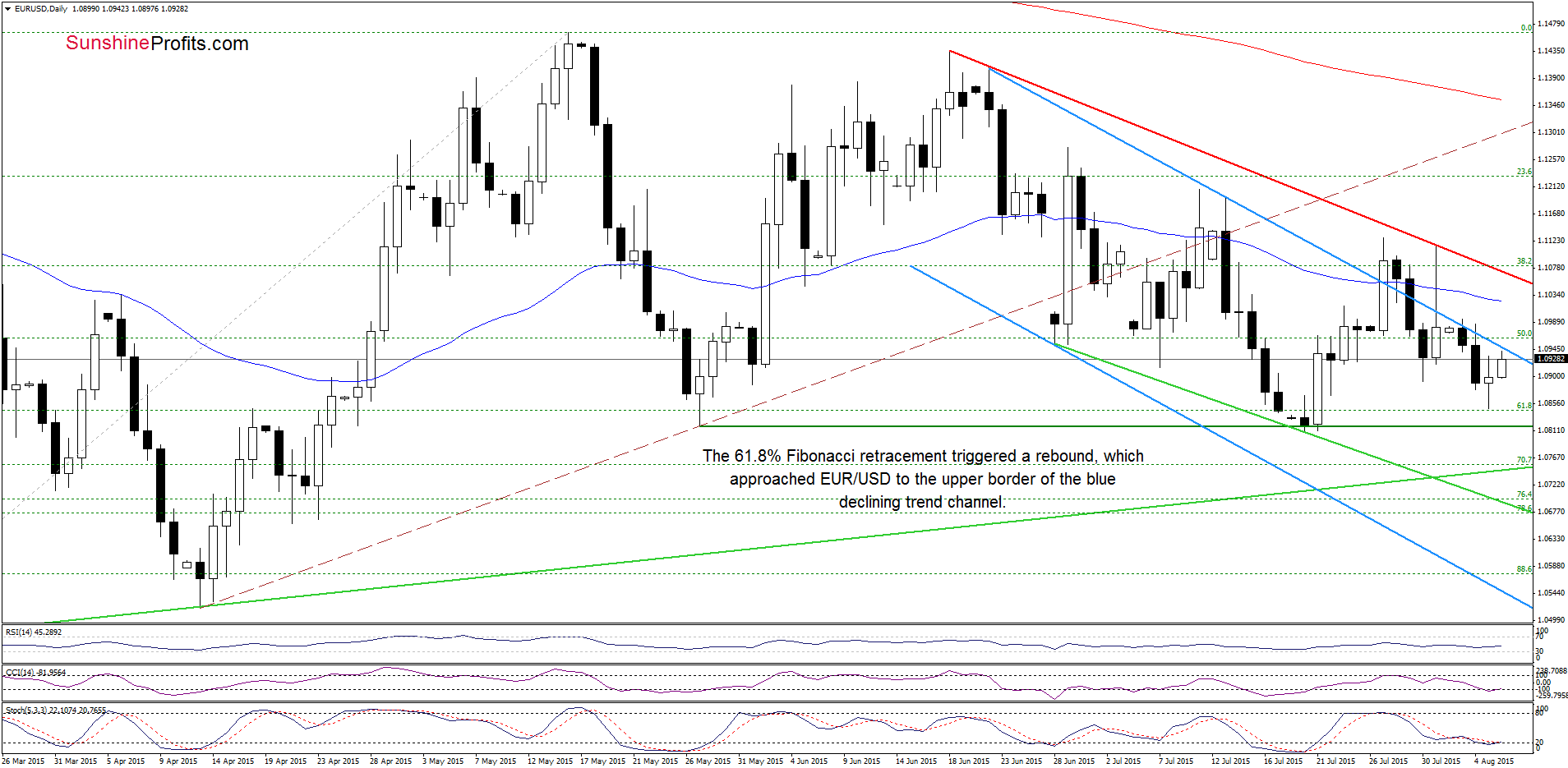

What can we infer from the very short-term picture? Let’s examine the daily chart and find out.

Looking at the daily chart we see that the 61.8% Fibonacci retracement triggered a rebound, which approached EUR/USD to the previously-broken upper border of the blue declining trend channel. What’s next? Taking into account the current position of the indicators (the CCI generated a buy signal, while the Stochastic is very close to doing the same) it seems that currency bulls will try to push the exchange rate above this resistance line in the coming day(s). If they succeed, we may see an increase to the 50-day moving average (currently at 1.1023) or even a test of the re declining resistance line (based on the Jun and Jul highs). Nevertheless, such rally will be more reliable if we see a daily close above the upper line of the trend channel.

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

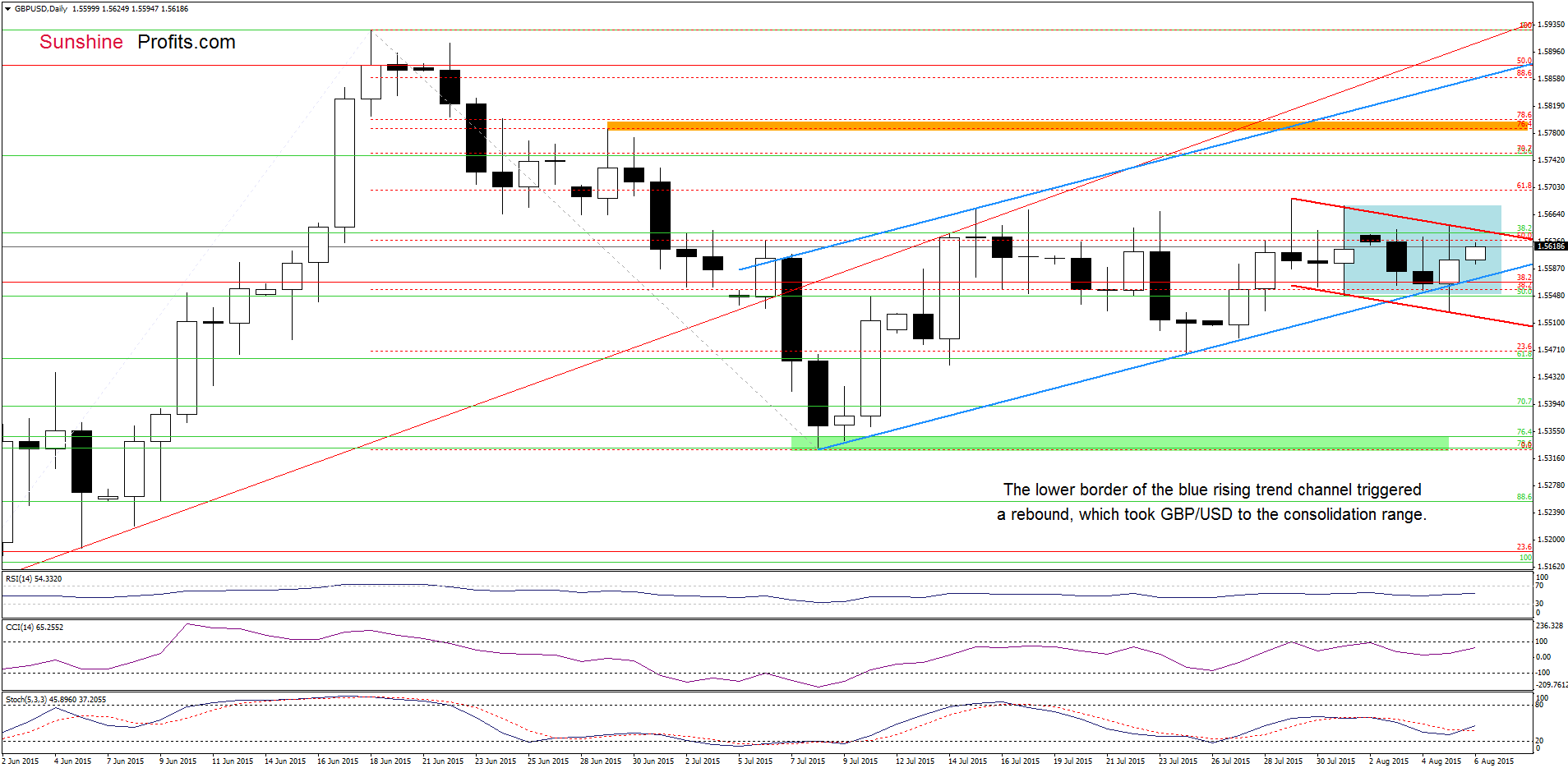

GBP/USD

The situation in the medium term remains almost unchanged as GBP/USD is trading in the blue consolidation. Today, we’ll focus on the very short-term picture.

From this perspective we see that the lower border of the red declining trend channel stopped currency bears and triggered a rebound, which invalidated earlier small breakdown under the blue support line. This positive event resulted in a test of the upper line of the formation. A this point, it is worth noting that the Stochastic Oscillator generated a buy signal, which suggests that currency bulls will try to push the pair above the red resistance line. If they succeed, we’ll see (at least) a test of the recent highs (around 1.5677-1.5688) in the coming day(s).

Very short-term outlook: mixed with bullish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

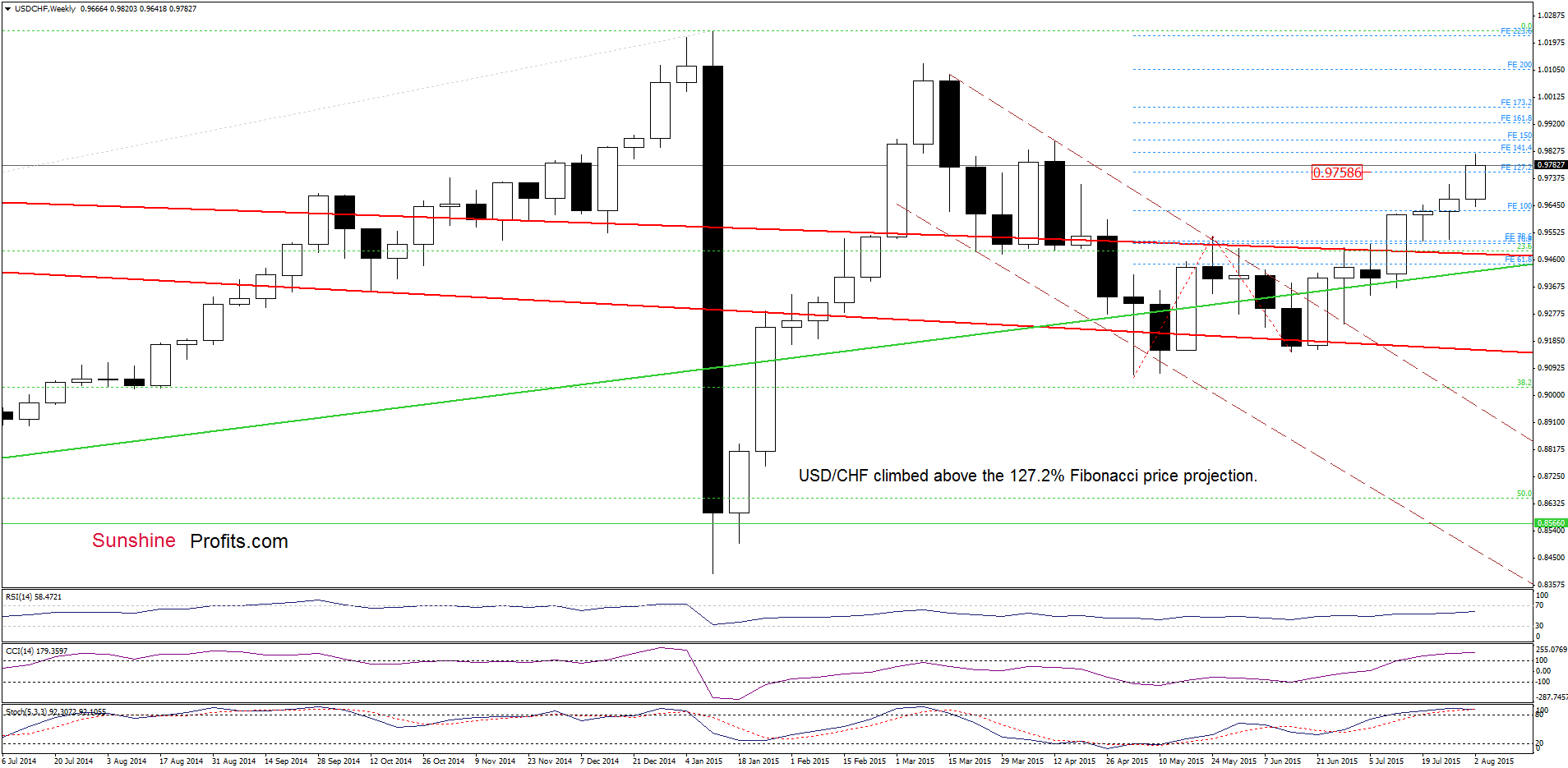

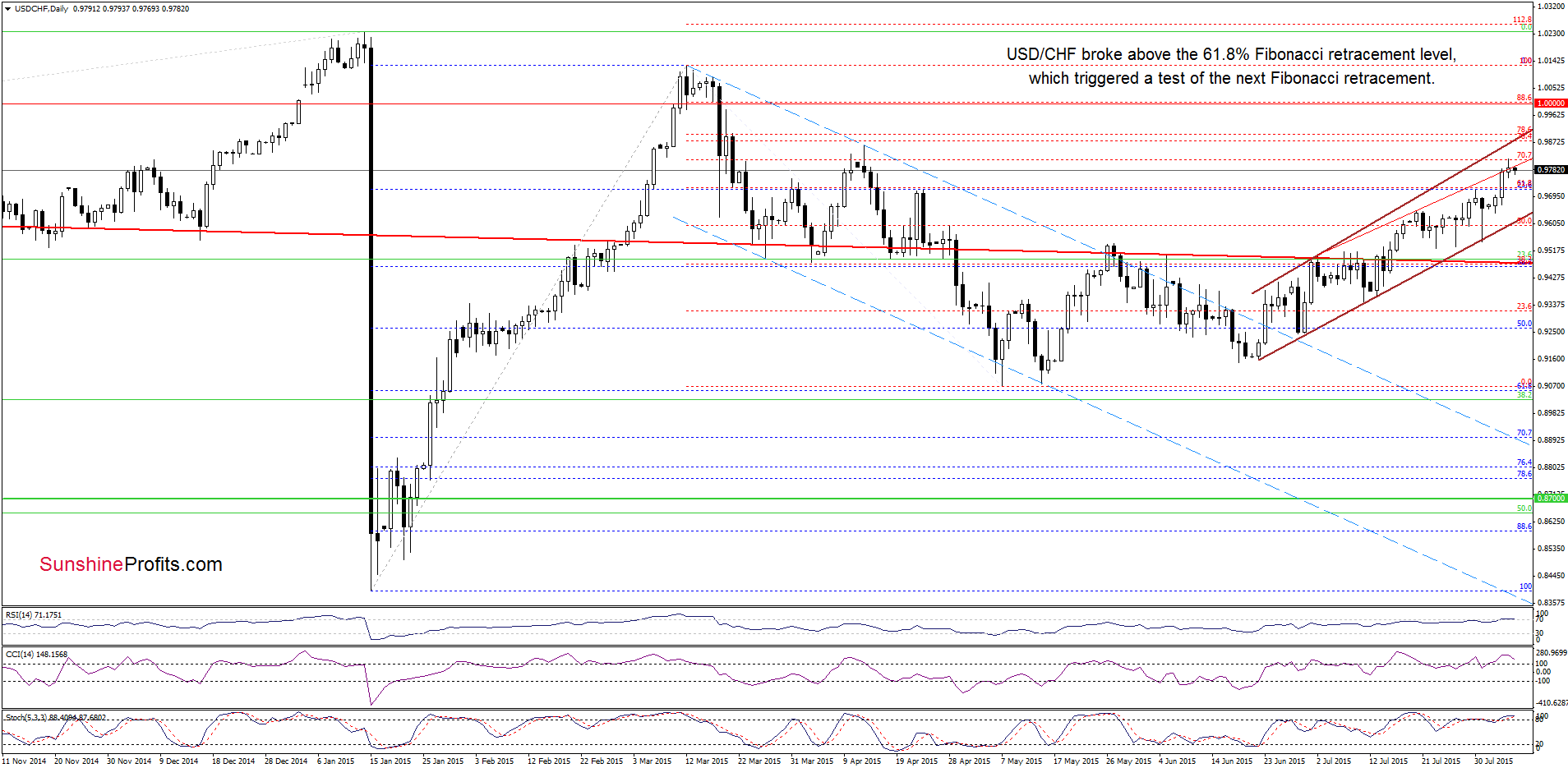

USD/CHF

USD/CHF extended gains and approached the 141.4% Fibonacci price projection (marked with blue). What impact did this move have on the very short-term picture? Let’s examine the daily chart and find out.

From today’s point of view we see that USD/CHF broke above the 61.8% Fibonacci retracement, which triggered a test of the next Fibonacci retracement. With this upswing the pair also climbed above the red resistance line (based on the previous highs), but as you see on the chart this improvement was only temporary and the exchange rate reversed and declined earlier today. Taking this fact into account, and combining it with the current position of the indicators (the RSI increased above the level of 70, while the CCI and Stochastic Oscillator are overbought) it seems that the next move will be to the downside. However, such price action will be more likely if we see sell signals in the coming days. Until this time, another attempt to move higher can’t be ruled out.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts