On Wednesday, the Bank of Canada raised its interest rates for the second time in 2017. What does it imply for the gold market?

Given the stronger-than-expected economic performance (the GDP rose jumped 4.5 percent in the second quarter), the Bank of Canada increased its target for the overnight rate from 0.75 percent to 1 percent. The bank rate and the deposit rate, which create the operating band, were raised to 1.25 percent and 0.75 percent, correspondingly. As one can see in the chart below, it was the second hike since July, although the key policy interest rate remains at a very low level. In that way, the BoC fully removed the two rate cuts from 2015 conducted to offset the negative impact of declining commodity prices on the Canadian economy.

Chart 1: BOC’s benchmark for the overnight interest rate over the last 10 years.

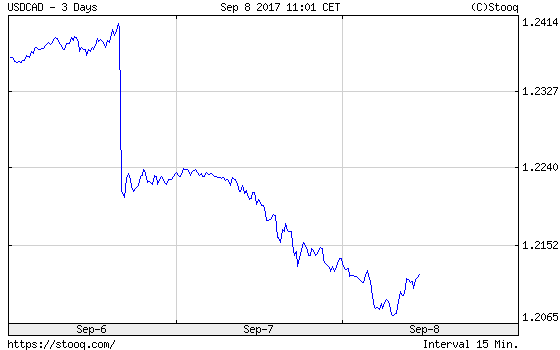

Although the BoC signaled that rising currency and sluggish price pressures may limit future tightening, investors forecast two more hikes over the next twelve months. The move combined with hawkish expectations made the Canadian dollar to surge. As the next chart shows, the loonie soared almost 2 percent after the decision, reaching the highest level since June 2015.

Chart 2: USD/CAD exchange rate over the three last days.

The BoC’s move is positive for the gold market, as the appreciation of the loonie should add some downward pressure on the U.S. dollar. The greenback has been struggling recently due to increased geopolitical uncertainty, natural disasters, indolence of the Trump administration, the rising expectations of a more dovish Fed this year, and of a more hawkish Draghi. Indeed, after yesterday’s ECB meeting, the euro rose to a fresh against the greenback (we will dig into the latest ECB’s monetary statement in the Monday’s edition of the Gold News Monitor). In such an environment, the BoC hike is one of a few factors contributing to the U.S. dollar weakness, which is fundamentally bullish for the gold market. Stay tuned!

If you enjoyed the above analysis, we invite you to check out our other services. We focus on fundamental analysis in our monthly Market Overview reports and we provide daily Gold & Silver Trading Alerts with clear buy and sell signals. If you’re not ready to subscribe yet and are not on our mailing list yet, we urge you to join our gold newsletter today. It’s free and if you don’t like it, you can easily unsubscribe.

Disclaimer: Please note that the aim of the above analysis is to discuss the likely long-term impact of the featured phenomenon on the price of gold and this analysis does not indicate (nor does it aim to do so) whether gold is likely to move higher or lower in the short- or medium term. In order to determine the latter, many additional factors need to be considered (i.e. sentiment, chart patterns, cycles, indicators, ratios, self-similar patterns and more) and we are taking them into account (and discussing the short- and medium-term outlook) in our trading alerts.

Thank you.

Arkadiusz Sieron

Sunshine Profits‘ Gold News Monitor and Market Overview Editor

Gold News Monitor

Gold Trading Alerts

Gold Market Overview