Although the euro increased against the greenback yesterday, important resistances continue to keep gains in check. But will they withstand the buying pressure in the coming week?

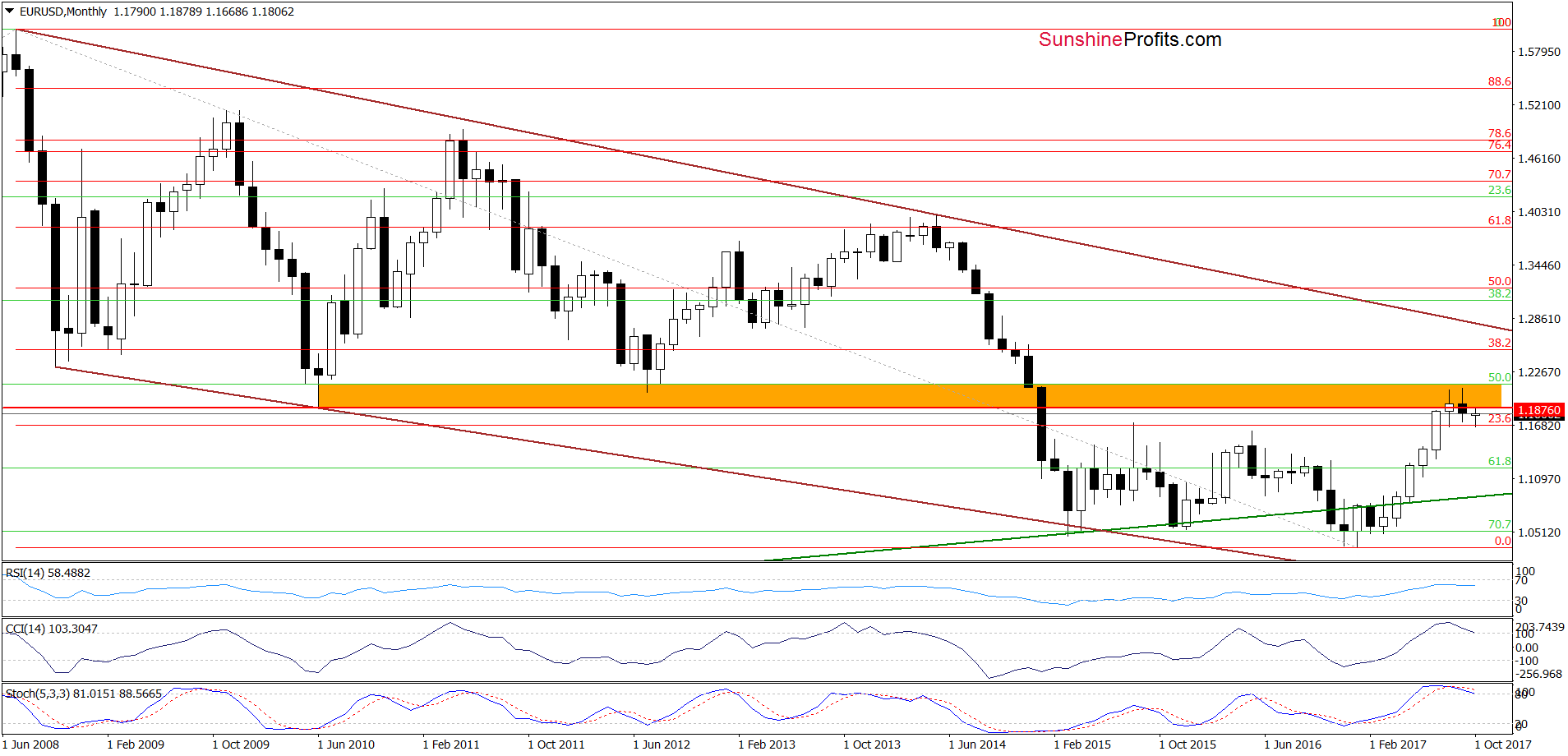

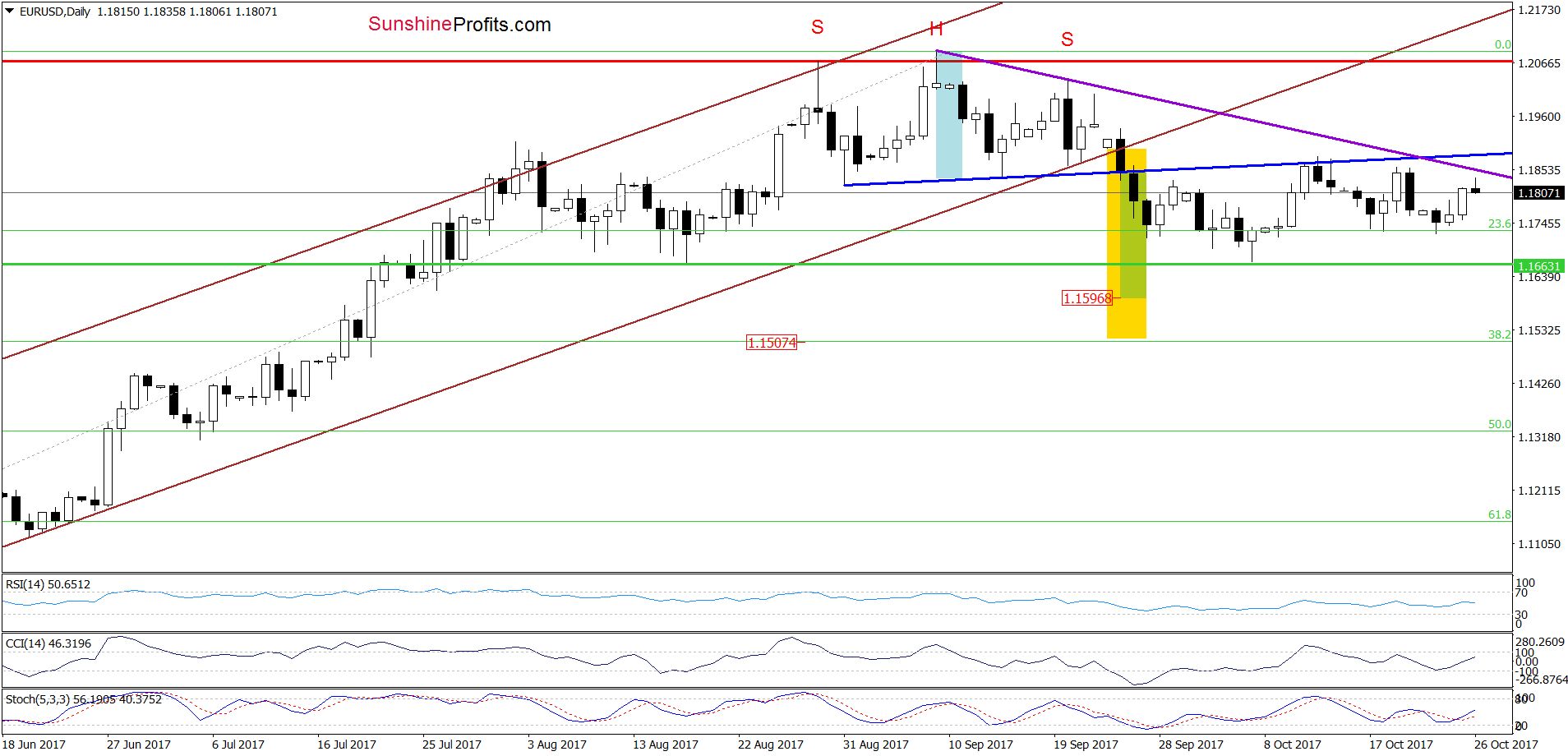

EUR/USD

Although EUR/USD increased yesterday, the major resistances (the orange resistance zone, the neck line of the head and shoulders formation and the purple declining line) continue to keep gains in check. This means that as long as there is no breakout above them another attempt to move lower and a re-test of the green horizontal support line based on the mid-August low are likely and short positions continue to be justified from the risk/reward perspective.

Very short-term outlook: mixed with bearish bias

Short-term outlook: bearish

MT outlook: mixed

LT outlook: mixed

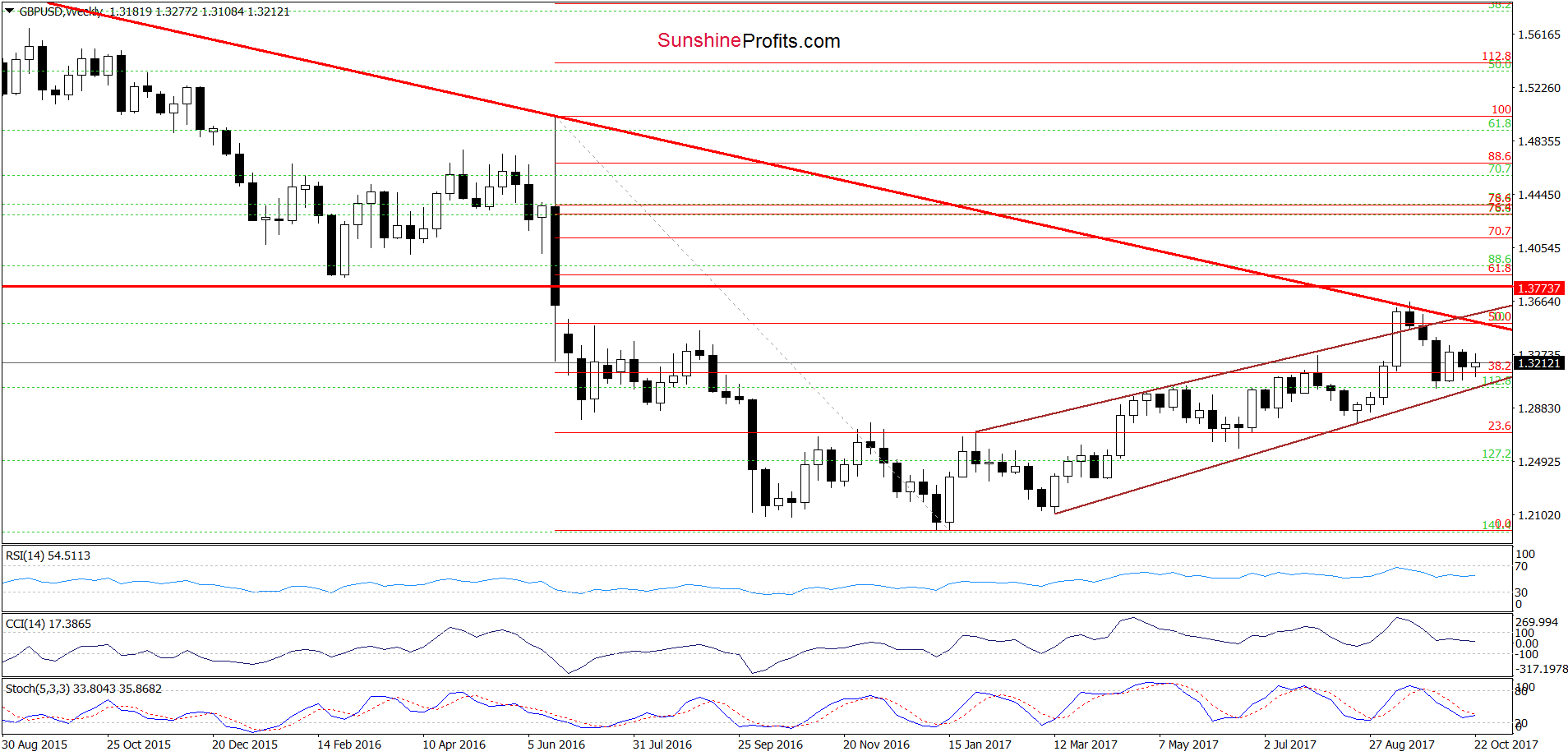

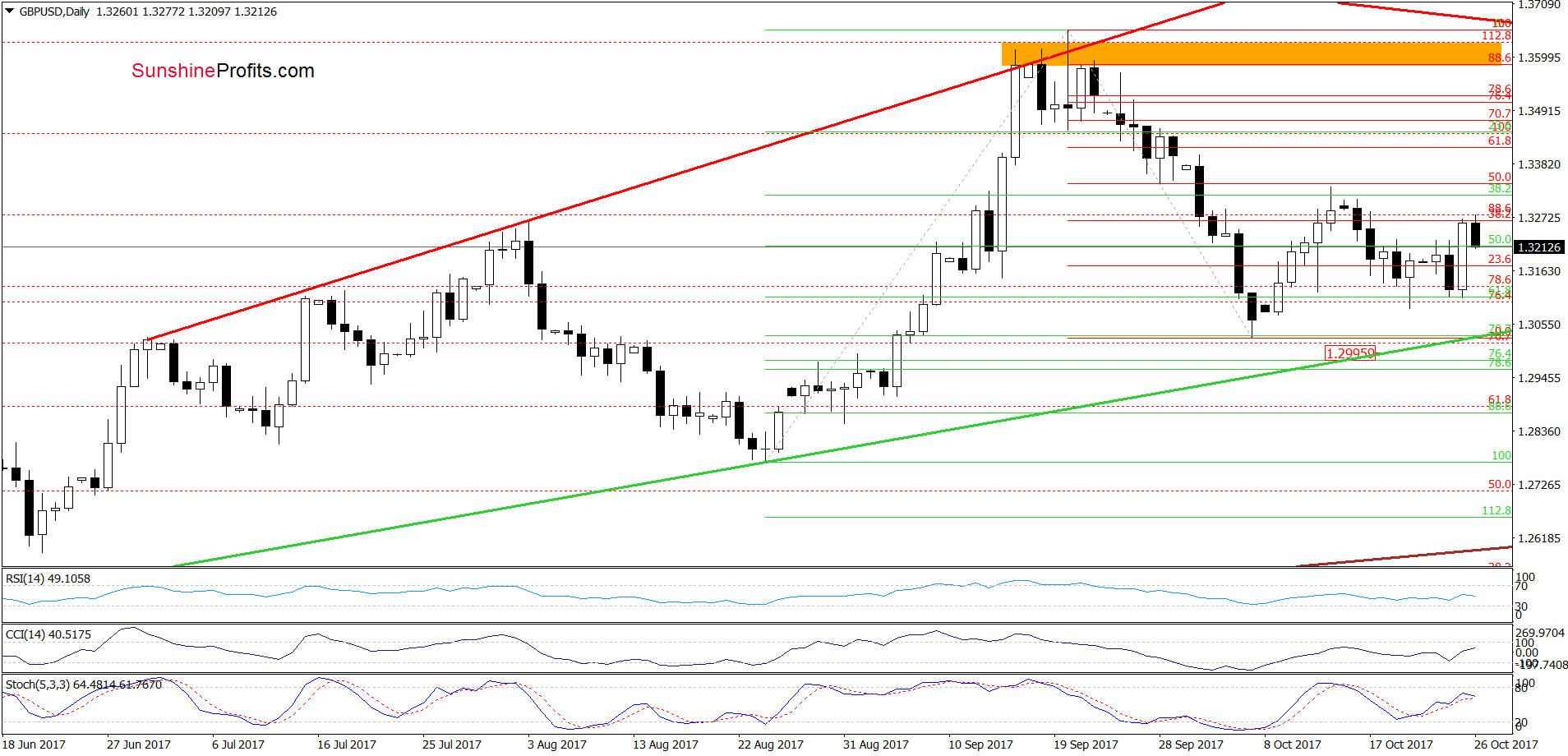

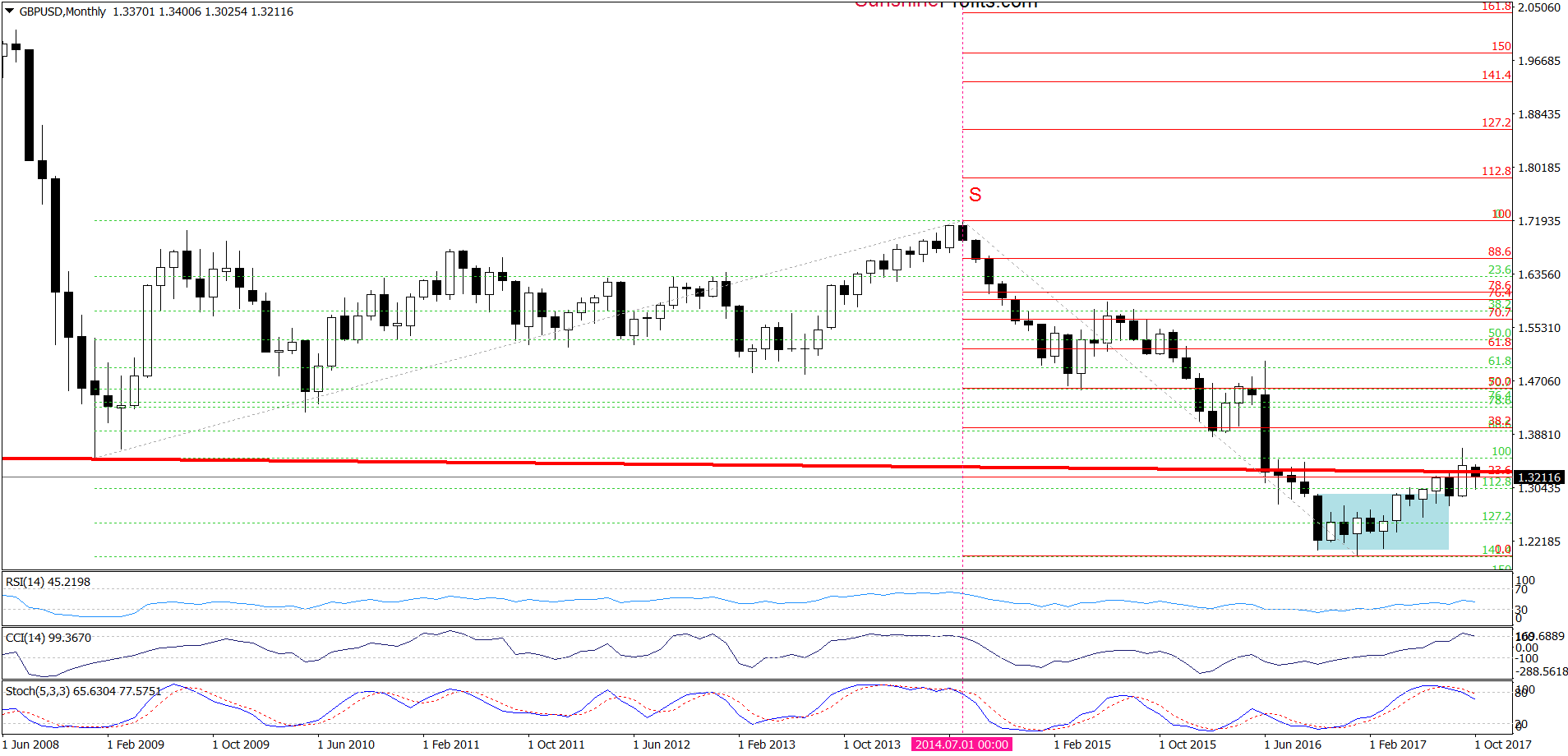

GBP/USD

Yesterday, GBP/USD rebounded sharply, which approached the exchange rate to the last week highs. Despite this increase, currency bears came back, which triggered a pullback earlier today. Additionally, the Stochastic Oscillator is close to re-generate a sell signal, which suggests that we’ll likely see a decline to the lower border of the brown rising trend channel marked on the weekly chart and the support zone created by the 76.4% and 78.6% retracements (around 1.3000) in the coming week.

Finishing today’s commentary on this currency pair, let’s take a look at the long-term chart.

From this perspective, we see that GBP/USD invalidated the earlier breakout above the red resistance line (the neck line of the long-term head and shoulders pattern), which together with the sell signal generated by the Stochastic Oscillator do not bode well for higher values of the exchange rate in the coming weeks, suggesting further deterioration.

Very short-term outlook: bearish

Short-term outlook: mixed with bearish bias

MT outlook: mixed with bearish bias

LT outlook: mixed

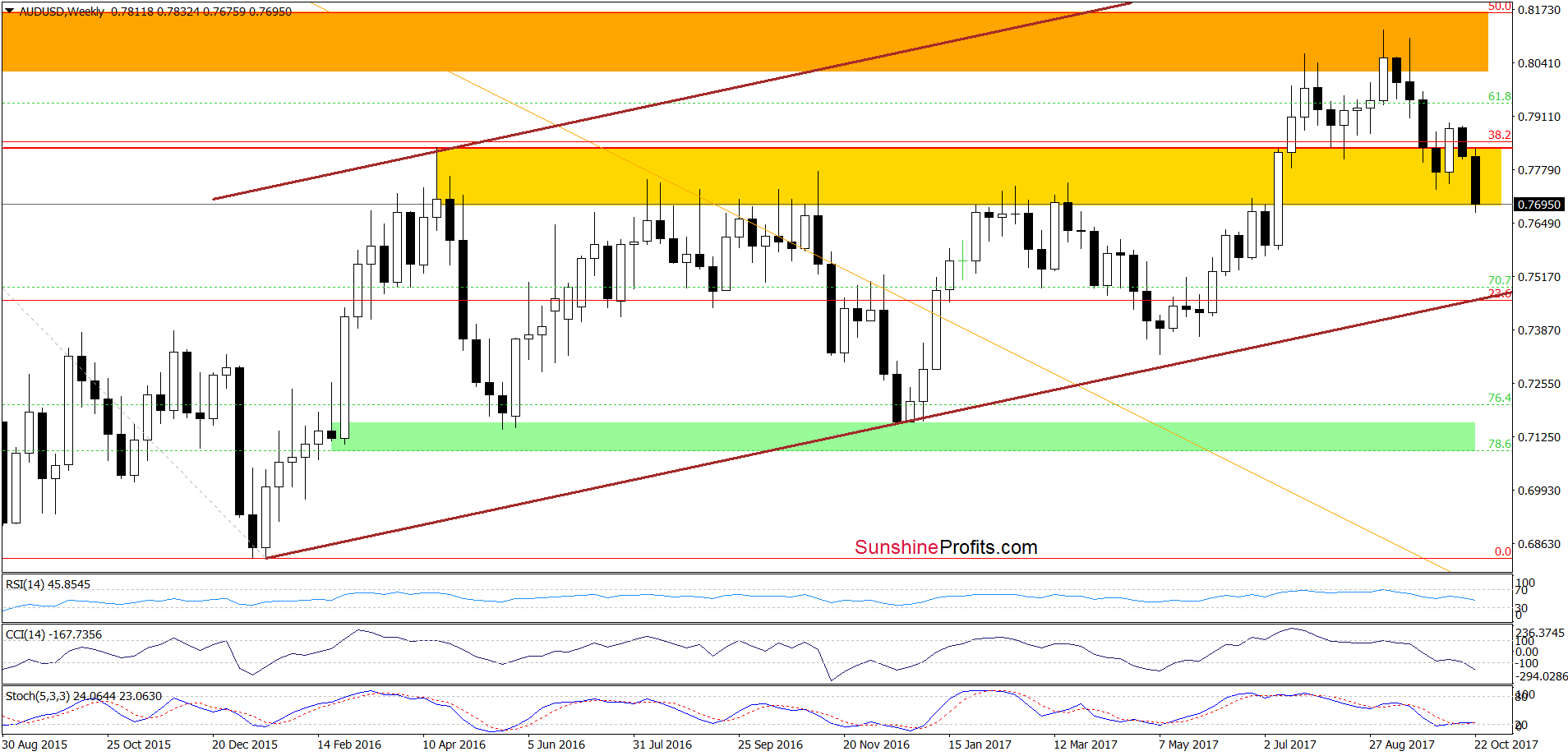

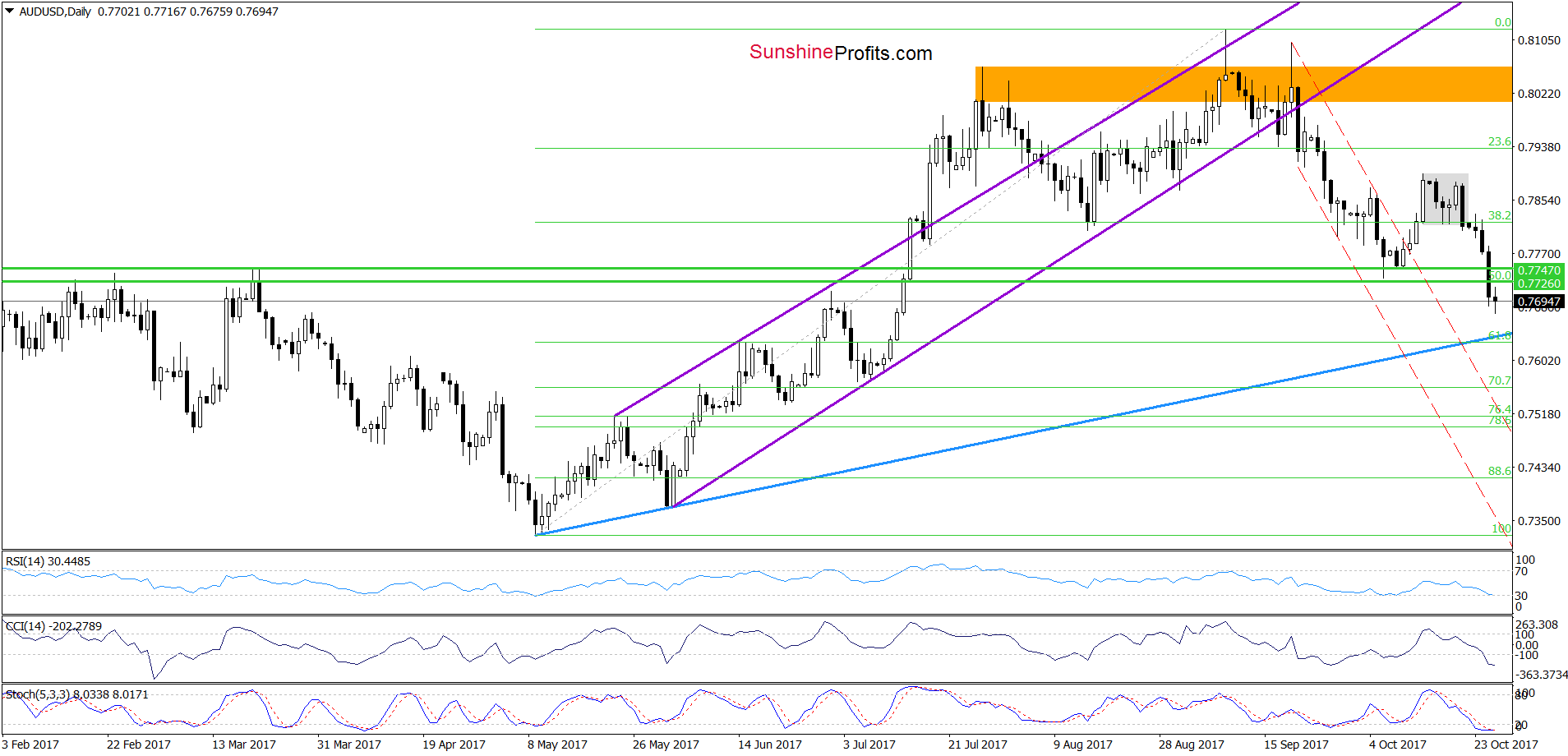

AUD/USD

On Friday, we wrote the following:

(…) taking into account the sell signals generated by the CCI and the Stochastic Oscillator it seems to us that the pair will (at least) test the support zone created by the green horizontal lines and the October low of 0.7730 in the coming days.

From today’s point of view, we see that the situation developed in line with the above scenario and AUD/USD not only slipped to our downside target, but currency bears managed to push the pair below it. Taking this fact into account and the lack of buy signals, which could encourage currency bulls to act, we think that the exchange rate will test the blue rising support line and the 61.8% Fibonacci retracement in the near future.

Very short-term outlook: bearish

Short-term outlook: mixed

MT outlook: mixed

LT outlook: mixed

Naturally, the above could change in the coming days and we’ll keep our subscribers informed, but that’s what appears likely based on the data that we have right now. If you enjoyed reading our analysis, we encourage you to subscribe to our daily Forex Trading Alerts.

Thank you.

Nadia Simmons

Forex & Oil Trading Strategist

Przemyslaw Radomski, CFA

Founder, Editor-in-chief, Gold & Silver Fund Manager

Gold & Silver Trading Alerts

Forex Trading Alerts

Oil Investment Updates

Oil Trading Alerts