Last week, the Bank of Japan offered to buy an unlimited amount of JGBs. What does it mean for the gold market?

After Draghi’s speech at the end of June, many significant central banks turned more hawkish. However, the shift does not apply to the Bank of Japan. On Friday, the BoJ, in a special market operation, offered to buy an unlimited amount of 10-year Japanese government bonds at a yield of 0.110 percent. The action came after an increase in JGB yields to 0.105 percent, the highest level since February. Since the BoJ targets zero percent under its yield control policy, it had to intervene. The announcement has been effective (at least so far), as the 10-year yield fell to 0.085 percent.

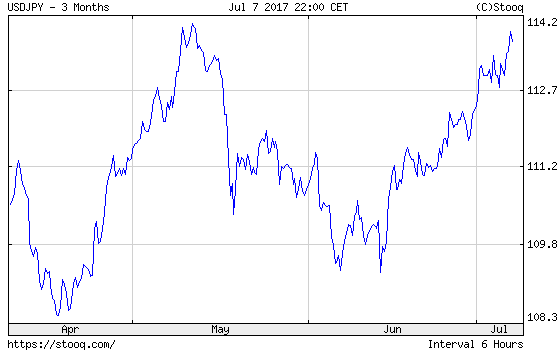

What does it mean for the gold market? Well, the action shows that the BoJ is committed to its dovish stance (well, for now, at least) and it is not joining the global tightening party. It should translate into a weaker Japanese yen. Indeed, the Japanese yen declined to 113.835 against the U.S. dollar after the decision, the lowest level since May. The chart below shows the rise in the USD/JPY exchange rate.

Chart 1: USD/JPY exchange rate over the last three months.

As one can see, the Japanese currency has been depreciating since June. That trend is negative for the gold market, as the yellow metal is negatively correlated to the USD/JPY exchange rate. Gold is a bet against the U.S. dollar and a safe-haven asset, similarly to yen. Hence, if the current trend lasts, gold will remain under downward pressure. Given that the U.S. yields are likely to rise, the BoJ will have to conduct more purchase operations. Therefore, as long as the BoJ is determined to control the yield curve, the yen is likely to depreciate, which would be an important headwind for the gold prices. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview