Gold, silver and corresponding equities have recently been acting very strongly and if you followed us on the speculative transactions, your gains are quite impressive. This alert is being sent, as we believe it is no longer profitable to bet on higher prices in the short term, especially with the February options.

Quoting the previous Market Update:

"When do we sell? Since options value decreases along with the time they have until their expiration, it is usually best not to wait too long for a 'perfect exit'. In this case it means selling when at the first serious resistance level, or earlier if there are other signals that the trend may be reversing at least temporarily. As far as the latter is concerned, we will send you an alert, when we decide that this is indeed taking place.

(...)

As far as the important resistance level is concerned, please refer to the first chart mentioned in this e-mail (http://sunshineprofits.com/files/images/email_feb112009.png). There is a very important resistance level at $1000, however we would not recommend waiting for it to be reached to sell their call options, because of the decreasing time value. The closest resistance level that we need to monitor is $970. This is a few dollars below the previous top (closing price $978.70 on Jul 15-th. Should gold get above $970, we will sell our call options."

This is exactly what happened today and we have therefore closed our speculative positions. It is possible that we will get a little higher from here, perhaps gold could touch its previous intra-day high of $989.6. However waiting for it to happen would not make much sense from the risk-to-reward perspective. While the market could go higher, it is not really very probable that these levels will be achieved immediately.

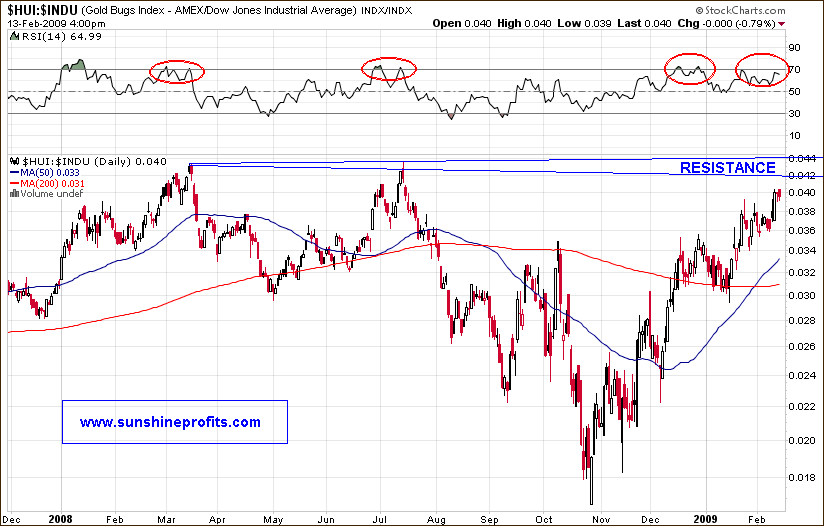

An additional reason to close our long speculative positions is that the HUI to DJIA ratio approached important resistance level. This ratio emphasizes how much PM stocks are outperforming the general stock market. As this ratio decreases it suggests lower PM stocks' prices unless the general stock market rallies strongly. Even in this case, it is doubtful that a strong upswing in the gold and silver stocks would follow. Please check details on the chart below:

The transaction details:

GDX 32 Feb calls sold for $5.2, 160% profit from $2, which was the price for which one could purchase these options on the day our Update was sent, and during the following day.

GDX 32 Mar calls are priced $6.2, 106.7% profit from $3, which was also the price for which one could purchase these options on the day our Update was sent, and during the following day.

Do we buy puts? It's always up to you to decide; we believe that the risk/reward ratio it not yet favorable to initiate such a trade, especially given the fact that this position would be taken against the major trend.

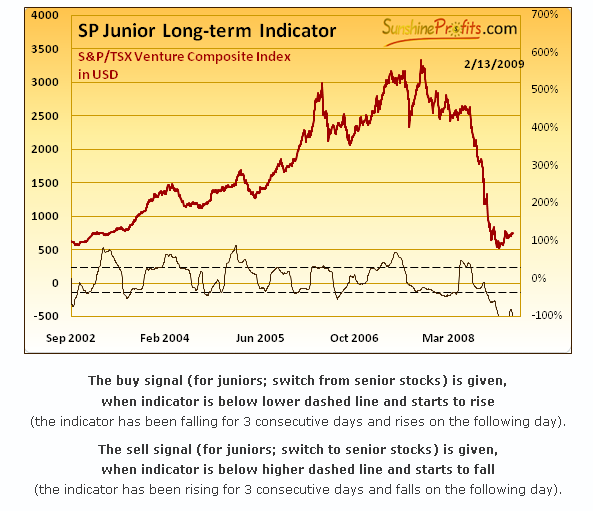

Many readers have asked for additional charts with our indicators. You may view one of the indicators by clicking the link below:

Sincerely,

Przemyslaw Radomski

Free Stocks & Gold Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts