Based on the June 17th, 2011 Premium Update. Visit our archives for more gold & silver articles.

Many times, we had talked about economic stability and precious metals markets and how significantly macroeconomic data influence the prices. While Greece is almost at the brim of a potential non-equilibrium, here comes again the scenario economic stability vs. precious metals. Lets begin todays session with a letter from one of our Subscribers. You might have noticed that we had been starting our last few free commentaries with answering our Subscribers questions. Although we dont want to get habituated by this style, we thought including questions in commentaries would provide all our readers an option to realize where we stand in terms of our market views.

Here is the question:

I'm not a trader per se, though I'm short term bearish on silver. I'm in ZSL so I don't see any real short term strength in silver or gold. If gold and silver were little moved by events in Europe, I think this is a real weak sign for both metals. So if Europe over the weekend has even a short term solution for Greece, this should hurt both gold and silver. Secondly, when the U.S. comes to a deal on the debt ceiling, and they will despite the politicking going on now, this will be positive for the U.S. dollar and the stock market; however, the risk premium in gold and silver will pop like a balloon and we'll see much lower prices. Just my thoughts, I'm interested in your opinion on this.

And here are our thoughts on this topic:

As far as the solution for Europe is concerned (concerning Greece), it seems that much depends on what the solution will be. If it will roughly translate to "all right, we'll print more euros - don't worry, you're safe", it will be bearish for this currency and bullish for the USD Index. At this point this is what the charts are suggesting. However, since gold has been recently positively correlated with euro (and negatively with the USD Index) it might not be bullish for gold. That is counter-intuitive as printing money should be viewed as something that would cause one to want to hedge by buying gold. However, at the same time markets could believe that this will indeed provide a "relief" to the Eurozone and this could make gold appear less attractive as gold usually thrives on fear.

As far as our thoughts on the general stock market are concerned, it seems that higher value of the USD would not be too good for US Exporters, which would translate into overall lower values for stock indices. While the short-term correlation between stocks and metals are weak at this moment, the medium-term ones are rather high, so if we would see a bigger decline in stocks, it could make metals move lower as well.

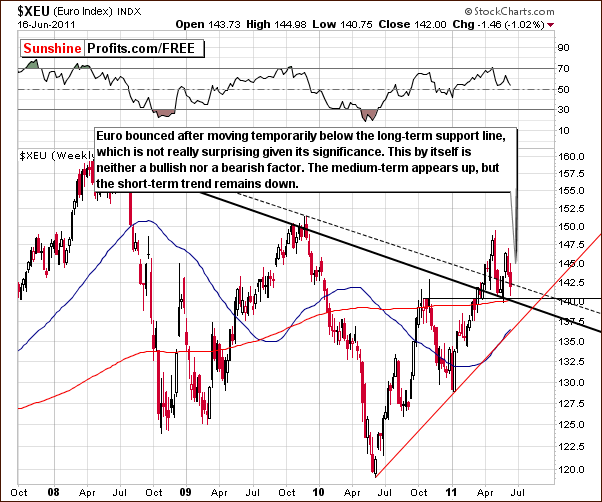

We will now turn to the technical portion with the analysis of the Euro Index chart (charts courtesy by http://stockcharts.com.)

The Euro Index levels bounced after temporarily moving below the declining support line created by the 2008 and 2009 tops. This support level is indeed significant.

The current index level is close to the local top seen late in 2010, so a pause here appears to be justified. The short-term trend still appears to be down but the medium-term trend seems to be up. If the current downtrend continues and the Euro Index reaches the red, rising support line in our chart, this will likely cause precious metals prices to move much lower. Please note that the medium-term outlook here is not overly important to the short-term outlook for the precious metals sector.

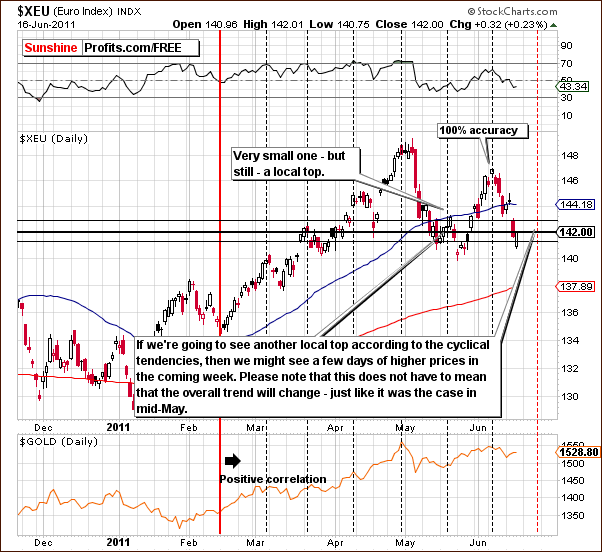

In the short-term Euro Index chart, we see that a support level based on the late 2010 top has been touched. It is certainly possible that a contra-trend rally may be seen from here; however, we dont think it would be a big one.

The cyclical tendencies of the Euro Index indicate that local tops repeat every two and a half weeks or so. Consequently, a local top is possible in the near days but this will be seen only if index levels reverse and move higher beforehand. This possibility is similar to what was seen in mid-May when a small rally led to slightly higher index level values but at the same time it did not really invalidate the previous downtrend.

As we have discussed in last weeks commentary Fundamentals, Technicals and Silver Be Cautious!, silvers cyclical turning point is coming up soon. This could mean that we may see a significant decline or possibly (and it seems a little more likely than not at this point) a slight move higher for a few days and then a decline. That would coincide with cyclical euro turning points examined earlier local top with euro could be seen very close to a local top in silver.

Before summarizing, lets have a look at the Dollar Index values too.

In the long-term USD Index chart, we see a similar (but opposite) outlook to what we discussed in the Euro Index chart. Resistance levels have been reached and a pause and/or some sideways movement may be seen. Perhaps the index could even decline slightly. On the other hand, there is a good possibility that a breakout could be seen soon after that and this would likely result in considerably lower prices for gold.

Summing up, the outlook is slightly bearish for the dollar in the immediate term although bullish for the short term. It appears that some sideways movement or slight declines could be followed by higher USD Index levels. Consequently, the implication for gold is rather positive in the immediate term (several days) and bearish soon after that.

To make sure that you are notified once the new features are implemented, and get immediate access to my free thoughts on the market, including information not available publicly, we urge you to sign up for our free e-mail list. Sign up for our gold & silver mailing list today and you'll also get free, 7-day access to the Premium Sections on my website, including valuable tools and charts dedicated to serious PM Investors and Speculators. It's free and you may unsubscribe at any time.

Thank you for reading. Have a great weekend and profitable week!

P. Radomski

--

We've sent out a message to our Subscribers yesterday with a quick update regarding the current market situation and our comments regarding the possibility of banning trading in gold and silver. We encourage you to Subscribe to the Premium Service today and read the full version of this week's analysis right away.