Over a month ago an essay entitled "The January Effect of another January disaster?" was posted in which we wrote the following:

Quoting the Fed's latest statement "The Federal Reserve will employ all available tools to promote the resumption of sustainable economic growth and to preserve price stability". "All available tools" most likely means increasing the money supply in the most tricky ways, not only by keeping the interest rates low. This is not bullish for USD and it is bullish for gold.

We surely did not need to wait long for a confirmation. According to the yesterday's statement from The Powers That Be (http://biz.yahoo.com/ap/090210/bailout_plan.html), decided to... (that's right, you guessed it) provide much more money than was previously announced. "The Federal Reserve said it would expand the size of a key lending program to as much as $1 trillion from $200 billion". This makes one think - if they are becoming dramatically more desperate on a monthly basis, then what else do they know that we don't? Whatever that is, it is most likely bullish for the precious metals, which are generally known as a safe haven during crises.

It seems that this news served as a catalyst to a new upswing in the precious metals market. At the moment of writing these words we have gold at $943, silver at $13.60 and the HUI Index at 319. These levels are substantially higher, than it was the case on Jan 20-th, when we sent the previous Market Update, in which we suggested getting back on the long side of the precious metals market. Like always, an Alert would be sent if we changed our mind regarding the direction in which the market will likely head next. Since the recent developments had the characteristic typical to a pause, rather than to a top, we kept our call options and waited for a decisive breakout.

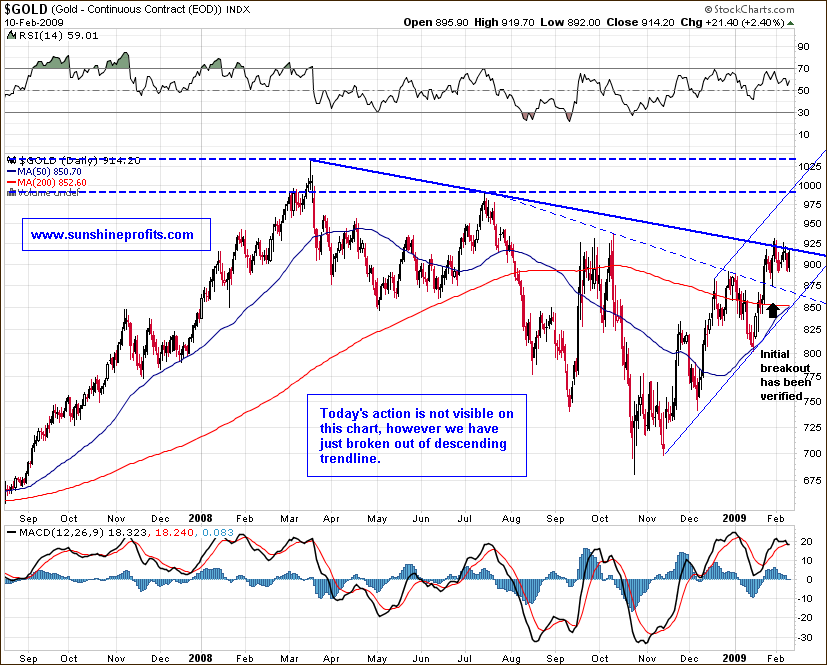

It is highly probable that this is what we are experiencing today. Please take a look at the following chart:

As you can see, we have just broken out of the descending trendline, and it happened on a strong volume. The trading session is half over (at the moment of writing), but the volume is already much higher than the average 3-month daily volume. This indicates that today's breakout is not likely to be a 'fakeout'. Therefore the most important question now is how should an investor / speculator deal with this situation.

Today's action increases the probability that we will see higher prices in the coming days. On the other hand, if one purchased call options with a part of their speculative capital - like we did, they have increased their position in the absolute terms. In other words, since these options have approximately doubled in value, its share in one's portfolio has also doubled. Therefore, on one hand we have bigger probability of further gains and on the other hand we have larger share of one's capital that is used for this transaction. Since it is appropriate to increase one's invested share (all other things equal), as the probability of achieving particular gains increases, we keep our positions. If the amount of money that you have on the table makes you emotional about this (or any other) transaction, than it would be best to close at least a part of your positions.

Details:

GDX 32 Feb calls are priced at $4.6, 130% profit from $2, which was the price for which one could purchase these options on the day our Update was sent, and during the following day.

GDX 32 Mar calls are priced $5.4, 80% profit from $3, which was also the price for which one could purchase these options on the day our Update was sent, and during the following day.

When do we sell? Since options value decreases along with the time they have until their expiration, it is usually best not to wait too long for a 'perfect exit'. In this case it means selling when at the first serious resistance level, or earlier if there are other signals that the trend may be reversing at least temporarily. As far as the latter is concerned, we will send you an alert, when we decide that this is indeed taking place.

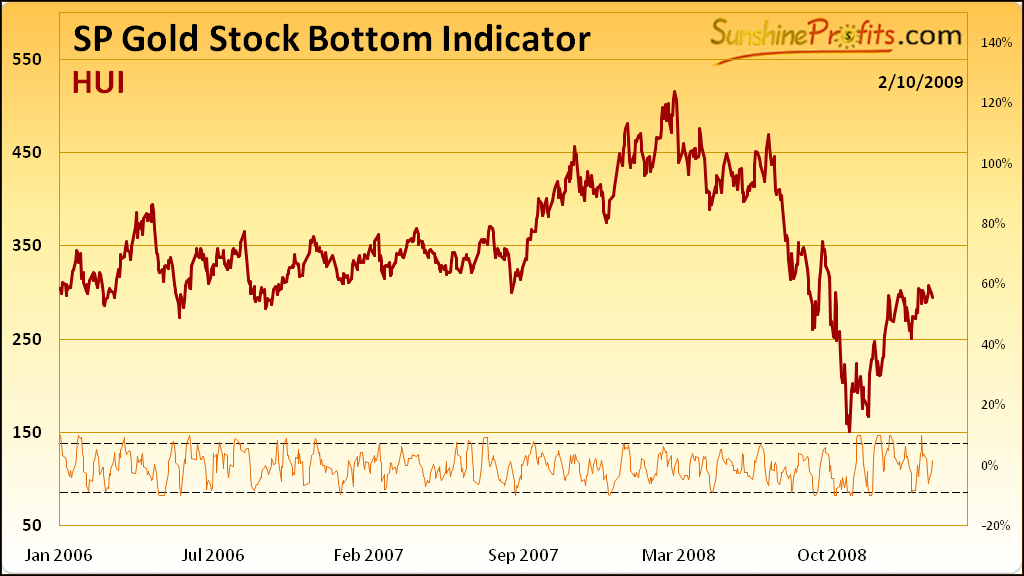

For now, none of our indicators suggests immediate top. On the contrary, we have had another buy signal at the end of January, but did not send another Update, as that was just a confirmation of what we have previously indicated. For details please take a look at the medium-term chart of HUI along with one of our indicators:

As far as the important resistance level is concerned, please refer to the first chart mentioned in this e-mail. There is a very important resistance level at $1000, however we would not recommend waiting for it to be reached to sell their call options, because of the decreasing time value. The closest resistance level that we need to monitor is $970. This is a few dollars below the previous top (closing price $978.70 on Jul 15-th. Should gold get above $970, we will sell our call options.

You will soon be able to access the above, and several other unique indicators which will be updated on a daily basis. This feature will become available along with the introduction of our Premium Service - if nothing unexpected happens, it should be ready within the next 14 days. Thank you for your patience.

Sincerely,

Przemyslaw Radomski

Free Stocks & Gold Newsletter

with details not available

to 99% investors

+ 7 days of Gold Alerts