In a historic referendum, Britain voted to leave the European Union. We covered this topic in our Gold News Monitors a few times, however it is worth analyzing in more detail, as the Brexit vote entails important implications for the global economy and the gold market.

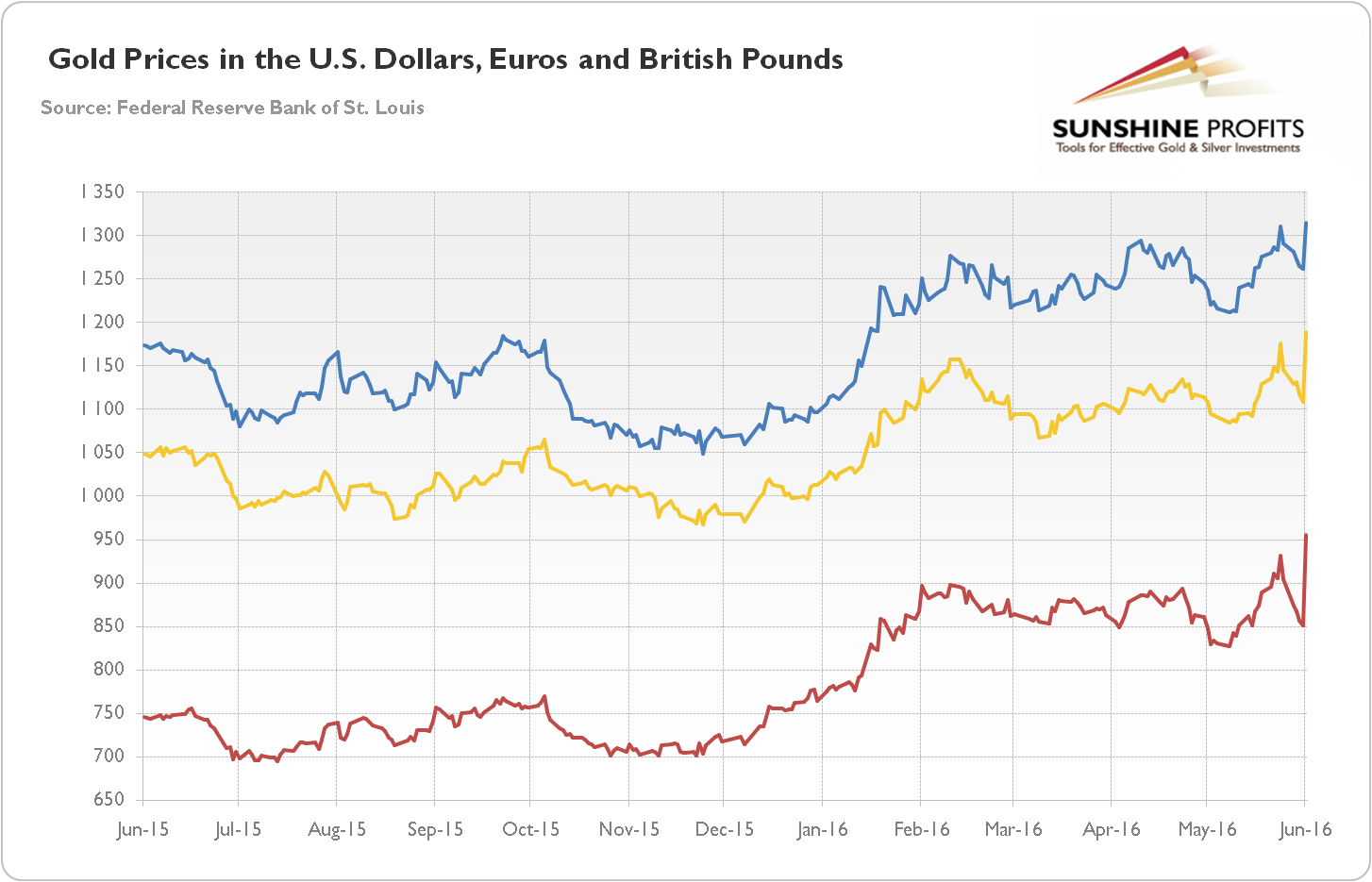

Initially, the Brexit vote led to short financial shock with a plunging pound and equities. However, the markets soon recovered, and the shock was not as bad as many had feared. Similarly, there was a knee-jerk reaction in gold, which boosted its price up to the $1,350 level immediately after the vote’s results were announced. As the chart below shows, the gold prices spiked in the U.S. dollar, in the Euro and, to a great extent, in the British pound.

Chart 1: The price of gold in the U.S. dollars (blue line), Euros (yellow line) and British pounds (red line)

But quickly after that rise the shiny metal pared down some of its earlier gains. Gold probably did not continue its parabolic rally from Thursday’s night because markets started to realize that it will take years for the UK to actually exit the EU. Although nothing has yet happened, smart investors should understand the economic effects of the Brexit vote. What are they?

- The most important economic effect of the Brexit vote is so far a significant rise in uncertainty. The uncertainty results from the unknown future of the UK itself, the UK-EU relationships and the fate of the EU, the second largest trading block on the planet whose existence is now under the question. After the referendum’s results were released, the UK and peripheral European sovereign credit spreads have widened. The rise in credit spreads is usually positive for the price of gold. The elevated uncertainty in Europe should discourage investors from the risky assets and support gold as a safe-haven.

- The Brexit vote and the resulting uncertainty imply a reduction in business investment in both the UK and the EU. Actually, investors were putting their plans on hold even before the referendum. Now, the detrimental impact from uncertainty on investment and GDP will increase. The slower pace of global economic growth is positive for gold, which usually shines in an environment of sluggish growth. But investors should not overestimate the impact of the UK’s developments for global growth (the Britain’s share of global GDP is estimated at less than 4 percent).

- However, European problems should also strengthen the U.S. dollar. The currency channel of the Brexit vote may limit gains in gold expressed in the greenback.

- But the appreciation of the U.S. dollar and the rise in the global uncertainty (which could trigger corrections in the world stock markets) will give the Fed cover to refrain from raising interest rates next month. Indeed, the July hike is off the table, according to the CME Group FedWatch. Markets do not expect any upward move this year. Actually, investors will see a 4.8 percent interest rate cut next month (as of June 29)! And the lower odds of interest rate hikes this year are fundamentally positive for the gold market.

- If the UK leaves the EU, the economic effects would be much more important. As we have written previously, the Brexit would lower the UK’s economic growth because of higher trade barriers, lower foreign direct investment, lower immigration and higher uncertainty. The Brexit would also hurt the EU’s economy. The exact impact depends on what the new economic relationship between the UK and the EU will look like. However, investors should remember that Brexit will not probably lead to a financial apocalypse. There is a life outside the EU: look at Switzerland, Norway or… oh well, the British Empire in the 19th century. Moreover, the readiness of central banks to provide liquidity supports financial markets (both the Bank of England and the ECB have already announced that they stand ready to provide additional liquidity, if needed), limiting potential gains in gold, which is usually negatively correlated with the risky assets.

However, so far the most important consequences of the Brexit vote have been political in their nature, as the UK’s vote created massive uncertainty from a political standpoint. Why?

- The Brexit vote may trigger independence referenda in Scotland and Northern Ireland who voted for “Remain”, which could end the existence of the United Kingdom. Nicola Sturgeon, the First Minister of Scotland, has already announced that the second referendum on Scottish independence is highly likely, as Scotland cannot be taken out of the EU against its will. Similarly, some Northern Ireland politicians have already called for a vote to unite the two sides of the Irish border. The Brexit vote also precipitated a change of prime minister as David Cameron has already announced his resignation by October, and one cannot exclude a call for a fresh general election. Therefore, Britain is entering a period of severe political turmoil, which would be positive for the gold market.

- Probably the biggest political threat connected to Brexit vote is the collapse of the EU. It is unlikely at this point, but the referendum’s results may prompt other countries (like France, Italy, Netherlands or Denmark) to negotiate new terms with Brussels or to organize their own referenda. The fear of contagion and the EU’s disintegration should support the price of gold.

- Another political effect of the Brexit vote may be an additional boost for the populist and anti-immigration politicians like Donald Trump. The current wave of nationalism and protectionism can only be bad for the global economy in the long run, but positive for gold.

The key takeaway is that the Brexit vote may entail significant consequences, but none of them are immediate, as it will take years for the UK to part ways with the EU. So far, the most important effect is the rise in uncertainty, especially from the political standpoint. The price of gold so far was supported by fears about the future of the UK and the EU, and lower odds of the Fed’s hike. However, the consequences of the Brexit vote could be rather small until we see an invocation of Article 50 or some steps undertaken by other countries to leave the EU. Therefore, the positive impact of the Brexit vote on the gold market may be overestimated by many people. When emotions are high, investors should be extremely cautious.

If you enjoyed the above analysis and would you like to know more about the consequences of the Brexit vote for the gold market, we invite you to read the July Market Overview report. If you’re interested in the detailed price analysis and price projections with targets, we invite you to sign up for our Gold & Silver Trading Alerts. If you’re not ready to subscribe at this time, we invite you to sign up for our gold newsletter and stay up-to-date with our latest free articles. It's free and you can unsubscribe anytime.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview