On Monday, Draghi held his quarterly hearing before the European Parliament. What does it mean for the gold market?

The topic of Monday’s hearing was the role of financial innovation, but Draghi also reviewed the economic outlook and discussed the monetary policy stance. The key takeaway from his introductory statement is that inflationary pressures remained subdued, so monetary accommodation is still needed to strengthen the rise in prices:

“Despite a firmer recovery (…) underlying inflation pressures have remained subdued. Domestic cost pressures, notably from wages, are still insufficient to support a durable and self-sustaining convergence of inflation toward our medium-term objective. For domestic price pressures to strengthen, we still need very accommodative financing conditions, which are themselves dependent on a fairly substantial amount of monetary accommodation.”

Thus, Draghi argued that despite improved economic growth, the Eurozone still requires substantial monetary stimulus:

“Overall, we remain firmly convinced that an extraordinary amount of monetary policy support, including through our forward guidance, is still necessary for the present level of underutilised resources to be re-absorbed and for inflation to return to and durably stabilise around levels close to 2% within a meaningful medium-term horizon.”

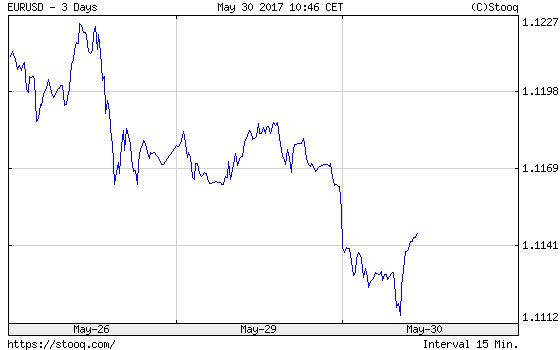

Hence, the expectations of a more hawkish ECB diminished after Draghi’s testimony. As a result of his relatively dovish comments, the euro dropped against the U.S. dollar, as one can see in the chart below.

Chart 1: EUR/USD exchange rate over the last three days.

The stronger greenback put gold under pressure, as the chart below shows.

Chart 2: Gold price over the last three days.

Moreover, there was a new round of political worries over some European countries, especially Greece, Italy and the U.K. In particular, worries about Greece’s fiscal situation and early election in Italy re-emerged (possibly as early as in September). And the lead of the Conservative Party in polls has shrunk further.

Summing up, Draghi’s comments were more dovish than expected. Combined with worries about the Eurozone and the U.K., they pushed the euro down, exerting downward pressure on the yellow metal. Although the U.S. dollar has been recently hit by concerns over Trump, its fundamentals are much stronger than in the case of the common currency (for example, the Fed conducts more hawkish monetary policy than the ECB). In the long-term, the greenback could strengthen further against the euro, which should put gold under pressure. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview