If this is the first e-mail that you receive from us, then it means that our previous messages have not reached you, due to the technical problems that we have encountered. You may view copy of the recently sent messages here:

http://www.sunshineprofits.com/?q=list/commentary . Until I am sure that we have solved the e-mail deliverability problem I will send you messages in the text format, as they are more likely to reach you. We apologize for not having narrowed down the problem earlier. If you changed your mind and do not want to receive our updates, please log into your account and click the DELETE button. If you don't remember your password, please reply to this message and tell us to unsubscribe you. If you do want to receive them, you can help us in reaching you by flagging us as NOT-SPAM (if this message is in your spam folder) and adding us ( to your address book / "safe sender list" in your e-mail client.) to your address book / SAFE SENDER LIST. Before you ask, our Premium Service will most likely (hopefully) be available next week.

In the previous Market Update I wrote:

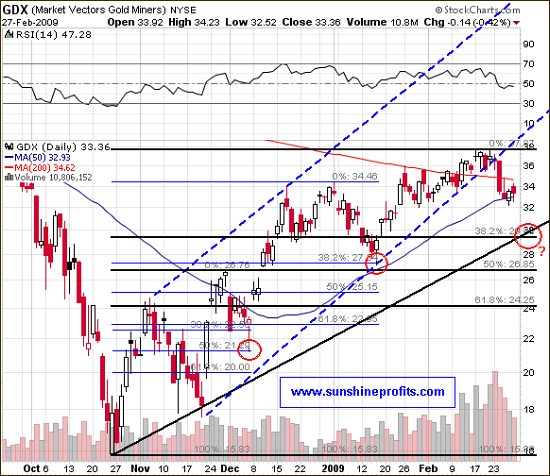

The precious metals stocks have corrected and are now at the minor support level, which is combination of a minor trend line and 50-day moving average. The drop here was rapid, but most corrections need more time to complete than just a few days. Knowing that PM stocks often correct in the zig-zag (or a-b-c-) fashion ( http://www.tradersedgeindia.com/images/ew10.gif ), we can infer that the precious metals stocks will experience another small decline. That would ideally correspond to the $30 GDX level or HUI at 250-260. In order to confirm this initial assumption, let's take a closer look:

Fibonacci retracement levels have so far (during this rally) proven a very good indication of where the correction will ultimately end - please take a look at the areas marked with red circles. This does not mean that this particular tool is perfect, but it seems that it is currently one of the best that we can use. For this correction the first retracement level is just under the previously mentioned $30 level. The second one corresponds to the previous local low around the $27 level. Should the first retracement level not hold PM stocks, the second one (-50%) will most likely do.

This is exactly what happened - we had GDX just under $30 and the HUI Index at 254.95. Where do we go from here? I am long-term bullish and I am not advocating waiting with one's long-term capital to make the final purchases of the precious metals. Short- and medium-term, however, is a different matter. It is difficult to say what the PM markets will do next, because there are several factors that need to be taken into account here and the signals are rather unclear. However, you registered at our website to know what we view as the most probable outcome, so here we are.

Let me digress here - why do we bother with the short term? Because it is the diversification between investment AND speculation that allows us to improve our risk/reward ratio - meaning more money in the long run.

The first factor that we need to take into account is the situation on the USD market. Please take look at the following chart:

This rally was similar to the preceding one, so it may be a fairly good indication of where we are going to go next. We have just broken below the rising trend line, and the previous time it happened, we had a brief pullback - that may be the case also here. This is not probable enough to make us open a speculative position, but it is probable enough to make us consider taking profits off the table (we use options and options have time value, so the situation is not symmetric). The USD is generally negatively correlated with the prices of commodities (particularly precious metals), so a pullback in the USD might hurt our speculative positions in RTP and FCX.

The key word in the previous sentence is GENERALLY, as precious metals have lately traded in tune with the dollar, which some found very confusing. Does this pose a serious long-term threat to the precious metals market, because the USD is long-term bearish? I don't think so, because:

1. This situation is not the "default mode" of the market, and will most likely change in the future.

2. Even if USD rises further temporarily, precious metals have other important fundamental factors to ensure that they will be higher in the long-run

3. We have just witnessed subtle signs that tell us that this situation may be changing.

Please take a look at the following chart for more details:

The precious metals stocks have touched their trend line, and for the last two days they have been rising along with declining dollar. If we get a small upswing in the USD and gold drops modestly, then it will be probable that we are in for another strong upleg.

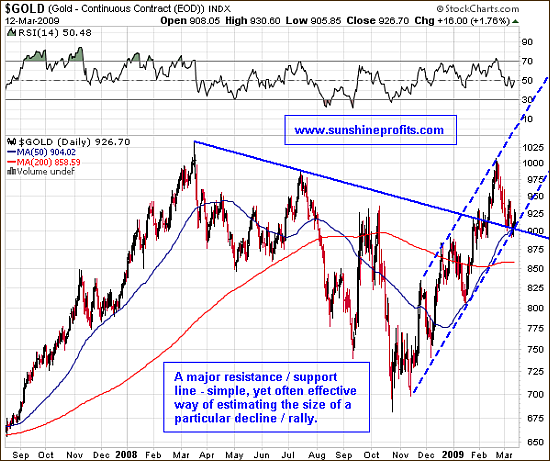

To put the current situation in the proper context, please take a look at the gold market from the long-term perspective:

From this point of view, the gold market is testing the long-term support level. We may rally directly from here, but it is also probable that we will trade sideways for a week or two, especially if the USD is to rise temporarily, and the correlation between USD and gold will turn negative again. This would most likely imply temporarily breaking the dashed support line and re-testing the solid one. Again, the situation is unclear here, so I am not opening a speculative position right now.

Summing up, the precious metals could rally from here, but it seems probable that we will trade sideways for a while.

Please note that it is also possible that the rally in RTP, FCX and commodity stocks in general will continue. However, taking into account options' time value, and the fact that we may get a pause here, I decide to close my positions. If we do get a pullback, we can always re-enter these or open similar positions.

It is difficult to assess the profitability of the trades that I am just about to close (RTP, FCX - please check the Weekly Commentary section for details), as I am sending this Market Alert before the market opens, however it is very likely that they will prove very profitable. I will provide you with more details in the next Market Update.

Sincerely,

Przemyslaw Radomski

Free Stocks & Gold Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts