In the last Speculative Alert we wrote the following:

(...), we can expect further long-term strength in the gold stocks. Nonetheless it seems that the previous resistance level needs to be verified as a support, thus confirming the breakout.

Rapid upswings usually need at least a brief breather before a particular stock/index can rise again (...)

In our view, we are approaching a very good entry point to add to your long-term holdings and perhaps to speculate on rising gold stock prices after the support level holds. (...)

This support level that we referred to is also mentioned in the latest commentary that has been posted on Kitco. Quoting its summary:

The plunge was rapid, and so is the pullback that we have seen over the last 2 months. As nothing moves straight up or down, we might expect a pullback in the current rally, and there are several signs that the local top is near. None of our unique indicators flashed the sell signal, however RSI, MACD and current intraday performance (decline in gold and the HUI Index despite lower USD Index) indicate that a local top is in fact near or that it has just materialized.

The probability that gold stocks (here: the GDX ETF) will touch the 24-26 level in the next 5-7 trading days is not yet very high - lets say its about 30-40% in our view. This is less than 50%, but given the fact that the GDX January 30 put options are priced around $1 at the moment of writing these words it seems to be worth to take a very small position in them. The risk to reward ratio is promising, but its not a no-brainer yet, so we remain cautious.

Having just purchased a modest amount of these options we do not recommend using more than couple percent of ones trading capital (or 1-2% of ones total capital) at this point to do so. If there is a confirmation from our indicators we may increase this position it will still be small, as we are dealing with a very profitable (and therefore risky) instrument here.

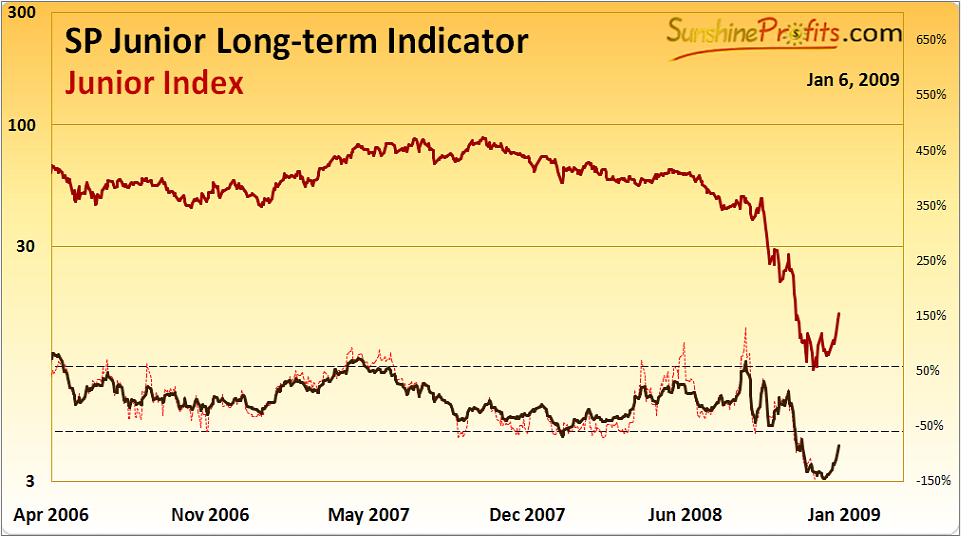

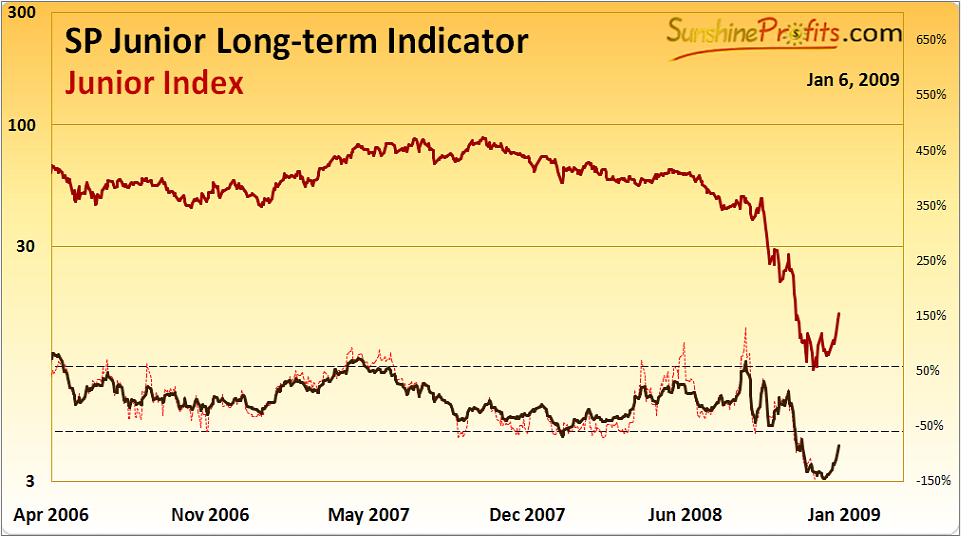

As far as the long term in concerned, juniors are beginning to regain strength relative to the senior precious metals stocks. In the latest essay on juniors (http://www.sunshineprofits.com/?q=research/junior-sector-dead-or-epic-buying-opportunity) we have introduced the SP Junior Long-term Indicator. It currently shows the improvement in this sectors performance, which is naturally very good news for anyone holding juniors right now please take a look at the recent (Jan 6-th 2009) version of the chart:

Once this pullback (if it does indeed materialize) is complete and juniors continue to hold well, then it will be a clear green light for this sector. Before you ask yes, there are more indicators that we have developed for the precious metals sector. This and much more will be included in our Premium Service, which will be available in a few weeks. Thank you for your patience.

Feel free to pass this e-mail to your relatives and friends. Heres a link if they would like to register and receive Updates from us in the future: http://www.sunshineprofits.com/?q=user/register

Sincerely,

Przemyslaw Radomski

Back

(...), we can expect further long-term strength in the gold stocks. Nonetheless it seems that the previous resistance level needs to be verified as a support, thus confirming the breakout.

Rapid upswings usually need at least a brief breather before a particular stock/index can rise again (...)

In our view, we are approaching a very good entry point to add to your long-term holdings and perhaps to speculate on rising gold stock prices after the support level holds. (...)

This support level that we referred to is also mentioned in the latest commentary that has been posted on Kitco. Quoting its summary:

The plunge was rapid, and so is the pullback that we have seen over the last 2 months. As nothing moves straight up or down, we might expect a pullback in the current rally, and there are several signs that the local top is near. None of our unique indicators flashed the sell signal, however RSI, MACD and current intraday performance (decline in gold and the HUI Index despite lower USD Index) indicate that a local top is in fact near or that it has just materialized.

The probability that gold stocks (here: the GDX ETF) will touch the 24-26 level in the next 5-7 trading days is not yet very high - lets say its about 30-40% in our view. This is less than 50%, but given the fact that the GDX January 30 put options are priced around $1 at the moment of writing these words it seems to be worth to take a very small position in them. The risk to reward ratio is promising, but its not a no-brainer yet, so we remain cautious.

Having just purchased a modest amount of these options we do not recommend using more than couple percent of ones trading capital (or 1-2% of ones total capital) at this point to do so. If there is a confirmation from our indicators we may increase this position it will still be small, as we are dealing with a very profitable (and therefore risky) instrument here.

As far as the long term in concerned, juniors are beginning to regain strength relative to the senior precious metals stocks. In the latest essay on juniors (http://www.sunshineprofits.com/?q=research/junior-sector-dead-or-epic-buying-opportunity) we have introduced the SP Junior Long-term Indicator. It currently shows the improvement in this sectors performance, which is naturally very good news for anyone holding juniors right now please take a look at the recent (Jan 6-th 2009) version of the chart:

Once this pullback (if it does indeed materialize) is complete and juniors continue to hold well, then it will be a clear green light for this sector. Before you ask yes, there are more indicators that we have developed for the precious metals sector. This and much more will be included in our Premium Service, which will be available in a few weeks. Thank you for your patience.

Feel free to pass this e-mail to your relatives and friends. Heres a link if they would like to register and receive Updates from us in the future: http://www.sunshineprofits.com/?q=user/register

Sincerely,

Przemyslaw Radomski