Forex Trading Alert originally sent to subscribers on May 12, 2015, 10:12 AM.

Earlier today, Greece repaid a €770 million loan installment to the International Monetary Fund, easing worries that the country was on the verge of default, which in combination with a renewed selloff in European government bond pushed EUR/USD sharply higher. In this way, the exchange rate reached its important resistance zone, but will we see further improvement?

In our opinion the following forex trading positions are justified - summary:

EUR/USD

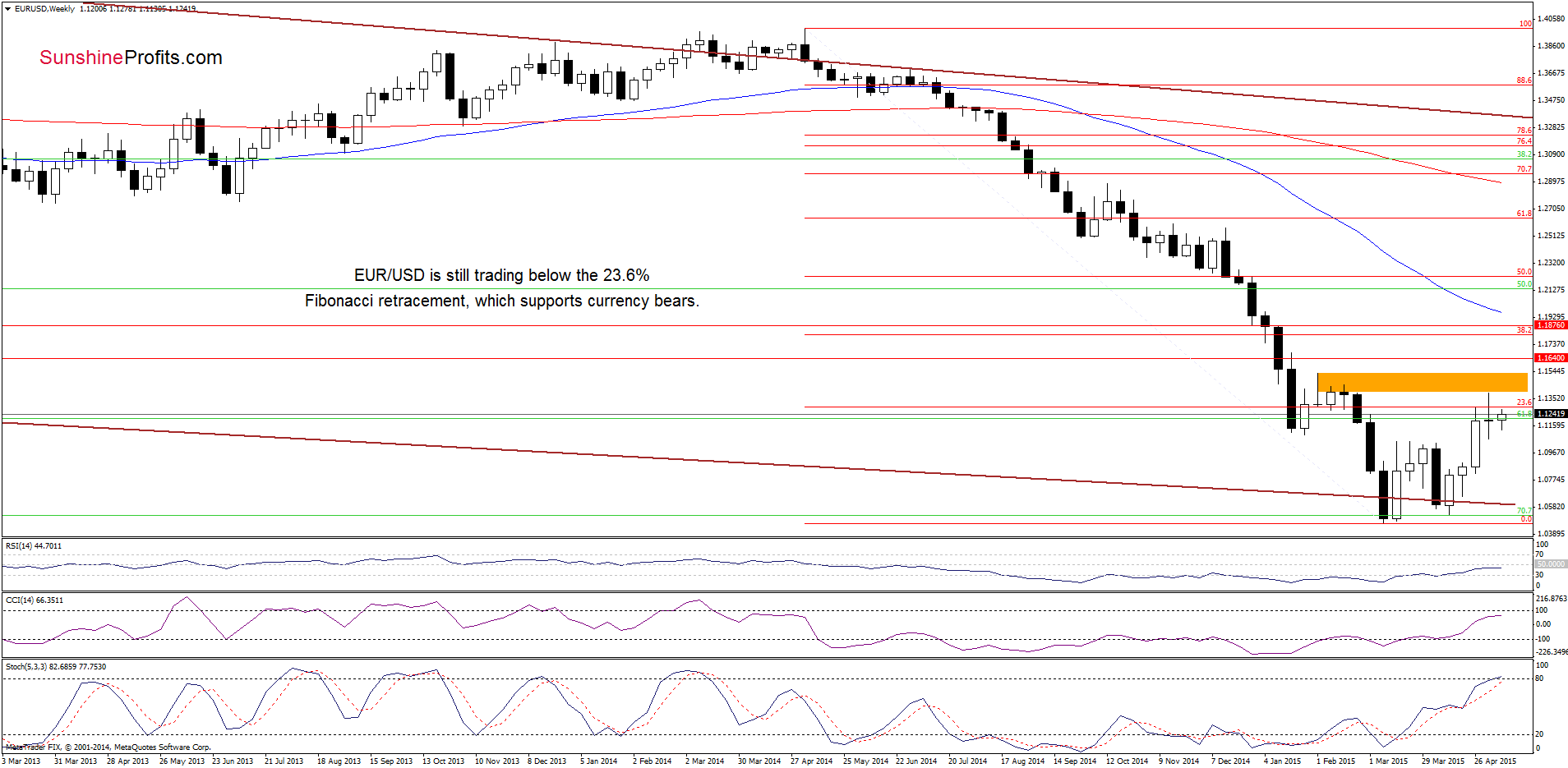

Looking at the weekly chart, we see that although EUR/USD moved little higher earlier this week, the pair is still trading under the previously-broken 23.6% Fibonacci retracement, which supports currency bears.

Will the exchange rate move lower in the coming days? Let’s examine the daily chart and find out.

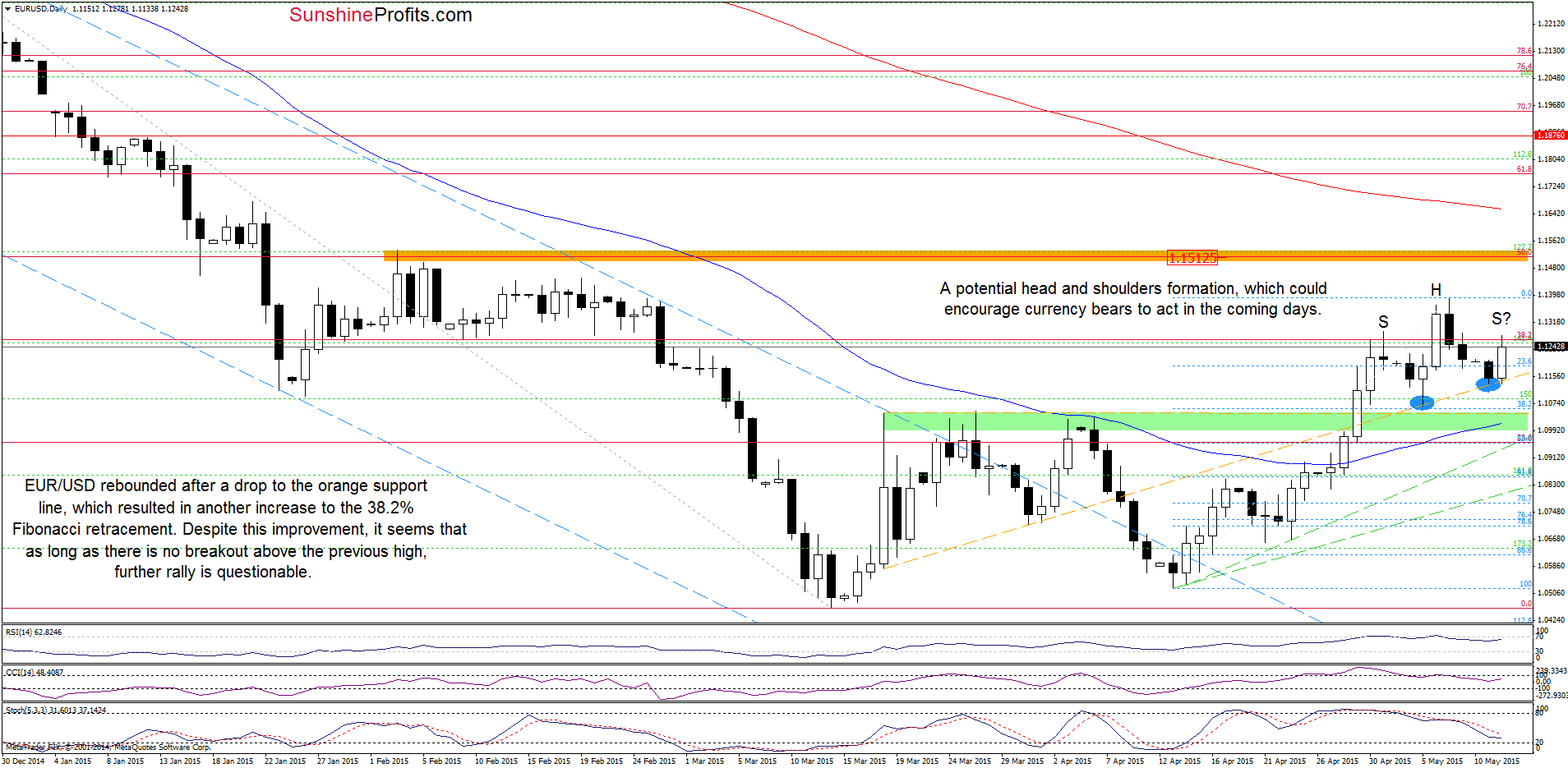

From this perspective, we see that EUR/USD rebounded after a drop to the orange dashed line. Similarly to what we saw in the previous week, this support triggered an upswing, which took the pair to the 38.2% Fibonacci retracement once again. Although this is a positive signal, we think that as long as there is no breakout above the recent high, a potential head and shoulders formation might be in play. As you see on the daily chart, if the exchange rate drops under the orange support line (which could be a neck line of the formation), we might see a bigger correction of the recent rally and a drop to at least the green support zone (around 1.1000-1.1050) supported by the 38.2% retracement (based on the recent upward move).

Very short-term outlook: mixed with bearish bias

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/JPY

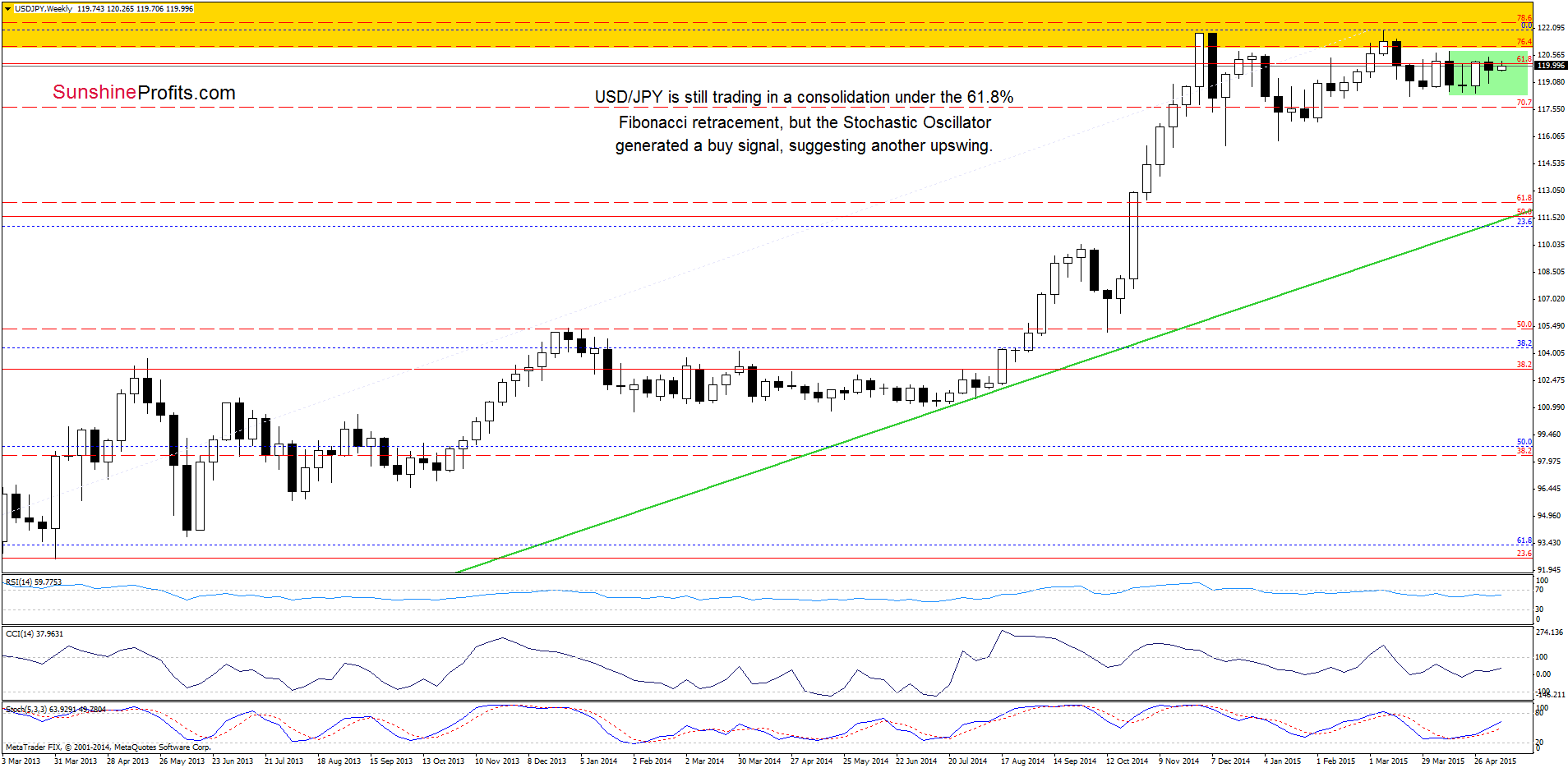

From the medium-term perspective the situation hasn’t changed much as USD/JPY is still trading in a consolidation (marked with green) under the 61.8% Fibonacci retracement level, which makes the outlook a bit unclear. Nevertheless, the Stochastic Oscillator generated a buy signal, suggesting another upswing.

Having said that, let’s check whether the daily chart give us some valuable clues about future moves or not.

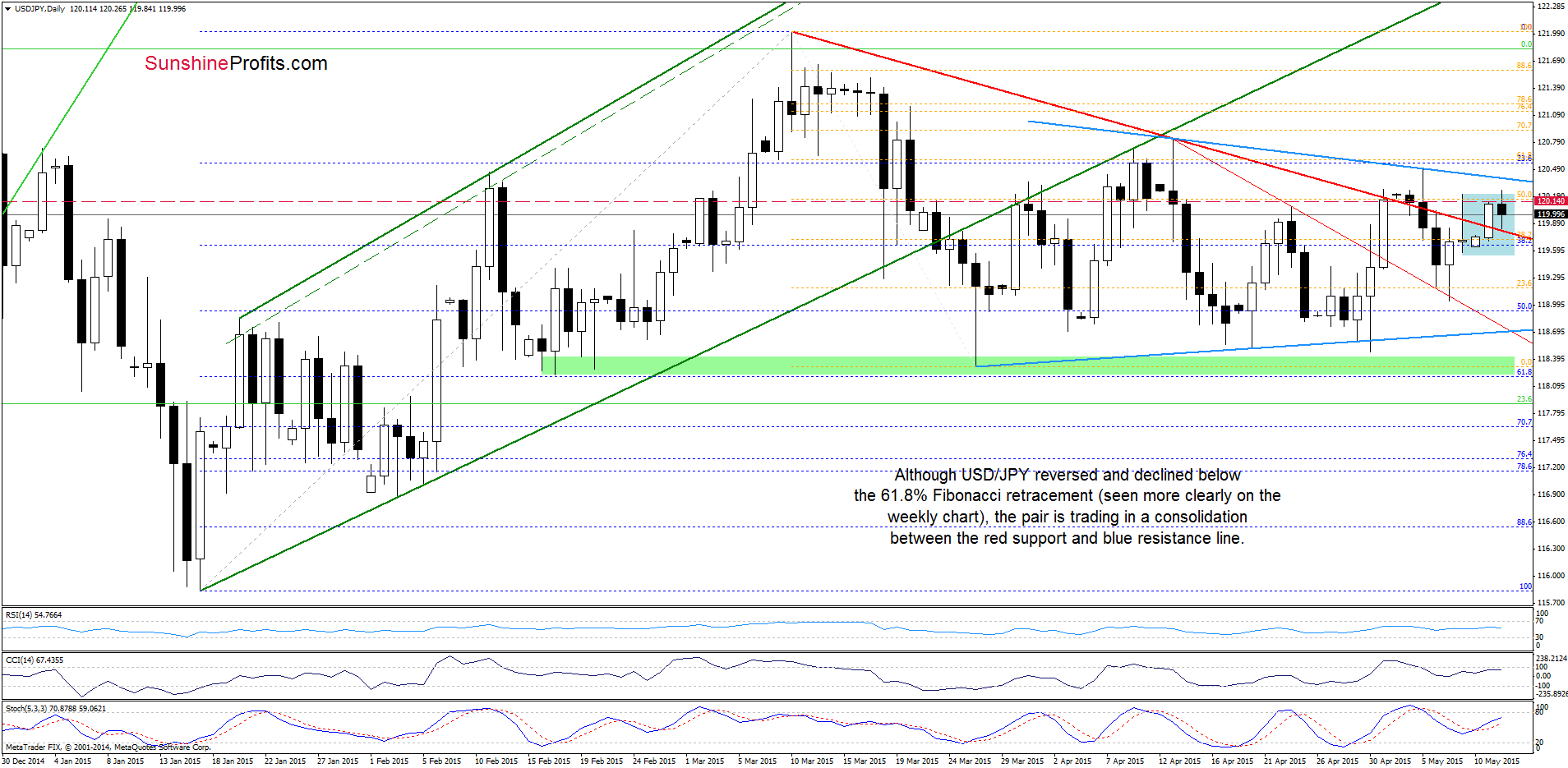

Earlier today, the exchange rate climbed to the 61.8% Fibonacci retracement (seen more clearly on the weekly chart), but this key resistance level stopped further improvement. As a result, the pair declined, but USD/JPY is still trading in a consolidation (marked with blue) above the red declining support line. In our opinion, as long as there is no breakout above the blue resistance line (currently around 120.40) or a breakdown under the lower line of the formation, a bigger move is not likely to be seen. Nevertheless, we should keep in mind that the Stochastic Oscillator generated a buy signal, supporting another attempt to move higher.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: bullish

Trading position (short-term; our opinion): No positions are justified from the risk/reward perspective at the moment. We will keep you informed should anything change, or should we see a confirmation/invalidation of the above.

USD/CAD

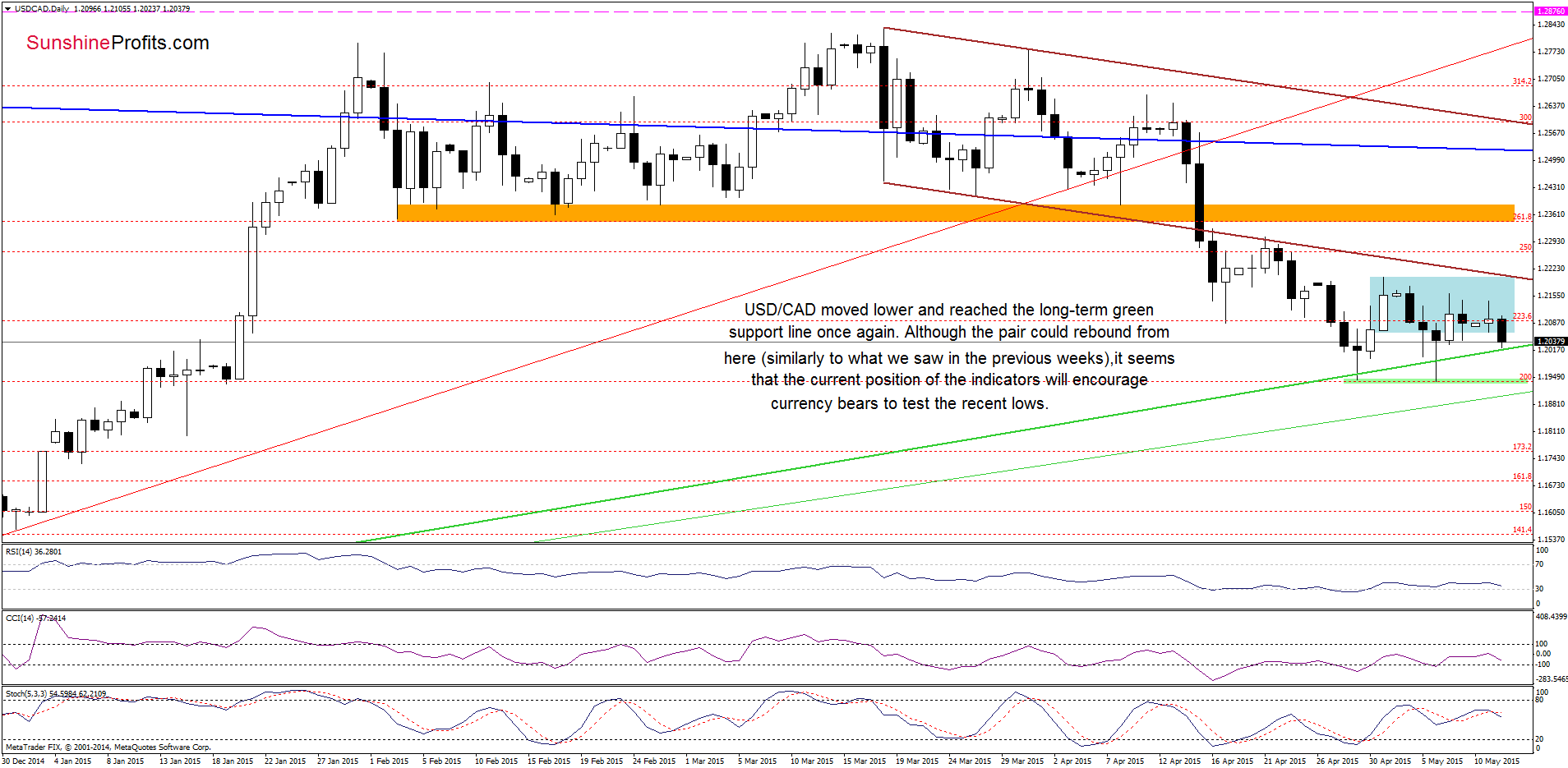

The situation in the medium term hasn’t changed much as USD/CAD is still trading above the 38.2% Fibonacci retracement. Toda, we’ll focus on the very short-term changes.

On the above chart, we see that USD/CAD moved lower and dropped to the long-term green support line once again. Although the pair could rebound from here (similarly to what we saw in the previous weeks), it seems that the current position of the Stochastic Oscillator (the indicator generated a sell signal) will encourage currency bears to test the strength of the support zone based on the recent lows (around 1.1940) in the coming days.

Very short-term outlook: mixed

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts